Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT: Stock and Investment Talk

- Thread starter RU-05

- Start date

Anyways I got in on Gnus on Thursday at $2.

Was up at $4.40 in extended hours trading this morning, thought I'd be prudent, sell half, thinking maybe a dip was due, and then work with house money.

Well it shot up over $7 before dipping back below $7, so I sold another half, again expecting a dip.

I've done really well in this recovery, have one stock that has doubled, but this one is my first real rocket takeoff.

Was up at $4.40 in extended hours trading this morning, thought I'd be prudent, sell half, thinking maybe a dip was due, and then work with house money.

Well it shot up over $7 before dipping back below $7, so I sold another half, again expecting a dip.

I've done really well in this recovery, have one stock that has doubled, but this one is my first real rocket takeoff.

So now you're working with 'house' money, feel good about yourself.

It doesn't happen too often.

Sell limit @ 5 IF the price keeps going up you can raise the sell limit as it appreciates.

I'm ALWAYS conservative on non-conservative stock picks.

The money still in is there's you want to limit your downside to lock in your house money.

The remaining shares you can ride up, IF they go up, and still sell off 1/2's of the remaining holdings at PREDERMINED prices. The sell limits keep you from riding the dead horse and losing your profits.

Even NASDQ stocks can put you on a wild ride.

It doesn't happen too often.

Sell limit @ 5 IF the price keeps going up you can raise the sell limit as it appreciates.

I'm ALWAYS conservative on non-conservative stock picks.

The money still in is there's you want to limit your downside to lock in your house money.

The remaining shares you can ride up, IF they go up, and still sell off 1/2's of the remaining holdings at PREDERMINED prices. The sell limits keep you from riding the dead horse and losing your profits.

Even NASDQ stocks can put you on a wild ride.

Last edited:

I got into PENN at about $11 it is now around $32 Wish I would have bought when it was below $5

Like I said above, when I am in on a 'score', I like to keep the score !

So especially if I'm in a self directed IRA I lock in profits. Set limits well below current trading prices to keep me profitable in that trade if it shits the bed, AND mentally or physically set additional sell limits (not the entire number of shares, but eventually I'll be out of it) if the stock continues to appreciate

I am also looking at any airline that was able to purchase J-3 jet fuel on future's contracts as Oil hit the bottom. Any CEO that had the foresight to buy his biggest operating expense cheap is a forward looking guy.

I got into PENN at about $11 it is now around $32 Wish I would have bought when it was below $5

Nice job at 11, I got it at around 20. On the dip a couple months ago i picked up WORK at $20, its now almost $40. Also still time to get on Zynga, got it at $6, up to around $9 but its got a big upside w/ its latest purchase.

Big boys looking at 10- 20 % appreciation by Nov 4th.(or before if Joe can't find the basement door and they have to run Mario).

Coke; KO. I don't drink it but someone we LOVE does (at least Diet).

IBM; anyone smart enough to hire one of my Son's is a smart company.

Both of them just back to previous Wuhan levels and it's a Big Board score.

Coke; KO. I don't drink it but someone we LOVE does (at least Diet).

IBM; anyone smart enough to hire one of my Son's is a smart company.

Both of them just back to previous Wuhan levels and it's a Big Board score.

For as well as I have done, on Gnus, but the market in general, there is always that "I wish" factor. I wish I was in earlier on Gnus, and wish I set my initial recoup of profits a little higher.I got into PENN at about $11 it is now around $32 Wish I would have bought when it was below $5

But I've made a bundle so I should just be happy with what I've done thus far.

For as well as I have done, on Gnus, but the market in general, there is always that "I wish" factor. I wish I was in earlier on Gnus, and wish I set my initial recoup of profits a little higher.

But I've made a bundle so I should just be happy with what I've done thus far.

Think of the posters here that will decry your perspicacity and claim that you didn't actually buy the stocks we're discussing. :Laughing

"Living well, the best revenge."

