A

anon_0k9zlfz6lz9oy

Guest

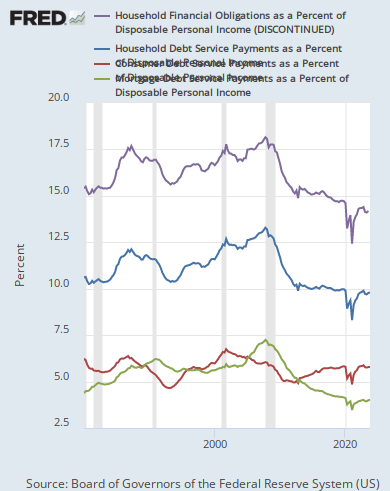

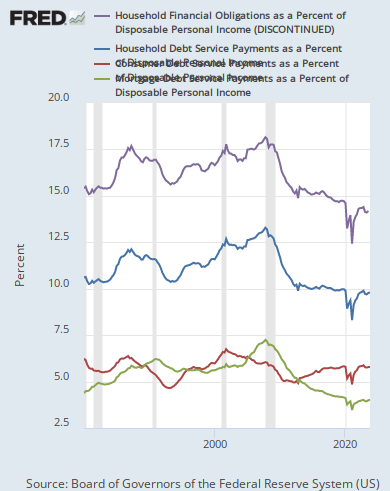

Yup. These are charts we posted back in june but for whatever reason people wanted to ignore.Better chart. Another thing that will help housing.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Yup. These are charts we posted back in june but for whatever reason people wanted to ignore.Better chart. Another thing that will help housing.

Although they might be measuring aggregate mortgage service vs aggregate income which reduces it given those with no mortgage. But still a big picture take away is aggregate balance sheets in pretty good shape.Yup. These are charts we posted back in june but for whatever reason people wanted to ignore.

Yup. These are charts we posted back in june but for whatever reason people wanted to ignore.

This is a reasonable assumption as incomes grow.

Sounds right if rates stay above 5.75% for the year

Which means they will otherwise housing costs increase again causing the Fed to move rates higherSounds right if rates stay above 5.75% for the year

Fed isnt singularly focused on housing prices thoughWhich means they will otherwise housing costs increase again causing the Fed to move rates higher

Hate the player, not the game.Haha dont link gerli. Hes a youtuber and since 2011 has been calling for a collapse. Estimated he makes $250K/yr off his youtube page views. Hes called 13 of the last zero crashes and has refused any debates because he knows hes a grifter who prays on fools haha

With that said, cancel rate is true. People went under contract a year ago when rates were 2.875% and now cant qualify for that same price at 6.20%

Mortgage rates gonna touch the 5’s today. Markets not in a bubble and people gotta stop reaching for it to be 2008

Maybe they are desperate? Maybe they are @Plum Street , didn't hire a realtor and did a poor market evaluation.Starting to see signs of market softness. One listing in my area started at 1.3775mm in 9/2022 is now 912.5k. Don’t know the whole story but they are chasing the market down. My neighbor’s house that’s similar sold 1.275mm in 5/2022.

Lol plum street asks advice here so plum street don’t make those mistakesMaybe they are desperate? Maybe they are @Plum Street , didn't hire a realtor and did a poor market evaluation.

House down street from me listed Nov15 and has not budged on price.

I've noticed an uptick in texts from purported buyers and realtors inquiring if one of our properties are for sale. I report every one of these as spammers.

They hired a broker. They chase the market down meaning they were always priced above market. Now it’s got a stigma because it sat too long and the huge price reduction.Maybe they are desperate? Maybe they are @Plum Street , didn't hire a realtor and did a poor market evaluation.

House down street from me listed Nov15 and has not budged on price.

I've noticed an uptick in texts from purported buyers and realtors inquiring if one of our properties are for sale. I report every one of these as spammers.

Good point. Good to ask. Sellers almost always seem to suffer from inherent bias that their home is worth more than the actual worth.Lol plum street asks advice here so plum street don’t make those mistakes

Are you one of the people who text me back "Fvck you"? I send out 500 texts a week.Maybe they are desperate? Maybe they are @Plum Street , didn't hire a realtor and did a poor market evaluation.

