Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT: Stock and Investment Talk

- Thread starter RU-05

- Start date

Problem is you know I‘m not lying. I only post what I’m trading to piss off calif, T2K, Big RedMach and PakT.Good post. 😜

I have no idea, definitely don't bother tracking your posts, but I have noticed plenty of inconsistencies. I also know that you were wrong on the overall market for the past several years and after the corona crash. You thought it would go down much more and take much longer to recover to previous highs. I said 3-6 months, which is why I kept buying, and I turned out to be right. If you made some good trades during this time, I am happy that you listened to me.Problem is you know I‘m not lying.

👍

Troll.Problem is you know I‘m not lying. I only post what I’m trading to piss off calif, T2K, Big RedMach and PakT.

:)

Bullish on the economy data:

IMO Immelt is a moron regardless of the situation he walked into and many his bad moves were well into his tenure. Welch created a big blackbox at GE Capital to smooth out earnings and pull rabbits out of and what not IMO but he probably at least knew how to keep a close eye on it unlike Immelt. It's what exposed them so badly during the crash and still accounts for billions of necessary reserves coming from LTC policies from a decade plus ago. It's funny I remember back then there was this whole thing about the triumvirate under Welch about who was going to take his place.....Immelt, Nardelli (left and went to HD) or McNierney (left and went to Boeing)....the other two left when they didn't get the spot but out of the 3 "would be kings" 2 were very bad CEOs. Immelt you can see what I think of him but Nardelli did a lousy job at HD too...the guy who replaced him Frank Blake brought over from GE as well IIRC is who took HD to new heights. McNierney at BA is the only one who did a solid job when he got a CEO position.Interesting post/POV on GE. Thanks! Immelt was dealt a tough hand at the start of his tenure, but seriously, he never seemed to make the right big moves.

I have no issues paying CEOs who deserve it whatever money (like Dimon or Iger) but a buffoon like Immelt should have every penny clawed back and the previous BODs should never be able to sit on a board. Too many CEOs make such bad moves and are overpaid and don't deserve the money or the title...Steve Ballmer the former Microsoft CEO is somewhat similar with all the bad moves he made and resources he wasted...luckily for him Microsoft still had a ton more. Nadella has taken MSFT to new heights and the company is doing awesome now.

I'm not surprised.

The real issue is large groups with no preventative measures like masks and social distancing. Frats, sororities and Washington Square are the obvious examples but not the only ones. Crack down on those and the problems are manageable. I think that if you compared that policy with a total shut down I think the economic AND health costs of a total shut down are far worse.

Crack down on large groups ? Do you mean legal protesting ?

How do you make that illegal ?

why do you give a shit what I post? It's an anonymous message board.Cheese why do you give a shit what Dave posts? He can come here and post whatever he wants bro it’s an anonymous message board. It’s an anonymous message board!!!!!!!! Dave could be very well be full of shit and lying. Just like all the other ballers here. WHO CARES!! Don’t get flustered about an anonymous message board where no one knows anyone lol. It’s a small part of your day and you cannot wait until the games and the commitments happen because that is why we pay $100 a year for. A guy wants to say that he does this that and the other thing hey you get one life and if bragging about what a BAUCE they are to total strangers that’s there life lol. As long as there is no unwarranted personal attacks it’s all good.

Great stuff, appreciate the insights. Yeah, Welch and Gate's replacements didn't do well. Don't know why. I guess they were just not up for the big desk. However, I have been surprised with how well Cook has done replacing Jobs.IMO Immelt is a moron regardless of the situation he walked into and many his bad moves were well into his tenure. Welch created a big blackbox at GE Capital to smooth out earnings and pull rabbits out of and what not IMO but he probably at least knew how to keep a close eye on it unlike Immelt. It's what exposed them so badly during the crash and still accounts for billions of necessary reserves coming from LTC policies from a decade plus ago. It's funny I remember back then there was this whole thing about the triumvirate under Welch about who was going to take his place.....Immelt, Nardelli (left and went to HD) or McNierney (left and went to Boeing)....the other two left when they didn't get the spot but out of the 3 "would be kings" 2 were very bad CEOs. Immelt you can see what I think of him but Nardelli did a lousy job at HD too...the guy who replaced him Frank Blake brought over from GE as well IIRC is who took HD to new heights. McNierney at BA is the only one who did a solid job when he got a CEO position.

