Don't bury the lead with your next post!On the other hand, if inflation and rates remain in-check and stimulus money makes its way through the economy it could be a good year for stocks.

Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT: Stock and Investment Talk

- Thread starter RU-05

- Start date

Ha - unfortunately I think it’s going to be a rocky year with plenty of highs and lows. Probably best to just hold your breath, stay long, and ignore the noise. Or keep it interesting and trade in and out of the volatility if you have the skills.Don't bury the lead with your next post!

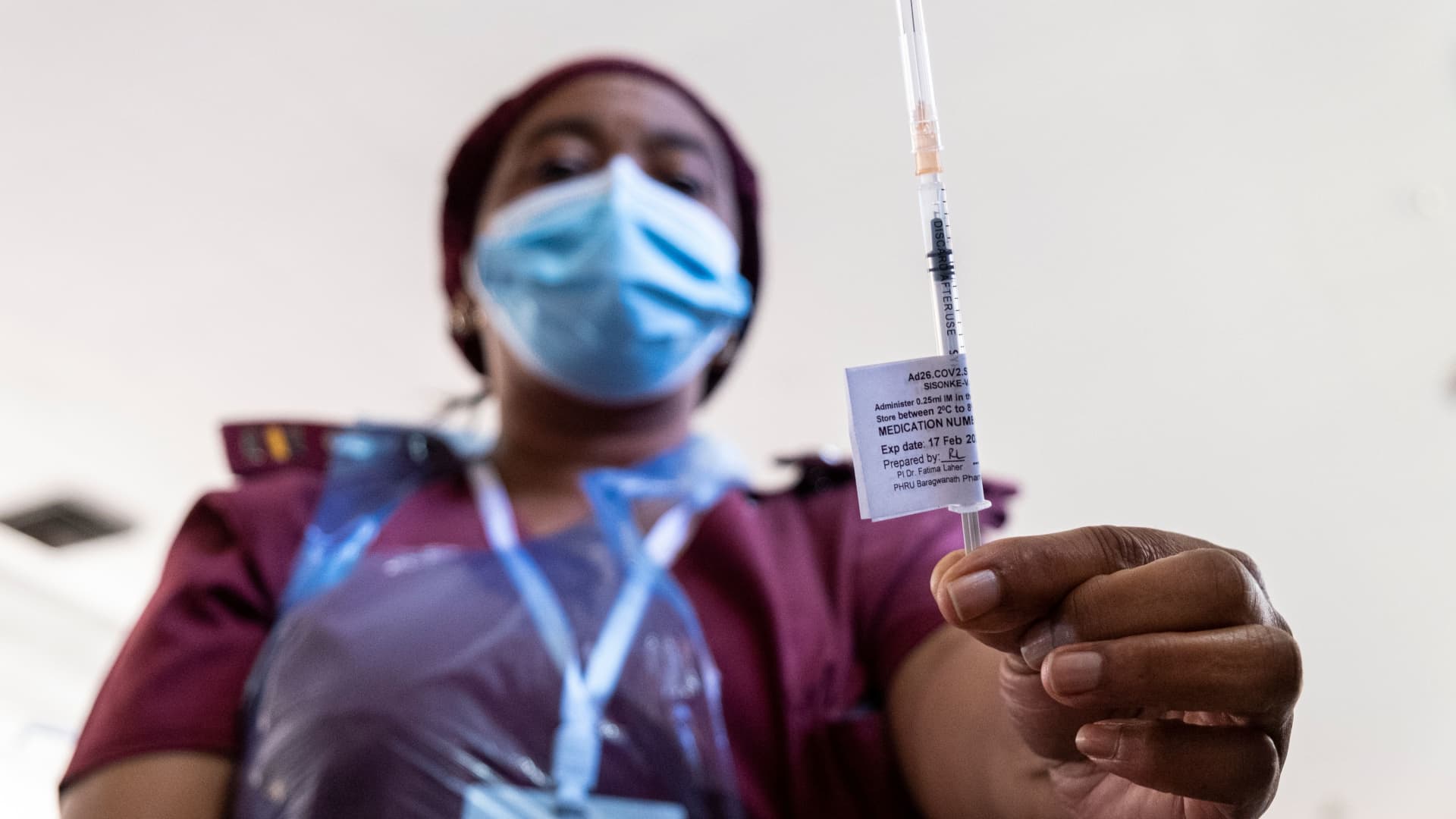

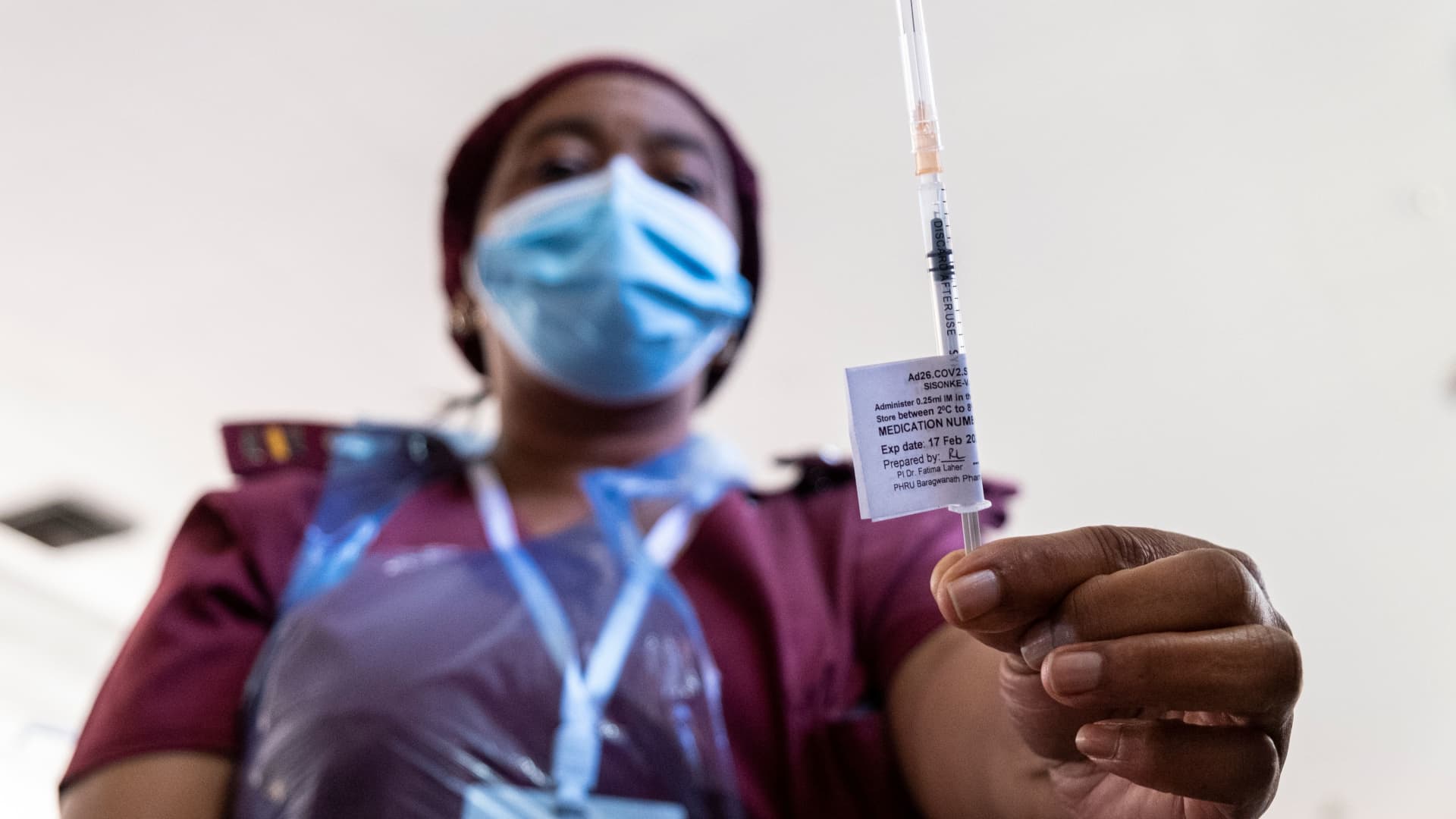

Good news for getting back to normal:

www.cnbc.com

www.cnbc.com

FDA approves Johnson & Johnson’s single-shot Covid vaccine for emergency use

The FDA has approved J&J's Covid-19 vaccine for emergency use, giving the U.S. a third tool to fight the pandemic.

