While real estate is always supply and demand but the purchase of such supply also largely depends on rates which are affected by the stock market. So, they sort of do rely on both.Alot of what you post is largely irrelevant for real estate, thats why. Real estate is a simple game. Supply and demand. We have bear all time low supply and all time high demand. We have the largest demographic patch in US history hitting peak home buying age. Higher rates are hitting the demand side but you keep pumping that not only is there a “bubble” but that “its gonna burst”. So put your money where you mouth is and bet me

Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

A

anon_0k9zlfz6lz9oy

Guest

Another month and yet another record for ALL TIME LOW delinquency rates. But guys, yeah, its a bubble, its all about to blow up!!!!

Will be interesting to see. The supply/demand argument will come into play for many areas on this topic as well. LBI typically averages around 900 new listings a year. That was down to 600 to 2021. It’s below 200 ytd.I don’t know if primary residential homes will take a huge hit, but I’d bet that secondary vacation homes get crushed the next few years.

This is a bad metric to use. Of course the delinquency rates are low because interest rate on those mortgages are low and employment numbers are strong. Everyone said this isn’t the GFC. The problem is demand will be down because it’s less affordable. People that don’t need to sell will ride it out. But if people need to sell will take a hit.

Another month and yet another record for ALL TIME LOW delinquency rates. But guys, yeah, its a bubble, its all about to blow up!!!!

And tracking sales in at least Sedona, saw a lot of the purchases were with CASH. Don't have hard data, but have to guess that a lot of that cash was from stock market gains in the extended bull market. Again, that's just a guess. With people's net worth/wealth and retirement nest eggs shrinking, people may not be inclined or have the funds to purchase real estate.While real estate is always supply and demand but the purchase of such supply also largely depends on rates which are affected by the stock market. So, they sort of do rely on both.

On the other hand (was going to use OTOH!!), I was watching a segment on Newsnation last night (fantastic and fairly unbiased news channel) where some "expert" was extolling the benefits of owning real estate for the long haul, especially rental property, because rents never go down. In our personal experience, that is correct, and the best investments we own are rental properties. We will be living off the cash flows from rents in retirement and may not need to hit our 401K savings. We shall see how that works out.

My wife gets a lot of buyers who are making “cash” offers. But this is to bypass the appraisal as they are planning to pay over value.And tracking sales in at least Sedona, saw a lot of the purchases were with CASH. Don't have hard data, but have to guess that a lot of that cash was from stock market gains in the extended bull market. Again, that's just a guess. With people's net worth/wealth and retirement nest eggs shrinking, people may not be inclined or have the funds to purchase real estate.

On the other hand (was going to use OTOH!!), I was watching a segment on Newsnation last night (fantastic and fairly unbiased news channel) where some "expert" was extolling the benefits of owning real estate for the long haul, especially rental property, because rents never go down. In our personal experience, that is correct, and the best investments we own are rental properties. We will be living off the cash flows from rents in retirement and may not need to hit our 401K savings. We shall see how that works out.

but they still end up getting a mortgage after. They just lose their protection on the contract if they wanted to back out.

Wonder if that is similar there. Cash offers but still get a mortgage

Another month and yet another record for ALL TIME LOW delinquency rates. But guys, yeah, its a bubble, its all about to blow up!!!!

I mean - were like in the stage where we just made contact with the iceberg.

Band will be playing on deck for a while before this thing goes down imo.

Well .. credit card debt at all time highs, savings rate is at the lowest since 2008. Consumer behavior will change, it has to. When it does, it will impact sales and services which will impact employment rates. Those dominos start to fall, I think we'll see the bubble burst.

Do you notice *any* changes to consumer behavior in your day to day life?

The last time I went into a restaurant, bar, casino, hotel, big box store, mall etc and it wasn't packed was 2019.

Nearly everyone I know switched jobs or got a big raise the last two years. People are looking at their increased paycheck which is over the rate of inflation...not their portfolio. At least what I see.

No. I get a report of closed sales, and they are listed as cash. But I never pressed my realtor if the "cash" refers to the offer or the closed deal. I assume it is the closed deal? I think this is from MLS data, so maybe your wife knows if "cash" offers that change to financing remain classified as "cash" after closing.My wife gets a lot of buyers who are making “cash” offers. But this is to bypass the appraisal as they are planning to pay over value.

but they still end up getting a mortgage after. They just lose their protection on the contract if they wanted to back out.