I have no issues paying CEOs who deserve it whatever money (like Dimon or Iger) but a buffoon like Immelt should have every penny clawed back and the previous BODs should never be able to sit on a board. Too many CEOs make such bad moves and are overpaid and don't deserve the money or the title...Steve Ballmer the former Microsoft CEO is somewhat similar with all the bad moves he made and resources he wasted...luckily for him Microsoft still had a ton more. Nadella has taken MSFT to new heights and the company is doing awesome now.

I don’t but you seemed triggered but carry on.why do you give a shit what I post? It's an anonymous message board.

He cares so little about anonymous message boards that he will keep posting on an anonymous message board to say how little he cares.why do you give a shit what I post? It's an anonymous message board.

LOL.

Brought before the market opened.Textbook buying day! The market reacting emotionally to non-economic news. Enjoy!

Unemployment down to 7.9%

www.cnbc.com

www.cnbc.com

Jobs report shows fewer hires as recovery loses momentum

The unemployment rate was 7.9%, the Labor Department said Friday in the final jobs report before the November election.

I think Cook has done solid job. I like that they're diversifying from just hardware to services also and getting an increasing share of their revenue from that. Recurring revenue streams are always nice and a lot of companies these days are relying on services which is smart IMO.Great stuff, appreciate the insights. Yeah, Welch and Gate's replacements didn't do well. Don't know why. I guess they were just not up for the big desk. However, I have been surprised with how well Cook has done replacing Jobs.

Wasn't a fan of him sort of being "bullied" by Icahn though awhile back into deploying their hoard of cash in buybacks and dividend increase. As I said above I like the dividend increase and the buyback ended up working because the share price has gone up a lot with the market as a whole but I'm never a fan of these buy high buybacks. When everything is hunky dory and going well CEOs buy back stock but when things are tanking and the share price is down I don't often, if ever, hear of buybacks...suddenly they get all conservative. It's the reverse of the whole buy low mantra. If you were conservative in the good times you'd still have cash to deploy in a buyback in the bad times and still have reserves beyond that. That's why I'm not a fan of buybacks. Too often they are ill timed.

Be like Buffet...so what if you're sitting on 10s of billions of cash. If there's nowhere compelling to deploy it why should you...just because. He deploys it when he sees value. I mean look at the sweet heart deals he was able to extract from some companies during the crash for lending them money. There was a time long while back Apple could have probably bought Netflix but they were too conservative to take a shot and still not been really hurt by it if it failed. Of course it's hindsight but that's why they're paid the big bucks. I find moves like that compelling or how Disney added Pixar, Star Wars, Marvel....very good moves and expensive at the time too...buybacks in a hot up market not so compelling to me.

👌 daveyou should have brought AMZN at 2,960 now 3,216, FB 248 now 268, MSFT 200 now 213, ADBE 462 now 500, NVDA $476 now $543, and AAPL 106 now 116. Just a few of the trades. Most are still 10% from the high.

Yep. dave was adamant about staying in cash until the Dow was c. 15k-16k during the chicomvirus crash. Didn't hear much from him until markets recovered and then he was trying to b.s. the Board he was buying even though DJIA bottomed above 18.5kI have no idea, definitely don't bother tracking your posts, but I have noticed plenty of inconsistencies. I also know that you were wrong on the overall market for the past several years and after the corona crash. You thought it would go down much more and take much longer to recover to previous highs. I said 3-6 months, which is why I kept buying, and I turned out to be right. If you made some good trades during this time, I am happy that you listened to me.

👍

Too bad you’re too scared to put money in the market. When the interest rate was cut almost to zero last year it changed the whole dynamics and made it easier to invest.Yep. dave was adamant about staying in cash until the Dow was c. 15k-16k during the chicomvirus crash. Didn't hear much from him until markets recovered and then he was trying to b.s. the Board he was buying even though DJIA bottomed above 18.5k

Nothing stays the same and investing has to take into account the changes in the environment.