If it makes them feel any better there were a couple stocks like MIK that I was "this" close to buying at it's bottom, but didn't.Think of the posters here that will decry your perspicacity and claim that you didn't actually buy the stocks we're discussing. :Laughing

"Living well, the best revenge."

Also bought HTZ just before the bankruptcy, and then was hesitant to go after CARS.

I've sold a couple dog stocks and have a couple bucks sitting there, but after a really hot run I'm expecting a bit of a pull back in the coming days.

Agreement?

Agreement?

I've sold a couple dog stocks and have a couple bucks sitting there, but after a really hot run I'm expecting a bit of a pull back in the coming days.

Agreement?

No.

"It's the economy stupid." as people see Basement Joe become Confused Joe as he get away from his tanning bed and has to string together coherent sentences unscripted.

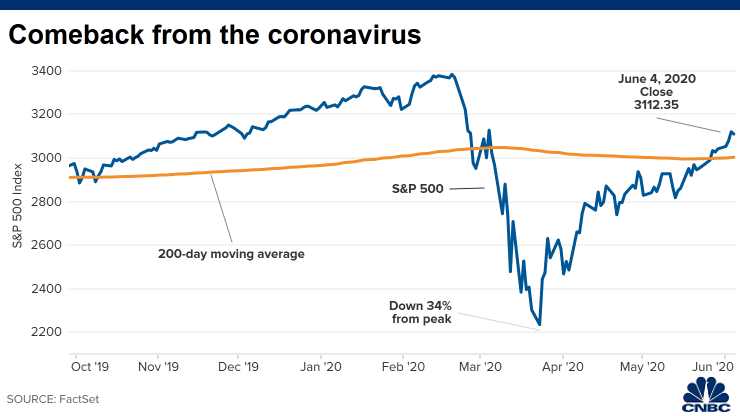

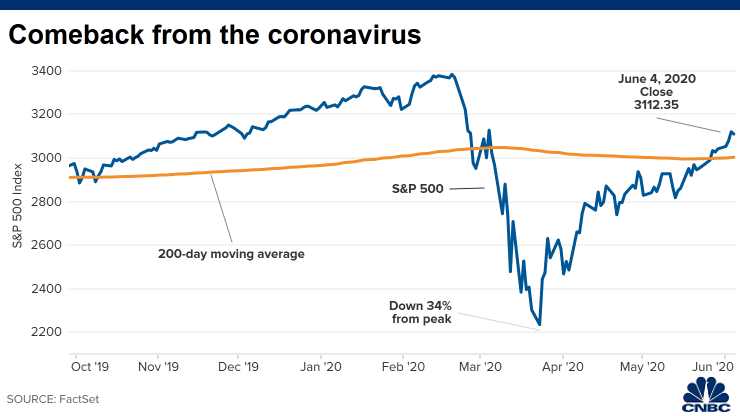

Looking good since the initial hysteria. For those that didn't panic and kept buying, they have done very well:I know there were some recent threads out there, but I looked and could not find them.

So I'm starting one up fresh.

But the economy is not exactly on fire right now.No.

"It's the economy stupid." as people see Basement Joe become Confused Joe as he get away from his tanning bed and has to string together coherent sentences unscripted.

This is a perfect time for me to ask a question I've been wondering. So 7/27/2017 I bought 119 shares of NOV @ $33.35 and yesterday bought 789 shares of the same stock @ $12.67. Now when I decide to sell is where I'm a bit confused about. Is it FIFO about which ones get sold? Do they just take the average price ($23.01?) I am aware of the 30 day rule of selling and then buying but don't think I would ever be in that situation. Any clarification would be helpful.

It will be very soon. Remember, the economy was booming prior to this medical event/crisis. Once it is over, the economy will boom again.But the economy is not exactly on fire right now.

Well that is a prediction, and not exactly a consensus one. I know the market does look to the future, but the current economic #'s are on still on the downward trend.It will be very soon. Remember, the economy was booming prior to this medical event/crisis. Once it is over, the economy will boom again.