Wonder if that is similar there. Cash offers but still get a mortgage

Do you notice *any* changes to consumer behavior in your day to day life?

The last time I went into a restaurant, bar, casino, hotel, big box store, mall etc and it wasn't packed was 2019.

Nearly everyone I know switched jobs or got a big raise the last two years. People are looking at their increased paycheck which is over the rate of inflation...not their portfolio. At least what I see.

Ffs

Listen to what I'm saying

Consumer credit card debt is now at all time highs. Translation: while times were good people started to spend again, they've now drawn their debt from recent lows to all time highs. That add heat into the economy and also drives inflation.

Savings rates are now back to lows. Translation: that positive cash flow which enables spending/saving is gone

Retail inventories are also at highs as are inventory in most businesses. Translation: for some it's according to plan to avoid JIT inventory to avoid the supply crisis. For retailers it's bad if. People stop buying. For SCM individuals like me it's an expected part of the whipsaw effect.

Employment: everyone who got hired due to record demand (the demand I mentioned earlier due to the pipeline fill effect of moving away from JIT ) will result in layoffs and higher unemployment as we start to stabilize supply and demand.

Again My thesis: based on whipsaw effect I think many businesses are going to be on hard times as their inventories are high, consumer confidence is dipping, inflation is being tamed by fed leading to a crunch at consumer level. The timing of this will result in lost business for many who are already flush with inventory. Energy costs will remain high, consumers will suffer. Business will have to fire sale inventory or declare bankruptcy. While this will also impact stock markets, my posts have nothing to do with equities tying into real estate. However, all of this said reduction in stock market,and crypto markets will feed a cycle of decline which allowed for record inflation. There will be a correction, and Im betting we'll see this globally and in real estate. Bubble bursting.

Yes I see an extreme bearish scenario forming.

We continued to scrupulously save, as we always have, and we always will. But both of us were raised by Depression-era parents, and we live well below our means and save as much as we can. But we are certainly an exception to most people we know. Only difference on spending for us is two kids in college at the same time--but we planned for that too--both kids have more money in "their" college savings accounts than needed to pay their tuition. Our oldest has cost us less than community college after all of the scholarships at RU Honors College and 3 semesters of living at home, where we actually received payments for those semesters.Ffs

Listen to what I'm saying

Consumer credit card debt is now at all time highs. Translation: while times were good people started to spend again, they've now drawn their debt from recent lows to all time highs. That add heat into the economy and also drives inflation.

Savings rates are now back to lows. Translation: that positive cash flow which enables spending/saving is gone

Retail inventories are also at highs as are inventory in most businesses. Translation: for some it's according to plan to avoid JIT inventory to avoid the supply crisis. For retailers it's bad if. People stop buying. For SCM individuals like me it's an expected part of the whipsaw effect.

Employment: everyone who got hired due to record demand (the demand I mentioned earlier due to the pipeline fill effect of moving away from JIT ) will result in layoffs and higher unemployment as we start to stabilize supply and demand.

Again My thesis: based on whipsaw effect I think many businesses are going to be on hard times as their inventories are high, consumer confidence is dipping, inflation is being tamed by fed leading to a crunch at consumer level. The timing of this will result in lost business for many who are already flush with inventory. Energy costs will remain high, consumers will suffer. Business will have to fire sale inventory or declare bankruptcy. While this will also impact stock markets, my posts have nothing to do with equities tying into real estate. However, all of this said reduction in stock market,and crypto markets will feed a cycle of decline which allowed for record inflation. There will be a correction, and Im betting we'll see this globally and in real estate. Bubble bursting.

Yes I see an extreme bearish scenario forming.

Last edited:

I think most of the posters if not all are conservative financially and will survive any financial downturn. The people that will be hurting are people earning 50-60k and below. Hand to mouth. When I see rent going for $2,000 mth, I wonder how they can save anything in their future unless they have have an above average job. If you are below the 70%, you will be hurting in the future.We continued to scrupulously save, as we always have, and we always will. But both of were raised by Depression-era parents, and we live well below our means and save as much as we can. But we are certainly an exception to most people we know. Only difference on spending for us is two kids in college at the same time--but we planned for that too--both kids have more money in "their" college savings accounts than needed to pay their tuition. Our oldest has cost us less than community college after all of the scholarships at RU Honors College and 3 semesters of living at home, where we actually received payments for those semesters.