#Receipts lyin'dave?Too bad you’re too scared to put money in the market.

Oh WOW you really went out on a limb saying you "brought' the Tech studs AFTER they were off their highs and would buy on more downside. LOLI made all those trades. Look back at Sept 4th post in this thread. They were crying when I brought the stocks.

The 3 clowns, T2K, BIDREDMachine, and Calif are Trump zombies that are mad whenever I post negative Trump articles for the last 3 years. They have been attacking me like they do numbers. They try to drive anti Trump posters away.

That’s what happens when you’re patience. All the high flying tech stocks, as I said in the past, go down 10-20% every quarter you just have to wait and they normally go back to their highs before the earning call.

I brought at 7% down and now they down another 3-5% and brought a little more. At 15 and 20% down will buy more in increments. Not for the faint of heart.

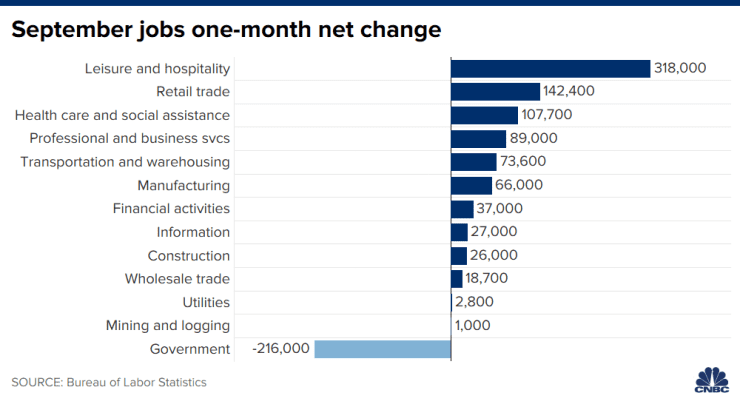

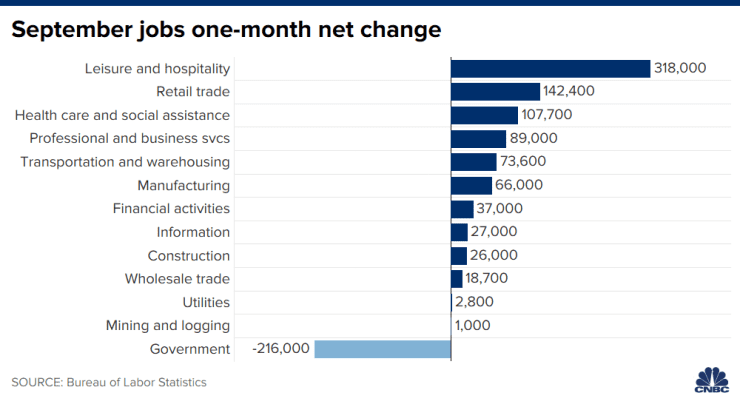

Here's where the jobs are — in one chart

CNBC studied the net change in employment by industry for September based on data from the Labor Department.

July and August monthly payrolls revised up. Trump recovery from Chicomvirus recession staying on track.

Here's where the jobs are — in one chart

CNBC studied the net change in employment by industry for September based on data from the Labor Department.www.cnbc.com

Here's a guy who knows his GE.GE is one I've traded a couple times but it's not for the faint of heart these days despite its brand name.

Immelt was a buffoon to say the least and made one ill timed wrong move after another. Digging out of that huge hole has been a task...imagine they've had to set aside reserves in recent timesfor LTC policies written over a decade ago. It's something that should have been dealt with long ago not rear its ugly head at the most inopportune time when cash flow was in a big crunch. I think they've been conservative about it now and may have gotten their hands around the issue but it's still a little bit of a blackbox issue....hate to say it but wonder if the COVID issue may have helped that portfolio. Of course the hit they took from COVID in their crown jewel of aviation (only really strong part of the company at the time) probably negated any sort of benefit and then some. Their moves into energy with the BHI merger and Allstom were also terrible decisions not to mention share buybacks (do companies ever get buybacks right, I'd rather cold hard cash dividends rather than buy high buybacks most CEOs engage in).