But better than expectations. Yes, the market is about the future, but also about expectations.Well that is a prediction, and not exactly a consensus one. I know the market does look to the future, but the current economic #'s are on still on the downward trend.

This is a perfect time for me to ask a question I've been wondering. So 7/27/2017 I bought 119 shares of NOV @ $33.35 and yesterday bought 789 shares of the same stock @ $12.67. Now when I decide to sell is where I'm a bit confused about. Is it FIFO about which ones get sold? Do they just take the average price ($23.01?) I am aware of the 30 day rule of selling and then buying but don't think I would ever be in that situation. Any clarification would be helpful.

FIFO is the default method for calculating your cost basis unless you specify otherwise. Specific Identification is another method available for determining cost basis and can potentially save on taxes but requires more record keeping. Average cost basis is an option for mutual funds but not individual equities. The above should not be construed as tax or legal advice. I’d suggest discussing with your tax advisor or tax preparation software support.

FIFO is the default method for calculating your cost basis unless you specify otherwise. Specific Identification is another method available for determining cost basis and can potentially save on taxes but requires more record keeping. Average cost basis is an option for mutual funds but not individual equities. The above should not be construed as tax or legal advice. I’d suggest discussing with your tax advisor or tax preparation software support.

Good explanation. And brokerage statements do this calculation for you, unlike in the old days. You just select the method. If you do nothing, FIFO is used as well stated by PHS.

So you sell the winners and ride the losers. Yikes.Like I said above, when I am in on a 'score', I like to keep the score !

So especially if I'm in a self directed IRA I lock in profits. Set limits well below current trading prices to keep me profitable in that trade if it shits the bed, AND mentally or physically set additional sell limits (not the entire number of shares, but eventually I'll be out of it) if the stock continues to appreciate

I am also looking at any airline that was able to purchase J-3 jet fuel on future's contracts as Oil hit the bottom. Any CEO that had the foresight to buy his biggest operating expense cheap is a forward looking guy.

The market is due for a correction that could easily reach and even exceed 20%. In the second half of June or perhaps sooner, the market would start focusing on the fundamentals and investors will realize that the estimated P/E ratio of the vast majority of the companies are way above the historical average for the sector. People will worry about second quarter earnings and once the first numbers are coming in, those who have been in the state of delirium suddenly wake up. Many of the less experienced investors will get panicked once the market participants try to factor in the many uncertainties that will impact future economic growth (Covid-19, presidential election, federal, state and local budget crisis, unprecedent debt amount that will create such a high debt service level that requires cuts to the core of the federal budget) that will all impact future earnings. The impact of future inflation expectations have not been factored in yet. Another huge question is that how long will it take to rehire the majority of the people who are out of work. It could take years. Many jobs are gone permanently/ While there will be new type of jobs created for people with high skills, many people need to realize that most of the low-skilled jobs are gone, perhaps forever. The prospect of choosing between two very old presidential candidates is not something anybody can get excited about it. Once Covid-19 is handled, there will be many new international disturbances we need to deal with. If you are a realist, you should defend your positions through limit orders and when the right time comes make money through shorting some of the overvalued stocks to counterbalance some of the inevitable losses you will suffer in your long positions.Looking good since the initial hysteria. For those that didn't panic and kept buying, they have done very well:

Anyways I got in on Gnus on Thursday at $2.

Was up at $4.40 in extended hours trading this morning, thought I'd be prudent, sell half, thinking maybe a dip was due, and then work with house money.

Well it shot up over $7 before dipping back below $7, so I sold another half, again expecting a dip.

I've done really well in this recovery, have one stock that has doubled, but this one is my first real rocket takeoff.

Wow, up 97% just today. But the question I have is whether or not anyone will admit to buying Gnus when is was at $87 back in 2012?