I haven’t read anyone predict we are headed for a 1929 market crash and prelude to a 1930s style depression. What I’ve pointed out, however, is current prices don’t reflect or discount much in the way of risks. To illustrate that point, I compared the current time period to the mid 1960s to show that strong economic performance, while certainly a very important variable, is not the sole determinative driver of equity prices. Ignoring opportunity costs, and how they are likely to evolve, was the message. Then, like now, rates were very low. Then, rates began a multi-decade climb and stocks went exactly nowhere. Had you placed a large amount of money into the market at that time, you would have enjoyed dividends that perhaps were reinvested, but the absolute level of the overall market went exactly nowhere. Did I select that time period deliberately? Absolutely, but more to illustrate how strong economic fundamentals married with a long term Treasury bear market can lead to very underwhelming results. It’s not an environment anyone today has experienced.

Others have selected decade long time period surrounding various advances and subsequent declines to show that, longer term, investors who stayed the course came out with a good result. All true for the periods selected, but I’d point out that none of those periods involve a sustained movement higher in yields. And we don’t need a return to late 1970s or early 1980s levels of inflations or rates for a re-rating of multiples to occur.

Ray Dalio and Jeremy Grantham have both "warned" about a market crash and subsequent depression.

Ray Dalio and Jeremy Grantham have both "warned" about a market crash and subsequent depression.

Yes. Certainly wouldn’t bet against either of those two.

If those 2 practiced what they have been preaching for the past few years, they have already lost a ton of returns:Yes. Certainly wouldn’t bet against either of those two.

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” - PL

Dalio made that call in April 2020 and Grantham qualified his statement by saying if investors lose confidence. I’m with Grantham that the market is in a bubble but leading to a depression is a bit of exaggeration.Yes. Certainly wouldn’t bet against either of those two.

If those 2 practiced what they have been preaching for the past few years, they have already lost a ton of returns:

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” - PL

Perhaps you should look up who Ray Dalio is, along with his return record, before making ignorant comments. Same with Grantham. And if you are going to quote Lynch, perhaps understand what he meant by his quote. Start with the difference between what it means for a correction to occur as compared to what it means for a bubble to reverse course.

Not to be whatever, you said you hadn't seen anyone calling for similar depression, yet the Grantham interview you shared weeks ago calls exactly for that.Yes. Certainly wouldn’t bet against either of those two.

Dalio made that call in April 2020 and Grantham qualified his statement by saying if investors lose confidence. I’m with Grantham that the market is in a bubble but leading to a depression is a bit of exaggeration.

When it comes to identifying bubbles, Grantham is as good as it gets. Yes, he often seems bearish but even when he sees overvaluation, he doesn’t counsel to exit. He does with bubbles, and he’s nailed each one in his career. Dalio’s record speaks for itself.

Not to be whatever, you said you hadn't seen anyone calling for similar depression, yet the Grantham interview you shared weeks ago calls exactly for that.

The post I responded to was when a posted was accused of predicting a 1929 style market performance.

Respect both men but they are human and have been wrong plenty.When it comes to identifying bubbles, Grantham is as good as it gets. Yes, he often seems bearish but even when he sees overvaluation, he doesn’t counsel to exit. He does with bubbles, and he’s nailed each one in his career. Dalio’s record speaks for itself.

+1Dalio made that call in April 2020 and Grantham qualified his statement by saying if investors lose confidence. I’m with Grantham that the market is in a bubble but leading to a depression is a bit of exaggeration.

Dalio missed out on a hell of a lot of returns over the past 10-11 months. If he took his own warnings.

Respect both men but they are human and have been wrong plenty.