There's also a JPM analyst who has got thing about GE too, he's been right all the way down but feel like he's overplaying his calls recently (especially just before the pandemic) and keeps pouncing on the stock whenever he can. Used to be if he opened his mouth about the stock it would take a hit...I think that affect has worn off at least a little.

Really the most faith in the stock comes from the faith in the current CEO Culp who once ran Danaher and was very good. He's had a huge hole to dig out of....slowly but surely he seems to be and was doing well before aviation got hit by the pandemic. He's been cutting costs, right sizing businesses, getting out of old ones that aren't profitable, trying to grow ones that are and paying down debt etc.....so it's a slow arduous process. Will he be successful...I think he could be as the pandemic goes away in the coming years and things return to some sort of normalcy. I've traded shares in the past bought in this 6-8 range but also hold some for the longer term. To streamline and reinvigorate the company is going to take time 3-5+ years additional at least I think and it's somewhat speculative (weird saying that for a GE) but I'll take the flyer putting my faith in this current CEO and new BOD. If I lose some money so be it but I also think it's got potential to be a good turnaround play over the longer haul but it's going to be a slog.

I'll prob get in eventually, but as you say it's a long term play, don't think there is much impetus to get in right now.

Good advice:

www.cnbc.com

www.cnbc.com

Cramer downplays market drop on Trump's coronavirus, says investors should ready a buy list

"I'm not saying this is much to do about nothing," CNBC's Jim Cramer said Friday. "I am saying that people should have a buy list ready."

+1Here's a guy who knows his GE.

I'll prob get in eventually, but as you say it's a long term play, don't think there is much impetus to get in right now.

Great info and thoughts on GE!

More on the Trump economic recovery: best 4 months for job growth since tracking data started in 1939, U.S manufacturing continuing to expand, confidence up.....and Q3 GDP tracking at an amazing 35% growth rebound. :Chop banana:

There is simply no historical parallel for the magnitude and speed of the current economic recovery

Following the four best months for job growth since the government began tracking the data in 1939 -- 4.8 million jobs in June, 2.7 million in May, 1.7 million in July, 1.4 million in August -- the economy added an additional 661,000 jobs in September.

But the jobs numbers are not the only positive economic indicators. For example, according to the respected Institute for Supply Management monthly Manufacturing Report released Thursday “[e]onomic activity in the manufacturing sector grew in September, with the overall economy notching a fifth consecutive month of growth.”

While we don’t have the September numbers as yet, retail sales surpassed pre-pandemic levels back in July and continued to grow in August, increasing by 0.6 percent.

That number should stay positive. Released on Tuesday, the Conference Board’s consumer confidence numbers spiked to 101.8 in September, the highest number since the pandemic began and the largest month-to-month jump in 17 years.

That’s important because consumer spending accounts for about two-thirds of our gross domestic product. To date, the highest quarterly GDP growth number recorded since 1948 when the government began reporting the data was 13.8 percent in the fourth quarter of 1952.

The Federal Reserve bank of Atlanta’s GDP Now forecasting model is predicting GDP growth of an astounding 34.6 percent in the third quarter, which ended September 30th. That would be a historic high on the heels of a historic drop of 31.4 percent in the second quarter.

www.foxbusiness.com

www.foxbusiness.com

There is simply no historical parallel for the magnitude and speed of the current economic recovery

Following the four best months for job growth since the government began tracking the data in 1939 -- 4.8 million jobs in June, 2.7 million in May, 1.7 million in July, 1.4 million in August -- the economy added an additional 661,000 jobs in September.

But the jobs numbers are not the only positive economic indicators. For example, according to the respected Institute for Supply Management monthly Manufacturing Report released Thursday “[e]onomic activity in the manufacturing sector grew in September, with the overall economy notching a fifth consecutive month of growth.”

While we don’t have the September numbers as yet, retail sales surpassed pre-pandemic levels back in July and continued to grow in August, increasing by 0.6 percent.