House down street from me listed Nov15 and has not budged on price.

I've noticed an uptick in texts from purported buyers and realtors inquiring if one of our properties are for sale. I report every one of these as spammers.

Address of both houses so I can take a look? Demand has picked up across the board nationwide to start the year and even moreso in NJStarting to see signs of market softness. One listing in my area started at 1.3775mm in 9/2022 is now 912.5k. Don’t know the whole story but they are chasing the market down. My neighbor’s house that’s similar sold 1.275mm in 5/2022.

Of course. Refi game is dead. Around 70% of mortgage holders have rates under 4%. Mortgage apps are also at 2008 levels right now. Only bizz theyre getting is purchases, past 2 years was the busiest theyll ever be as everyone and their mother refi’dHate the player, not the game.

Merely incidental and coincidental find, but this person is from Seattle, replying to a tweet about tech laoyoffs in Seattle.

I’m in summitAddress of both houses so I can take a look? Demand has picked up across the board nationwide to start the year and even moreso in NJ

Nah. My concern is that some of the texts might be robotexts and I will get on some list or something.Are you one of the people who text me back "Fvck you"? I send out 500 texts a week.

Yep. I think I made 30k in commissions last year off of text messages that converted to listings. I showed kyk that software and his head damn near exploded. I do it for listings and property management business. We got an 8 unit under management from the texts a few months ago. It's way easier for people than cold calls.Nah. My concern is that some of the texts might be robotexts and I will get on some list or something.

Do you ever get responses of interest in selling?

Just wait until someone files a TCPA lawsuit will cost you way more than $30K to defend…Yep. I think I made 30k in commissions last year off of text messages that converted to listings. I showed kyk that software and his head damn near exploded. I do it for listings and property management business. We got an 8 unit under management from the texts a few months ago. It's way easier for people than cold calls.

Interesting. Summit is on fire. Im good friends with sue whos the top dog in town. They have tons of buyers, no houses to sell themI’m in summit

Can attest to this. I use it now too. Its unrealYep. I think I made 30k in commissions last year off of text messages that converted to listings. I showed kyk that software and his head damn near exploded. I do it for listings and property management business. We got an 8 unit under management from the texts a few months ago. It's way easier for people than cold calls.

So heres the data. The softness your seeing was anecdotal and an exception in Summit, not the norm.I’m in summit

Yeah good luck pal. I get 10 cold texts a day from random numbers.Just wait until someone files a TCPA lawsuit will cost you way more than $30K to defend…

Jobs is the key. Strong employment = no crashAll the people with 3% fixed rate mortgages are staying put, depressing inventory. This alone, will keep a floor under prices.

The Fed has nothing to do with home affordability. It has two jobs.....inflation and employment. Inflation is plummeting and essentially over and the job market is holding up nicely. Look for a formal pause at the March Fed meeting. Powell knows where the CPI math is heading. This is why he was so calm and dovish on Wed.Lol Fed is not pausing rates. 3.4 unemployment and 500 K new jobs. They might have to go back to. 5 increases and one of the feds goals is to bring home affordable ability back into line.

And no crash means, welcome to the new bull market.Jobs is the key. Strong employment = no crash

Or more rate hikesAnd no crash means, welcome to the new bull market.

Stay away.@kyk1827 and @RUskoolie (or anyone else)- we are landlords for a couple of multifamily properties, and this is part of our investment mix for when we retire.

Something we got from a friend- have you ever heard of Pro One Seven Capital Partners? They are looking for investors at various ranges for a commercial retail property in Kansas. I've seen @kyk1827 mention real estate syndicates that pay a cashflow dividend in addition to capital appreciation.

Is that outfit a legit one? We prefer our approach of being close to (on top) of the action and being hands on landlords rather than passive. To us, it's fun, and it will give us more control and something to actively do in retirement. Maybe passive is not for us? Maybe we are a couple of simpletons and should stay in our lane? LOL.

Based on the market/asset or the company? I did a quick look, and did not get a peaceful easy feeling. I think I'm already gone!Stay away.