You don’t have to worry, you’re probably in the top 5% in assets that post.

Even at 100k- how does someone save anything meaningful for their future.I think most of the posters if not all are conservative financially and will survive any financial downturn. The people that will be hurting are people earning 50-60k and below. Hand to mouth. When I see rent going for $2,000 mth, I wonder how they can save anything in their future unless they have have an above average job. If you are below the 70%, you will be hurting in the future.

You don’t have to worry, you’re probably in the top 5% in assets that post.

I'm not worried, regardless of my asset/worth, which I prefer not to discuss/reveal, but people can draw conclusions if they wish. In my own experience and personal observation, I see people earning the least spending the most. As an example, I see some folks who have the least money upgrading their mobile phone every 18-24 months to have the latest technology. I keep my phones until they don't work anymore. Several years ago, we were on a road trip to Las Vegas from Arizona, and my phone battery on my six plus year old phone started expanding and getting warm. Being the cheapo that I am, I debated with my better half about the need to get a new phone. I loved that phone. I caved, and I get a Samsung phone that I hated. My better half was correct that we probably needed to abandon that old phone before it caught on fire while charging.I think most of the posters if not all are conservative financially and will survive any financial downturn. The people that will be hurting are people earning 50-60k and below. Hand to mouth. When I see rent going for $2,000 mth, I wonder how they can save anything in their future unless they have have an above average job. If you are below the 70%, you will be hurting in the future.

You don’t have to worry, you’re probably in the top 5% in assets that post.

I see this in other areas- buying more expensive cars that people can afford, getting the upper range model with leather/leatherette seats and stuff that is not needed. Sometimes, we take our cheapness to ridiculous extremes on purchasing items that we should just buy instead of wasting time shopping to save a few extra dollars, but that is how we were wired. It has served us well.

Ffs

Listen to what I'm saying

Consumer credit card debt is now at all time highs. Translation: while times were good people started to spend again, they've now drawn their debt from recent lows to all time highs. That add heat into the economy and also drives inflation.

Savings rates are now back to lows. Translation: that positive cash flow which enables spending/saving is gone

Retail inventories are also at highs as are inventory in most businesses. Translation: for some it's according to plan to avoid JIT inventory to avoid the supply crisis. For retailers it's bad if. People stop buying. For SCM individuals like me it's an expected part of the whipsaw effect.

Employment: everyone who got hired due to record demand (the demand I mentioned earlier due to the pipeline fill effect of moving away from JIT ) will result in layoffs and higher unemployment as we start to stabilize supply and demand.

Again My thesis: based on whipsaw effect I think many businesses are going to be on hard times as their inventories are high, consumer confidence is dipping, inflation is being tamed by fed leading to a crunch at consumer level. The timing of this will result in lost business for many who are already flush with inventory. Energy costs will remain high, consumers will suffer. Business will have to fire sale inventory or declare bankruptcy. While this will also impact stock markets, my posts have nothing to do with equities tying into real estate. However, all of this said reduction in stock market,and crypto markets will feed a cycle of decline which allowed for record inflation. There will be a correction, and Im betting we'll see this globally and in real estate. Bubble bursting.

Yes I see an extreme bearish scenario forming.

I get those numbers. I don't think they're accounting for segments of society that have piled on savings, that are working from home permanently, and that are spending like it's going out of style while not incurring debt.

That is who is buying in NJ. I am confident it's the same in CA just based on prices in both places.

I am looking to buy a second house. A 2 bedroom townhome I was tracking sold for 3 days for 535k- no basement, 1400 sqft where you'd have to bike or drive to the beach unless you were super intrepid, in a town with meh schools by NJ standards. That was this month.

Yeah there's people pushed but kinda like the 2020 recession it's not very even.

Your parent didn’t live thru the depression.Even at 100k- how does someone save anything meaningful for their future.