That number should stay positive. Released on Tuesday, the Conference Board’s consumer confidence numbers spiked to 101.8 in September, the highest number since the pandemic began and the largest month-to-month jump in 17 years.

That’s important because consumer spending accounts for about two-thirds of our gross domestic product. To date, the highest quarterly GDP growth number recorded since 1948 when the government began reporting the data was 13.8 percent in the fourth quarter of 1952.

The Federal Reserve bank of Atlanta’s GDP Now forecasting model is predicting GDP growth of an astounding 34.6 percent in the third quarter, which ended September 30th. That would be a historic high on the heels of a historic drop of 31.4 percent in the second quarter.

September jobs numbers best since Reagan-era, don't panic America: Andy Puzder

September’s very positive jobs numbers actually confirm that we are still experiencing the most dynamic economic recovery in American history.

The Fed and Congress probably have more to do with it, but that's a debate for another thread. Start one up if your interested, this one is about stocks and investments.More on the Trump economic recovery: best 4 months for job growth since tracking data started in 1939, U.S manufacturing continuing to expand, confidence up.....and Q3 GDP tracking at an amazing 35% growth rebound. :Chop banana:

There is simply no historical parallel for the magnitude and speed of the current economic recovery

Following the four best months for job growth since the government began tracking the data in 1939 -- 4.8 million jobs in June, 2.7 million in May, 1.7 million in July, 1.4 million in August -- the economy added an additional 661,000 jobs in September.

But the jobs numbers are not the only positive economic indicators. For example, according to the respected Institute for Supply Management monthly Manufacturing Report released Thursday “[e]onomic activity in the manufacturing sector grew in September, with the overall economy notching a fifth consecutive month of growth.”

While we don’t have the September numbers as yet, retail sales surpassed pre-pandemic levels back in July and continued to grow in August, increasing by 0.6 percent.

That number should stay positive. Released on Tuesday, the Conference Board’s consumer confidence numbers spiked to 101.8 in September, the highest number since the pandemic began and the largest month-to-month jump in 17 years.

That’s important because consumer spending accounts for about two-thirds of our gross domestic product. To date, the highest quarterly GDP growth number recorded since 1948 when the government began reporting the data was 13.8 percent in the fourth quarter of 1952.

The Federal Reserve bank of Atlanta’s GDP Now forecasting model is predicting GDP growth of an astounding 34.6 percent in the third quarter, which ended September 30th. That would be a historic high on the heels of a historic drop of 31.4 percent in the second quarter.

September jobs numbers best since Reagan-era, don't panic America: Andy Puzder

September’s very positive jobs numbers actually confirm that we are still experiencing the most dynamic economic recovery in American history.www.foxbusiness.com

Stocks, bonds, and the economy are interconnected in many ways, and the competing economic policies of the POTUS candidates couldn't be more relevant to this thread. The article stands.The Fed and Congress probably have more to do with it, but that's a debate for another thread. Start one up if your interested, this one is about stocks and investments.

Yea it's not something that's going anywhere significantly any time soon while aviation is hobbled by the pandemic. It has and can make forays into the high single/low double digits possibly if cash flow news is positive outside of the earnings themselves. Escape velocity beyond that area though seems unrealistic while their best business segment, aviation, is hurt by the pandemic.Here's a guy who knows his GE.

I'll prob get in eventually, but as you say it's a long term play, don't think there is much impetus to get in right now.

GE Predix software was another hole I forgot to mention. Immelt used a lot of resources on it for little in return so far. It was suppose to be an industrial internet of things which actually isn't a terrible idea but the execution was lousy and resources deployed for return as well. You're GE, not AMZN, MSFT, GOOG...should've made some sort of strong partnership with them to get the thing off the ground and maybe it would have gotten some return by now. Just another example of wasted resources.

Also forgot to mention that Culp's compensation package has a lot of incentive to get that share price up. IIRC if the share price gets up to the high teens like 18 area he'll get like a huge amount of stock and then if by some chance, certainly not any time soon, it got up to the 30 area, he'll get even a lot more stock. If he met both those metrics it could total like 300 million in compensation IIRC. So he's got a good reputation prior to GE but he's also very incentivized to get the company on solid footing and the share price up. It would be well deserved and definitely worth considering all the value destruction from the previous idiot Immelt (well actually 2 idiots ago lol there was an internal promotion of Flannery for a time as well). Again though likely a long slog to meet those goals.

