Cultural neo-Marxism (DEI brought to US by Blackrock from CCP) killing chip manufacturing in US

"DEI—the identity-obsessed dogma that goes by “diversity, equity, and inclusion”—has now trained Google’s new AI to refuse to draw white people. What’s even more alarming is that it’s also infected the supply chain that makes the chips powering everything from AI to missiles, endangering national security....

Intel announced it’s putting the brakes on its Columbus factory. The Taiwan Semiconductor Manufacturing Company (TSMC) pushed back production at its second Arizona foundry (called a fab). The remaining major chipmaker, Samsung, just delayed its first Texas fab. This is not the way companies typically respond to multi-billion-dollar subsidies.

What explains chipmakers’ ingratitude? In large part, frustration with DEI. Commentators have noted that CHIPS and Science Act money has been sluggish. What they haven’t noticed is that it’s because the CHIPS Act is so loaded with DEI pork that it can’t move."

The CHIPS Act’s current identity as a jobs program for favored minorities means companies are forced to recruit heavily from every population except white and Asian men already trained in the field; it’s like fishing in all the places you aren’t getting bites.

www.aol.com

Its no accident new jobs leaving out US men and going heavy on foreigners . That's the goal of "war of deterioration" and not a coincidence - has zip to do with "rights' or "justice".

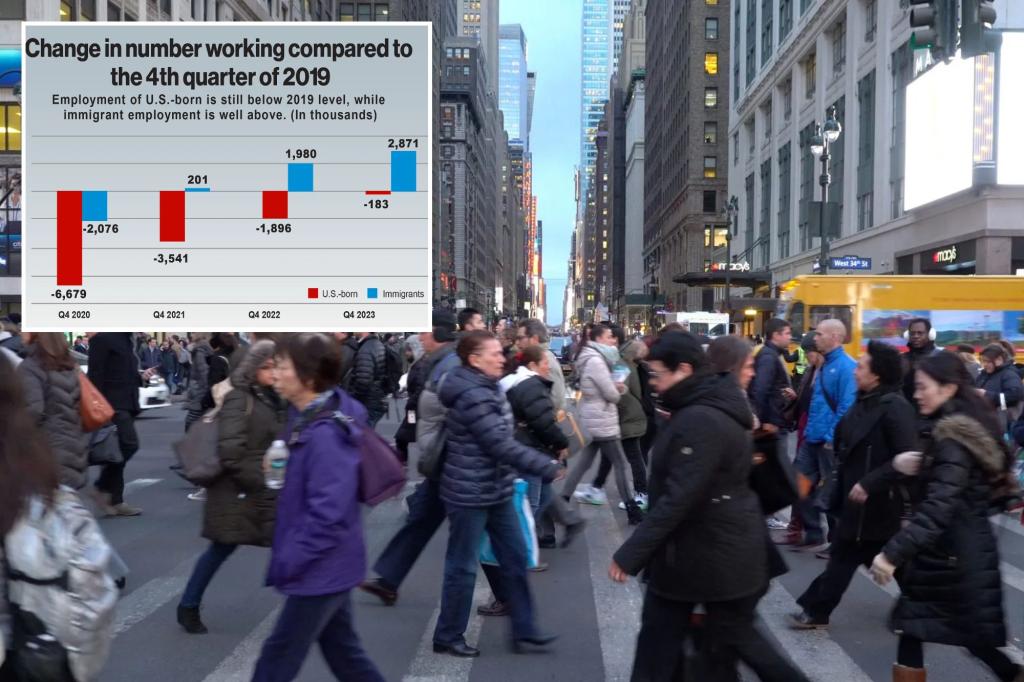

Comparing to the fourth quarter of 2019, right before Covid hit, to the fourth quarter of 2023 shows 2.7 million more people working.

nypost.com