They have been right far more often than wrong,

+1

Dalio missed out on a hell of a lot of returns over the past 10-11 months. If he took his own warnings.

Dalio doesn’t play in the same sandbox you do.

Agreed. There have been plenty of people talking about a correction or bubble for the past 4-5 years (at least). The thing about predicting such an event, sooner or later you will be right. I remember that a bunch of bears were trying to take credit for the 2020 crash. Yeah, seriously. I guess they tried to ignore the fact that a freaking out of the blue pandemic caused it.Respect both men but they are human and have been wrong plenty.

I would be interested to see if Dalio still believes we are headed for a depression. I have not seen him reiterate that call from April 2020.They have been right far more often than wrong,

+1Dalio doesn’t play in the same sandbox you do.

I don't say things and then do something different.

Agreed. There have been plenty of people talking about a correction or bubble for the past 4-5 years (at least). The thing about predicting such an event, sooner or later you will be right. I remember that a bunch of bears were trying to take credit for the 2020 crash. Yeah, seriously. I guess they tried to ignore the fact that a freaking out of the blue pandemic caused it.

Well, that’s a very interesting and revealing post. In essence, you’re stating that those who took credit for calling for the massive decline in risk assets should not take any credit because they could not have predicted the catalyst. And that’s where your post is revealing, extreme overvaluation is subject to reversal, and sometime quickly, when unforeseen negative items come to fruition. The point is prices are too stretched to digest that information without a massive price move. At bottoms, the opposite is true, no one can see what positive might occur. Your reacting too excessive optimism, like today, or excessive pessimism. Most times, prices are somewhere in between. But not today. And they were last spring, either.

Great stuff from The Man:

www.cnbc.com

www.cnbc.com

Invest in the US

No bonds

Added more into energy (like Chevron) - proudly, I added XLE to my portfolio at the beginning of the year. Up about 20% already.

:)

Warren Buffett says 'never bet against America' in letter trumpeting Berkshire's U.S.-based assets

Warren Buffett, chairman and CEO of Berkshire Hathaway, released his annual shareholder letter on Saturday.

Invest in the US

No bonds

Added more into energy (like Chevron) - proudly, I added XLE to my portfolio at the beginning of the year. Up about 20% already.

:)

I would be interested to see if Dalio still believes we are headed for a depression. I have not seen him reiterate that call from April 2020.

Absent massive government intervention, we were headed for a depression. But I’m not as focused on that aspect of his call. More focused on his perception of the market. As a rule, I dismiss global macro style proclamations. However, his track record is strong enough that I do pay attention to his public statements (and read his books. His debt bubble book is dry but amazingly informative).

Last edited:

Try to be coherent, please.+1

I don't say things and then do something different.

I was right about the Covid crash. I said it was artificial (due to a medical reason, nothing financial) and it would correct within months. That's exactly want happened. Many folks, on this board and in the business, predicted a long recovery and bear market.Well, that’s a very interesting and revealing post. In essence, you’re stating that those who took credit for calling for the massive decline in risk assets should not take any credit because they could not have predicted the catalyst. And that’s where your post is revealing, extreme overvaluation is subject to reversal, and sometime quickly, when unforeseen negative items come to fruition. The point is prices are too stretched to digest that information without a massive price move. At bottoms, the opposite is true, no one can see what positive might occur. Your reacting too excessive optimism, like today, or excessive pessimism. Most times, prices are somewhere in between. But not today. And they were last spring, either.

I certainly won't be right all the time in the future and don't expect to be, but this one is in my win column! LOL.

I was right about the Covid crash. I said it was artificial (due to a medical reason, nothing financial) and it would correct within months. That's exactly want happened. Many folks, on this board and in the business, predicted a long recovery and bear market.

I certainly won't be right all the time in the future and don't expect to be, but this one is in my win column! LOL.

Very common for people to confuse skill with luck. And your response had nothing to do with the substance of my post,

Sound logic, paying attention to the facts, and making the right decision is only "luck" in your book because you were wrong about it. LOL.Very common for people to confuse skill with luck. And your response had nothing to do with the substance of my post,

You are in the business and surely right more than I am. However, not a big deal to admit the truth about this case.