Last edited:

Unemployment down to 7.9%

Jobs report shows fewer hires as recovery loses momentum

The unemployment rate was 7.9%, the Labor Department said Friday in the final jobs report before the November election.www.cnbc.com

Imagine what the numbers would be with California, New York, New Jersey, Mich, Ill, Pennsy were opened up !

My wife finally sold hers at $100 on Friday. Not bad 500% return in 6-7 monthsFSLY has bounced between $95 and around $78 3 times over the last 3 months. Just sold 1/3 of my position at $93. Let's see if I get the opportunity to buy back in below $80.

Well done.My wife finally sold hers at $100 on Friday. Not bad 500% return in 6-7 months

I think it might still be a good stock to own going fwd, but like with some of these other young growth stocks that have jumped tremendously, it's no sure thing that they continue to gain market share at the rates we have recently seen, and if not, they will not maintain their current valuations, let alone continue to rise. So taking that level of profit right now sounds like a great call.

Saw some TV guys talking about GILD recently and how it has gotten down to a level which has proven to be a support level going back to 2017.

If Trump's health recovers quickly while taking remdesivir that news could be the impetus of a bounce for GILD's stock price which already looks to be a pretty safe level. (although I guess the support could be broke through if his health doesn't turn quickly)

If Trump's health recovers quickly while taking remdesivir that news could be the impetus of a bounce for GILD's stock price which already looks to be a pretty safe level. (although I guess the support could be broke through if his health doesn't turn quickly)

No Joe, You Didn’t Hand Trump A Booming Economy

Joe Biden – along with his amen chorus in the press – keeps insisting that he and President Barack Obama handed Donald Trump a booming economy when they left office in 2016.

“We left a booming economy, ” Biden said during the first presidential debate, “and he caused the recession.” Debate moderator Chris Wallace jumped in to help Biden, adding that job growth was faster in the last three years of Obama’s term than the first three of Trump’s.

One is a flat out lie, the other a clever deception.

After presiding over the worst economic recovery since the Great Depression, Obama and Biden left office with the economy stalling out, leading experts to warn that the nation was facing “secular stagnation.”

Look at the numbers. GDP growth sharply decelerated in 2016, falling from 3.1% the year before down 1.7% in 2016 – the second-worst year under Obama/Biden after the recession ended and the third year of below 2% growth on their watch.

Other indicators were equally distressing. Small business optimism had been on the decline before the November 2016 election. Business investment was stagnant. The rate of growth in blue-collar jobs was falling.

In Obama’s last year, the unemployment rate remained basically unchanged — it was 4.9% in Jan 2016, and 4.8% when Trump took office in Jan. 2017.

Real median family income didn’t budge from August 2015 to November 2016, according to Sentier Research.

The stock market had been flat for more than a year.

Here’s now the New York Times described the economy that Obama and Biden were leaving behind:

“For three quarters in a row, the growth rate of the economy has hovered around a mere 1%. In the last quarter of 2015 and the first quarter of 2016, the economy expanded at feeble annual rates of 0.9% and 0.8%, respectively. The initial reading for the second quarter of this year, released on Friday, was a disappointing 1.2%.”

The Times warned that “the underlying reality of low growth will haunt whoever wins the White House.”

The economy was so tepid when Obama and Biden were packing their bags that economists started to warn of “secular stagnation” – meaning permanent slow growth.

As CBS News put it at the time: “With U.S. economic growth stuck in low gear for several years, it’s leading many economists to worry that the country has entered a prolonged period where any expansion will be weaker than it has been in the past.”

Does any of this sound anything like a booming economy?

issuesinsights.com

issuesinsights.com

Joe Biden – along with his amen chorus in the press – keeps insisting that he and President Barack Obama handed Donald Trump a booming economy when they left office in 2016.