The market is due for a correction that could easily reach and even exceed 20%. In the second half of June or perhaps sooner, the market would start focusing on the fundamentals and investors will realize that the estimated P/E ratio of the vast majority of the companies are way above the historical average for the sector. People will worry about second quarter earnings and once the first numbers are coming in, those who have been in the state of delirium suddenly wake up. Many of the less experienced investors will get panicked once the market participants try to factor in the many uncertainties that will impact future economic growth (Covid-19, presidential election, federal, state and local budget crisis, unprecedent debt amount that will create such a high debt service level that requires cuts to the core of the federal budget) that will all impact future earnings. The impact of future inflation expectations have not been factored in yet. Another huge question is that how long will it take to rehire the majority of the people who are out of work. It could take years. Many jobs are gone permanently/ While there will be new type of jobs created for people with high skills, many people need to realize that most of the low-skilled jobs are gone, perhaps forever. The prospect of choosing between two very old presidential candidates is not something anybody can get excited about it. Once Covid-19 is handled, there will be many new international disturbances we need to deal with. If you are a realist, you should defend your positions through limit orders and when the right time comes make money through shorting some of the overvalued stocks to counterbalance some of the inevitable losses you will suffer in your long positions.

Which is why Draft Kings is the way to go. If the market tanks, people will still need somewhere to bet their money:Wink:

A bunch of years ago I bought DFFN for $400 something, only to see it tank until I sold it this year at like .80 cents.Wow, up 97% just today. But the question I have is whether or not anyone will admit to buying Gnus when is was at $87 back in 2012?

It was a big reason why I never played the market between then and now.

Welcome to the CL crew!The market is due for a correction that could easily reach and even exceed 20%. In the second half of June or perhaps sooner, the market would start focusing on the fundamentals and investors will realize that the estimated P/E ratio of the vast majority of the companies are way above the historical average for the sector. People will worry about second quarter earnings and once the first numbers are coming in, those who have been in the state of delirium suddenly wake up. Many of the less experienced investors will get panicked once the market participants try to factor in the many uncertainties that will impact future economic growth (Covid-19, presidential election, federal, state and local budget crisis, unprecedent debt amount that will create such a high debt service level that requires cuts to the core of the federal budget) that will all impact future earnings. The impact of future inflation expectations have not been factored in yet. Another huge question is that how long will it take to rehire the majority of the people who are out of work. It could take years. Many jobs are gone permanently/ While there will be new type of jobs created for people with high skills, many people need to realize that most of the low-skilled jobs are gone, perhaps forever. The prospect of choosing between two very old presidential candidates is not something anybody can get excited about it. Once Covid-19 is handled, there will be many new international disturbances we need to deal with. If you are a realist, you should defend your positions through limit orders and when the right time comes make money through shorting some of the overvalued stocks to counterbalance some of the inevitable losses you will suffer in your long positions.

I don't know if it's the best but I use E-trade.I’m new to this

What’s the best site to trade?

Robinhood. No feesI’m new to this

What’s the best site to trade?

I have to imagine most online trading sites are no fees. Etrade is as well.Robinhood. No fees

Charles Schwab has no fees either, and it has brick and mortar locations if neededI have to imagine most online trading sites are no fees. Etrade is as well.

The market is running on newly printed money. As long as the government is willing to print, the market will have support.

And as long as interested rates are set to zero. One less place to put money for returns.The market is running on newly printed money. As long as the government is willing to print, the market will have support.

And as long as interested rates are set to zero. One less place to put money for returns.

Hidden inside this statement is if more people want their money in the market post Covid then they did pre covid then the market will grow because of that regardless of the economy.

So if technology is making it easier, and it has, if people who were into online betting(think of it as a gateway drug) have picked up market investing, if people who had poor success in the past but saw this as a golden oppurtunity(I fit both this and the first hypothetical), then the value of the market will reflect that in a positive way.

Similar threads

- Replies

- 171

- Views

- 6K

- Replies

- 293

- Views

- 6K

- Replies

- 33

- Views

- 759

- Replies

- 10

- Views

- 5K

ADVERTISEMENT

ADVERTISEMENT