Sound logic, paying attention to the facts, and making the right decision is only "luck" in your book because you were wrong about it. LOL.

You are in the business and surely right more than I am. However, not a big deal to admit the truth about this case.

Hardly. I’ve always utilized the exact same approach, because it works. When security prices are attractive relative to what they are worth, and you can purchase them at a meaningful discount to intrinsic value, you buy. The time to do so, as was succinctly put last year by one prominent investor, is when you least want to. Others have said to be greedy when others are fearful, and fearful when others are greedy. Same concept, last spring was a time to be aggressive. In my view, that time passed as markets recovered and we are squarely in a period where the vast majority of investors are greedy. the fear of losing money doesn’t exist right now among the vast majority of investors. Forget valuations for a moment and look at actions. Margin debt has never been higher, for example. that’s an ominous sign. This thread is another. We have people who’ve never invested before, and certainly not through a tough stretch, taking very risky positions. And then add in valuations. As a risk averse investor, it is a textbook flashing red warning situation.

So I’m content to be less aggressive in public markets today. My money isnt really in public markets anymore, either, unless an opportunity arises and then I have resources to take advantage of attractive situations. And a small pullback from highly overvalued mArkets still results in an overvalued, unattractive, market.

And to wind up, I think taking Buffetts comments in the context of his actions are more telling. He made some marginal stock purchases, both of which in relatively out of favor sectors. Most of the capital he deployed was to repurchase Berkshire shares. That’s a lot more telling, and perhaps more in line with his comments at last years annual meeting.

“Now, let’s move on now to a much broader subject, what I don’t know. I don’t know, and perhaps with a bias, I don’t believe anybody knows what the market is going to do tomorrow, next week, next month, next year. I know America is going to move forward over time, but I don’t know for sure, and we learned this on September 10th, 2001, and we learned it a few months ago in terms of the virus. Anything can happen in terms of markets, and you can bet on America, but you got to have to be careful about how you bet, simply because markets can do anything.”

Even when we are arguing I learn a lot from you. I'm more bullish over the next year or two, but I have put some hedge feelers into our portfolio to keep an eye on. XLE for energy and two value funds/etfs (VTV and PRSVX). So far XLE and PRSVX are doing well and VTV is okay.Hardly. I’ve always utilized the exact same approach, because it works. When security prices are attractive relative to what they are worth, and you can purchase them at a meaningful discount to intrinsic value, you buy. The time to do so, as was succinctly put last year by one prominent investor, is when you least want to. Others have said to be greedy when others are fearful, and fearful when others are greedy. Same concept, last spring was a time to be aggressive. In my view, that time passed as markets recovered and we are squarely in a period where the vast majority of investors are greedy. the fear of losing money doesn’t exist right now among the vast majority of investors. Forget valuations for a moment and look at actions. Margin debt has never been higher, for example. that’s an ominous sign. This thread is another. We have people who’ve never invested before, and certainly not through a tough stretch, taking very risky positions. And then add in valuations. As a risk averse investor, it is a textbook flashing red warning situation.

So I’m content to be less aggressive in public markets today. My money isnt really in public markets anymore, either, unless an opportunity arises and then I have resources to take advantage of attractive situations. And a small pullback from highly overvalued mArkets still results in an overvalued, unattractive, market.

And to wind up, I think taking Buffetts comments in the context of his actions are more telling. He made some marginal stock purchases, both of which in relatively out of favor sectors. Most of the capital he deployed was to repurchase Berkshire shares. That’s a lot more telling, and perhaps more in line with his comments at last years annual meeting.

“Now, let’s move on now to a much broader subject, what I don’t know. I don’t know, and perhaps with a bias, I don’t believe anybody knows what the market is going to do tomorrow, next week, next month, next year. I know America is going to move forward over time, but I don’t know for sure, and we learned this on September 10th, 2001, and we learned it a few months ago in terms of the virus. Anything can happen in terms of markets, and you can bet on America, but you got to have to be careful about how you bet, simply because markets can do anything.”