“We left a booming economy, ” Biden said during the first presidential debate, “and he caused the recession.” Debate moderator Chris Wallace jumped in to help Biden, adding that job growth was faster in the last three years of Obama’s term than the first three of Trump’s.

One is a flat out lie, the other a clever deception.

After presiding over the worst economic recovery since the Great Depression, Obama and Biden left office with the economy stalling out, leading experts to warn that the nation was facing “secular stagnation.”

Look at the numbers. GDP growth sharply decelerated in 2016, falling from 3.1% the year before down 1.7% in 2016 – the second-worst year under Obama/Biden after the recession ended and the third year of below 2% growth on their watch.

Other indicators were equally distressing. Small business optimism had been on the decline before the November 2016 election. Business investment was stagnant. The rate of growth in blue-collar jobs was falling.

In Obama’s last year, the unemployment rate remained basically unchanged — it was 4.9% in Jan 2016, and 4.8% when Trump took office in Jan. 2017.

Real median family income didn’t budge from August 2015 to November 2016, according to Sentier Research.

The stock market had been flat for more than a year.

Here’s now the New York Times described the economy that Obama and Biden were leaving behind:

“For three quarters in a row, the growth rate of the economy has hovered around a mere 1%. In the last quarter of 2015 and the first quarter of 2016, the economy expanded at feeble annual rates of 0.9% and 0.8%, respectively. The initial reading for the second quarter of this year, released on Friday, was a disappointing 1.2%.”

The Times warned that “the underlying reality of low growth will haunt whoever wins the White House.”

The economy was so tepid when Obama and Biden were packing their bags that economists started to warn of “secular stagnation” – meaning permanent slow growth.

As CBS News put it at the time: “With U.S. economic growth stuck in low gear for several years, it’s leading many economists to worry that the country has entered a prolonged period where any expansion will be weaker than it has been in the past.”

Does any of this sound anything like a booming economy?

No Joe, You Didn’t Hand Trump A Booming Economy

When it comes to the economy, it’s Joe Biden, not President Trump, who is employing Goebbels’ technique.

issuesinsights.com

issuesinsights.com

Even CNN had to admit it. Sorry -05.Today was a good day. 😀

Global stocks rise after Trump's doctor said he could leave hospital soon

Hong Kong (CNN Business)US President Donald Trump is trying to convince the world that his Covid-19 diagnosis is not a big deal after all. That strategy might be working on investors, for now.

Global markets and US stock futures are rising after Trump's physicians said that the president could be discharged from Walter Reed National Medical Center as early as Monday. A quick recovery could ease some of the huge uncertainty surrounding the US election with just four weeks left in the campaign.

Global stocks rise after Trump's doctor said he could leave hospital soon

US President Donald Trump is trying to convince the world that his Covid-19 diagnosis is not a big deal after all. That strategy might be working on investors, for now.

Red states are outperforming blue states economicallyImagine what the numbers would be with California, New York, New Jersey, Mich, Ill, Pennsy were opened up !

Of the 20 states with the smallest decrease in state GDP, 13 were run by Republican governors, while the bottom 25 states with the highest decrease in state GDP were predominantly Democratic-run states.

Furthermore, the average unemployment rate across Republican states was 6.5% in August, compared to an average of 9% in Democrat states, according to an analysis of unemployment data by the Heritage Foundation, a conservative think tank.

“The GDP data confirms that blue states are severely underperforming red states, even if there are some outliers for sure,” said Stephen Moore, one of President Trump’s top economic advisers.

“It’s pretty clear blue states with the most severe lockdown had the most damage done to their economies,” said Moore, who is also a contributor to the Washington Examiner.

Red states are outperforming blue states economically - Washington Examiner

States run by Republican governors on average have economically outperformed states run by Democratic governors in recent months.The difference in economic growth is likely due to the pathway of the coronavirus pandemic in the first few months and the economic restrictions imposed by Democratic...

Similar threads

- Replies

- 31

- Views

- 2K

- Replies

- 15

- Views

- 1K

- Replies

- 12

- Views

- 11K

- Replies

- 18

- Views

- 872

ADVERTISEMENT