I'm not worried, regardless of my asset/worth, which I prefer not to discuss/reveal, but people can draw conclusions if they wish. In my own experience and personal observation, I see people earning the least spending the most. As an example, I see some folks who have the least money upgrading their mobile phone every 18-24 months to have the latest technology. I keep my phones until they don't work anymore. Several years ago, we were on a road trip to Las Vegas from Arizona, and my phone battery on my six plus year old phone started expanding and getting warm. Being the cheapo that I am, I debated with my better half about the need to get a new phone. I loved that phone. I caved, and I get a Samsung phone that I hated. My better half was correct that we probably needed to abandon that old phone before it caught on fire while charging.

I see this in other areas- buying more expensive cars that people can afford, getting the upper range model with leather/leatherette seats and stuff that is not needed. Sometimes, we take our cheapness to ridiculous extremes on purchasing items that we should just buy instead of wasting time shopping to save a few extra dollars, but that is how we were wired. It has served us well.

CNBC’s Jim Cramer tells Gen Z to ‘learn to be more frugal’

CNBC financial analyst Jim Cramer thinks Gen Z millennials are spending too much on discretionary items.

Dad born in 1925 Flatbush to first generation immigrants.Your parent didn’t live thru the depression.

what does that have to do with my comment?

Isn't the time period of the Great Depression generally accepted as 1929-1939?Dad born in 1925 Flatbush to first generation immigrants.

what does that have to do with my comment?

Your Dad would have been 13 or 14 at the end, and he certainly would have had memories of living frugally and doing less with more, unless his family was wealthy?

Yep…that was my point. And it has nothing to do with $100 k in 2022 and hard to really save for a future in NJ on it.Isn't the time period of the Great Depression generally accepted as 1929-1939?

Your Dad would have been 13 or 14 at the end, and he certainly would have had memories of living frugally and doing less with more, unless his family was wealthy?

yes, a family can live nicely and not paycheck to paycheck but if you figure in mortgage plus property tax, cars, college etc…what is really being saved for retirement? Not everyone gets a pension.

a family at 100k hopes on their 401k and maybe what ends up to averaging out at 5-10k a year savings.

While that is living nice but also very tight.

You can close cash and finance after. Know a few people helped their kids buy homes that way. Short bridge loan from mom and dad.No. I get a report of closed sales, and they are listed as cash. But I never pressed my realtor if the "cash" refers to the offer or the closed deal. I assume it is the closed deal? I think this is from MLS data, so maybe your wife knows if "cash" offers that change to financing remain classified as "cash" after closing.

The whole cash then loan later thing always seemed like a ticking time bomb to meYou can close cash and finance after. Know a few people helped their kids buy homes that way. Short bridge loan from mom and dad.

Not if its mom and pop backstopping you. Also think it gets the appraisal value up.The whole cash then loan later thing always seemed like a ticking time bomb to me

No need for appraisal and that is what excites the seller Downfall, is that buyer has no protection.Not if its mom and pop backstopping you. Also think it gets the appraisal value up.

mid you have a mortgage contingency- and the house doesn’t appraise, you can back out. Cash offer, even if you go for the mortgage, there is no backing out.

Mini-thread hijack! What are you plans for that extra 529 money? I'm pretty sure we overshot as well. We started to pull out $10k a year for private K-12 ahead of schedule, but this likely won't close the entire gap.We continued to scrupulously save, as we always have, and we always will. But both of us were raised by Depression-era parents, and we live well below our means and save as much as we can. But we are certainly an exception to most people we know. Only difference on spending for us is two kids in college at the same time--but we planned for that too--both kids have more money in "their" college savings accounts than needed to pay their tuition. Our oldest has cost us less than community college after all of the scholarships at RU Honors College and 3 semesters of living at home, where we actually received payments for those semesters.