Jumped more into EM over the past 3 months as well. Some of my biggest funds are about 1/3 global, so I have that covered.

Agreed. There have been plenty of people talking about a correction or bubble for the past 4-5 years (at least). The thing about predicting such an event, sooner or later you will be right. I remember that a bunch of bears were trying to take credit for the 2020 crash. Yeah, seriously. I guess they tried to ignore the fact that a freaking out of the blue pandemic caused it.

What is a “blue pandemic”?

Why any discussion of bubble, since most on this board, said they don’t time the market and they just stay long with their stocks. I trade the market now to be in cash position as much as possible.

The crash doesn’t happen in one day but over the course of weeks until capitulation. Last week could be the first sign.

The crash doesn’t happen in one day but over the course of weeks until capitulation. Last week could be the first sign.

Last edited:

I don't even want to know because I'm sure it will lead this thread in the wrong direction.What is a “blue pandemic”?

What is a “blue pandemic”?

I’m guessing there are a couple of commas missing: ...a freaking, out of the blue, pandemic.

A long time ago, I use to go to the library to check the PE trend on the Standard and Poor reports on a stock. I was in college back then. I guess it’s on line now but probably too expensive for me. On Yahoo, you get get past stock prices and dividends going back 20 years or so but strange it doesn’t have PE in the past.Does anyone have a link to historical P/E's?

The last company I worked for 12 years ago the PE was about 15 for about 10 years but in the last 10 years it kept growing from 20 to 30 to now 46. Of course the market is a bubble, the question is when it’s going to burst.

Last edited:

"out of the blue pandemic" not "blue pandemic".....but I agree that it reads rather awkwardly!What is a “blue pandemic”?

You know, based on your posts for the past 5 years, you have been mostly cash all of the time. You have been predicting a crash forever. Perhaps this time you will be right, but you haven't been so far.Why any discussion of bubble, since most on this board, said they don’t time the market and they just stay long with their stocks. I trade the market now to be in cash position as much as possible.

The crash doesn’t happen in one day but over the course of weeks until capitulation. Last week could be the first sign.

Does anyone have a link to historical P/E's?

S&P 500 PE Ratio by Year

S&P 500 PE Ratio table by year, historic, and current data. Current S&P 500 PE Ratio is 22.24, a change of +0.14 from previous market close.

www.multpl.com

No I haven’t you idiot. You know you trading in funds is the sane as trading in stocks. You still have a lot to learn. I see as you get older, you will be trading stocks as you learn more.You know, based on your posts for the past 5 years, you have been mostly cash all of the time. You have been predicting a crash forever. Perhaps this time you will be right, but you haven't been so far.

Let's be serious. You have been calling for a crash for years. Is this not true? You are one of the biggest bears on the board.No I haven’t you idiot. You know you trading in funds is the sane as trading in stocks. You still have a lot to learn. I see as you get older, you will be trading stocks as you learn more.

Does anyone have a link to historical P/E's?

S&P 500 PE Ratio - Shiller PE Ratio | Longtermtrends

The price earnings ratio is calculated by dividing a company's stock price by it's earnings per share. In other words, the price earnings ratio shows what the market is willing to pay for a stock based on its current earnings. It is one of the most widely-used valuation metrics for stocks.

click the 30 year chart. It shows that we’re in the “extreme bubble” category. And the last two times it got out of whack, we crashed.

Did we have zero interest rates and the feds pumping last time?S&P 500 PE Ratio - Shiller PE Ratio | Longtermtrends

The price earnings ratio is calculated by dividing a company's stock price by it's earnings per share. In other words, the price earnings ratio shows what the market is willing to pay for a stock based on its current earnings. It is one of the most widely-used valuation metrics for stocks.www.longtermtrends.net

click the 30 year chart. It shows that we’re in the “extreme bubble” category. And the last two times it got out of whack, we crashed.

Similar threads

- Replies

- 171

- Views

- 6K

- Replies

- 279

- Views

- 6K

- Replies

- 33

- Views

- 757

- Replies

- 10

- Views

- 5K

ADVERTISEMENT

ADVERTISEMENT