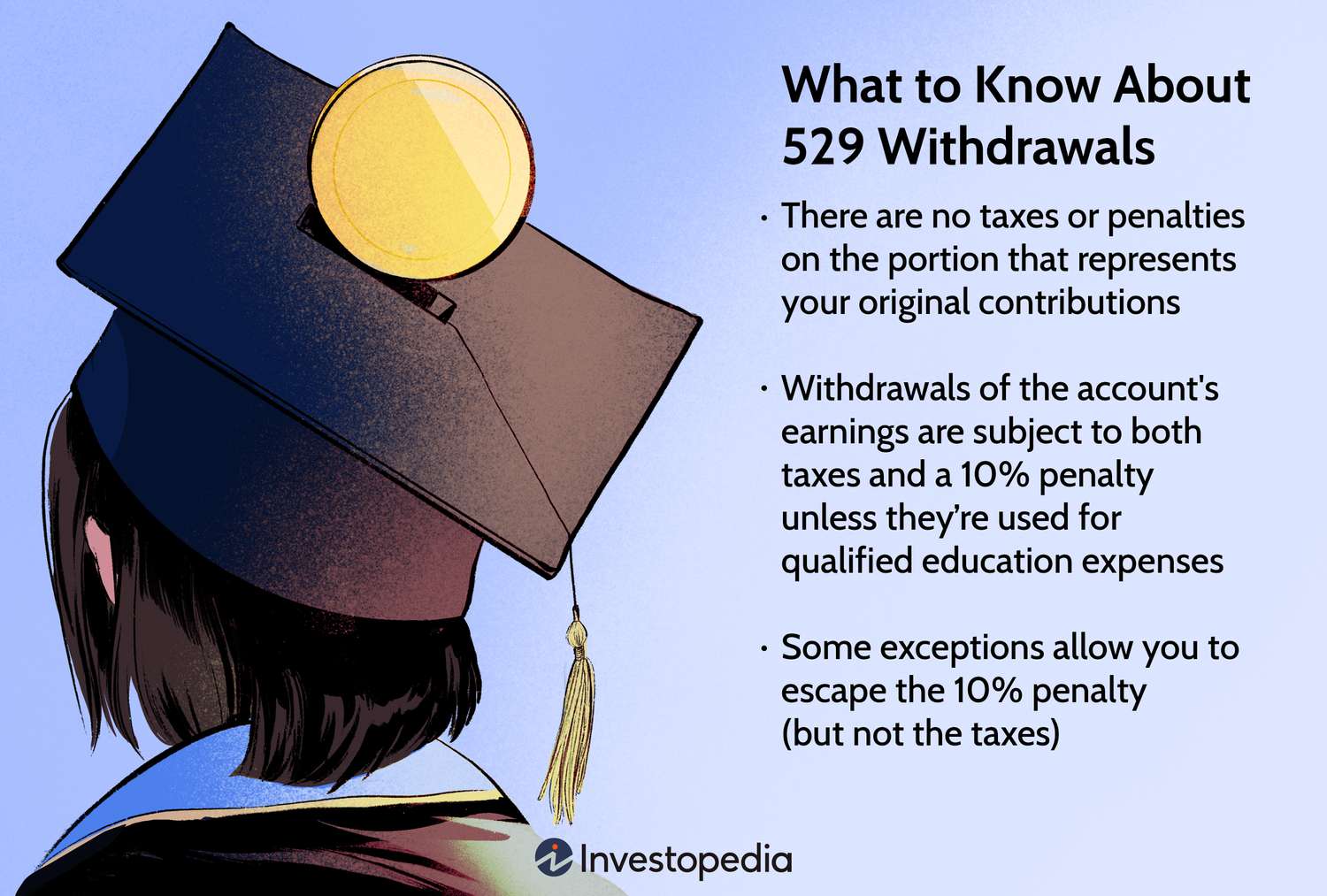

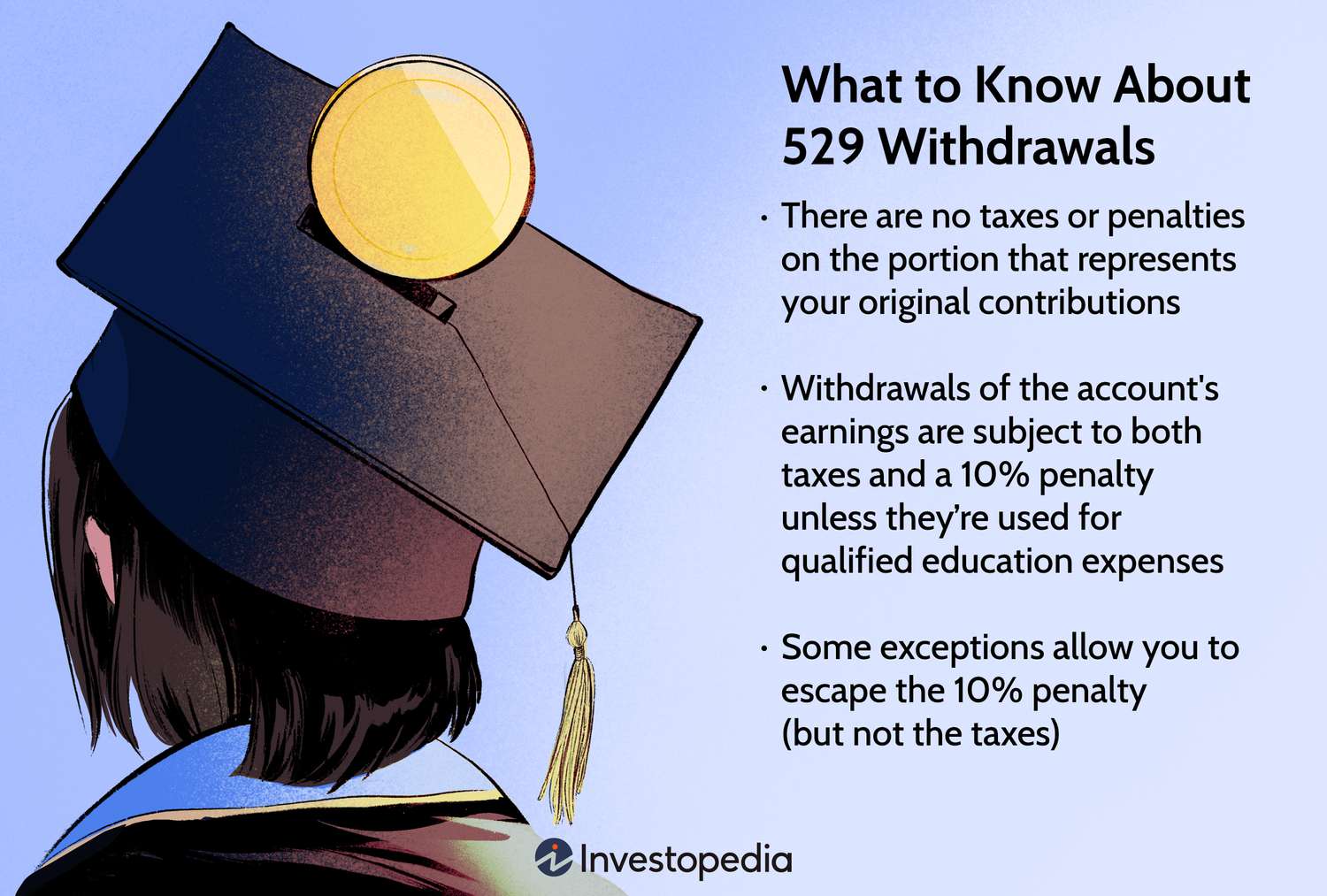

As I understand it, only the earnings of 529 plans are taxed when not used for qualified education expenses (QEE--note that I defined my acronym before just tossing it out there!). Some guidance here, and we are still trying to figure it out.Mini-thread hijack! What are you plans for that extra 529 money? I'm pretty sure we overshot as well. We started to pull out $10k a year for private K-12 ahead of schedule, but this likely won't close the entire gap.

A Penalty-Free Way to Get 529 Money Back

Your 529 plan withdrawals that aren’t used for qualified education expenses can be subject to tax and a 10% penalty. Here’s how to avoid that penalty.

That's a good resource. I wish the K-12 limit was raised or eliminated. That would give us the needed flexibility.As I understand it, only the earnings of 529 plans are taxed when not used for qualified education expenses (QEE--note that I defined my acronym before just tossing it out there!). Some guidance here, and we are still trying to figure it out.

A Penalty-Free Way to Get 529 Money Back

Your 529 plan withdrawals that aren’t used for qualified education expenses can be subject to tax and a 10% penalty. Here’s how to avoid that penalty.www.investopedia.com

We will probably expend all (or perhaps exceed) our youngest kid's account, who is in a six year program at a private university. For the oldest kid, we will have excess for undergrad, and while probably not going to grad school right away, that may happen after working for a couple of years. That is the other part we have to figure out.That's a good resource. I wish the K-12 limit was raised or eliminated. That would give us the needed flexibility.

Last edited:

Holding money for grad school is an option. Obviously, you can play the long game and hold a small amount of leftover money in an account and then assign it to grandkids as them come along.We will probably expend all (or perhaps exceed) our youngest kid's account, who is a six year program at a private university. For the oldest kid, we will have excess for undergrad, and while probably not going to grad school right away, that may happen after working for a couple of years. That is the other part we have to figure out.

Eugene Xu said that the housing market is cooling down a bit but it’s very unlikely to see a 10%+ pullback.

True but in this market you won’t have an offer considered unless you waive the appraisal so it’s a moot point anyway. And in a 50/50 market you probably wouldn’t need the whole close cash then mortgage stunt.No need for appraisal and that is what excites the seller Downfall, is that buyer has no protection.

mid you have a mortgage contingency- and the house doesn’t appraise, you can back out. Cash offer, even if you go for the mortgage, there is no backing out.

Which Eugene Xu?Eugene Xu said that the housing market is cooling down a bit but it’s very unlikely to see a 10%+ pullback.

Most of those guys are one hit wonders.The Asian quant in “The Big Short”.

A

anon_0k9zlfz6lz9oy

Guest

Why are they trying to back out? What area? What type of real estate?Talked to my real estate agent this weekend. Said tides are changing. He has two buyers in the past week trying to back out of deals now. I’d also add that the vacation home market is most vulnerable at times like this especially when the stock market blows.

Talked to my real estate agent this weekend. Said tides are changing. He has two buyers in the past week trying to back out of deals now. I’d also add that the vacation home market is most vulnerable at times like this especially when the stock market blows.

Interesting enough, my wife has had a couple of clients back out of their deals for various reasons this past couple of weeks and were willing to lose their down payments.Why are they trying to back out? What area? What type of real estate?

Maybe FOLM (fear of losing money)>>>FOMO (fear of missing out) has set in for a lot of people. Don't think that people doing well understand how hard the inflationary environment is on a lot of people. This was a very sobering read of people living on the edge:Interesting enough, my wife has had a couple of clients back out of their deals for various reasons this past couple of weeks and were willing to lose their down payments.

No movies, less meat, more stress: How these NJ residents cope with inflation

Families across the country are feeling squeezed as inflation reached a new 40-year high. Here's how five New Jersey families are trying to cope.

www.app.com

Is this possibly true?Maybe FOLM (fear of losing money)>>>FOMO (fear of missing out) has set in for a lot of people. Don't think that people doing well understand how hard the inflationary environment is on a lot of people. This was a very sobering read of people living on the edge:

No movies, less meat, more stress: How these NJ residents cope with inflation

Families across the country are feeling squeezed as inflation reached a new 40-year high. Here's how five New Jersey families are trying to cope.www.app.com

"What Holly Schepisi earns in a day as a state senator no longer covers the cost to drive from her home in River Vale to Trenton and back. Between rising gas prices and tolls, a round trip rings up to around $170, compared to the $135 a day she makes as a legislator representing parts of Bergen and Passaic counties."

Wikipedia says (assuming it is correct), state legislators make $49,000/year. Divide that by 365, and it is actually $134.25/day.Is this possibly true?

"What Holly Schepisi earns in a day as a state senator no longer covers the cost to drive from her home in River Vale to Trenton and back. Between rising gas prices and tolls, a round trip rings up to around $170, compared to the $135 a day she makes as a legislator representing parts of Bergen and Passaic counties."

But that is a bit deceiving--is she driving to Trenton every day? I thought that being an assemblyperson is a part-time job? Looking at the calendar, there will be 27 days where the assembly is in session through the end of June. Taking that number, aren't assembly members only going to Trenton about 50-60 times per year? It's definitely not 365 days a year, so her point is a bit disingenuous?

New Jersey General Assembly - Wikipedia

Session Schedules | NJ Legislature

Listing of current, upcoming and past NJ Senate and General Assembly sessions with ability to add to your calendar and view archived proceedings from past sessions

Similar threads

- Replies

- 280

- Views

- 6K

- Replies

- 1

- Views

- 145

A

Kirk is a top 20 OC in America, Most Here Dont Know What Hes Trying to do, We Explain In The Thread

- anon_0k9zlfz6lz9oy

- The Round Table 2

- Replies

- 75

- Views

- 2K

- Replies

- 560

- Views

- 14K

ADVERTISEMENT

ADVERTISEMENT