Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT: Stock and Investment Talk

- Thread starter RU-05

- Start date

Should have gotten in on SPI, small solar company that announced it was getting into the EV market. Shot up 1200%.anybody get into SPAQ?

i got in yesterday. apparently i should have waited a little longer. the Nikola goings on has put on damper on this some.

My long EV plays are F and GM.

NKLA and TSLA could both be good trade ops given their most recent drops, SPAQ too perhaps, but this whole segment is becoming flooded with new players who haven't actually sold any cars .

Last edited:

Starting to see chatter in MSM and political channels that the EU is seriously considering a 6 month total and complete shutdown starting in October. Biden has also voiced his support for a similar approach should he win the election.

If this has legs the market should start reflecting it pretty soon. Personally I don't believe this is going to happen. The EU has no way to support its constituents financially for 6 months, the union would collapse.

Of course, you've got some leaders like Prince Charles publicly stating that this is a prime opportunity to "reset" the global financial system, whatever that is supposed to mean. I'm quite positive the wealth of the European financial elite won't be "reset".

If this has legs the market should start reflecting it pretty soon. Personally I don't believe this is going to happen. The EU has no way to support its constituents financially for 6 months, the union would collapse.

Of course, you've got some leaders like Prince Charles publicly stating that this is a prime opportunity to "reset" the global financial system, whatever that is supposed to mean. I'm quite positive the wealth of the European financial elite won't be "reset".

Starting to see chatter in MSM and political channels that the EU is seriously considering a 6 month total and complete shutdown starting in October. Biden has also voiced his support for a similar approach should he win the election.

If this has legs the market should start reflecting it pretty soon. Personally I don't believe this is going to happen. The EU has no way to support its constituents financially for 6 months, the union would collapse.

Of course, you've got some leaders like Prince Charles publicly stating that this is a prime opportunity to "reset" the global financial system, whatever that is supposed to mean. I'm quite positive the wealth of the European financial elite won't be "reset".

Utter insanity were it to happen. How many Covid cases have been the result of dentists offices being open for regular checkups. Has there been a single case from a barber shop or a non-essential business? Seems to me that the increases are overwhelming coming from large crowds at fraternities and sororities, large crowds in places like Washington Square and bars. Likely also some spread from protests but that would be suppressed by the media.

And I don't even want to calculate the damage and costs of a lockdown like that. But my guess is that the loss of life from suicide and domestic violence might even exceed the current lower level of deaths from Covid-19.

+1Utter insanity were it to happen. How many Covid cases have been the result of dentists offices being open for regular checkups. Has there been a single case from a barber shop or a non-essential business? Seems to me that the increases are overwhelming coming from large crowds at fraternities and sororities, large crowds in places like Washington Square and bars. Likely also some spread from protests but that would be suppressed by the media.

And I don't even want to calculate the damage and costs of a lockdown like that. But my guess is that the loss of life from suicide and domestic violence might even exceed the current lower level of deaths from Covid-19.

Agreed.

Nice way to start the week.

www.cnbc.com

www.cnbc.com

Dow closes more than 400 points higher to start the week, led by banks and tech

Stocks rose sharply on Monday as Wall Street built on strong gains from the previous session.

I tried to find one article about a EU shutdown for 6 months and couldn’t find one recently. From what I heard in the past, it would only take 4-6 weeks complete shutdown to stop it.Starting to see chatter in MSM and political channels that the EU is seriously considering a 6 month total and complete shutdown starting in October. Biden has also voiced his support for a similar approach should he win the election.

If this has legs the market should start reflecting it pretty soon. Personally I don't believe this is going to happen. The EU has no way to support its constituents financially for 6 months, the union would collapse.

Of course, you've got some leaders like Prince Charles publicly stating that this is a prime opportunity to "reset" the global financial system, whatever that is supposed to mean. I'm quite positive the wealth of the European financial elite won't be "reset".

I tried to find one article about a EU shutdown for 6 months and couldn’t find one recently. From what I heard in the past, it would only take 4-6 weeks complete shutdown to stop it.

Only????? Do know the damage that would be done? Well I stated my case above. Kindly respond when you find a single case caused by a dentist's visit or trip to a barber shop.

Well 4-6 weeks is well below 6 months. We did way more damage by not closing for 4-6 weeks. Most of the Asians countries shut down completely for 4 weeks. Our will continue for at least another 6 months at this slow pace.Only????? Do know the damage that would be done? Well I stated my case above. Kindly respond when you find a single case caused by a dentist's visit or trip to a barber shop.

Not to late to get back into the tech stocks.Nice way to start the week.

Dow closes more than 400 points higher to start the week, led by banks and tech

Stocks rose sharply on Monday as Wall Street built on strong gains from the previous session.www.cnbc.com

I tried to find one article about a EU shutdown for 6 months and couldn’t find one recently. From what I heard in the past, it would only take 4-6 weeks complete shutdown to stop it.

New coronavirus restrictions could last for six months, Boris Johnson says

Measures to come into effect in England over the next six days

Imperial College initially suggested a hypothetical 6 month lockdown for the UK/EU, they are backing off of that but looks like business restrictions will last up to 6 months which will still be devastating to the industries affected.

Not a complete shutdown.

New coronavirus restrictions could last for six months, Boris Johnson says

Measures to come into effect in England over the next six dayswww.independent.co.uk

Imperial College initially suggested a hypothetical 6 month lockdown for the UK/EU, they are backing off of that but looks like business restrictions will last up to 6 months which will still be devastating to the industries affected.

Nobody should have left the techs. Just keep buying. Still rolling with our growth portfolio:Not to late to get back into the tech stocks.

FDGRX

TRBCX

IWF

VWIGX (recently jumped into this one, first venue into international and 4-5 years)

My EV stocks are DPHC, GPV, SHLL, WKHS, only GP is down and they have good product on the road with backorders, my health stocks are novavax, best flu shot nanoflu coming out next yr, best immune response to coronavirus w/ safe protein vaccine coming and the company vaxart, the only oral tablet covid vaccine coming out.

Last edited:

Yes please:

The private bank forecasts that the S&P 500 would rise to between 3,500-3,600 points by the end of this year and then 3,750 by September 2021, representing a potential 10% rise from its last close at nearly 3,352 points.

In addition to technology and health care, Peters said this market rally would broaden out to other sectors such as industrial and construction material stocks.

“We think certainly that the U.S. markets can make new highs over the next 12 months … we still think the earnings picture for the U.S. corporate is very strong … and also it’s that broader economic backdrop when we look at equities relative to other asset classes,” she told CNBC.

“So U.S. equities to us, we can see around a 10% upside over a 12 month view,” she added.

The private bank forecasts that the S&P 500 would rise to between 3,500-3,600 points by the end of this year and then 3,750 by September 2021, representing a potential 10% rise from its last close at nearly 3,352 points.

In addition to technology and health care, Peters said this market rally would broaden out to other sectors such as industrial and construction material stocks.

“We think certainly that the U.S. markets can make new highs over the next 12 months … we still think the earnings picture for the U.S. corporate is very strong … and also it’s that broader economic backdrop when we look at equities relative to other asset classes,” she told CNBC.

“So U.S. equities to us, we can see around a 10% upside over a 12 month view,” she added.

Yes please:

The private bank forecasts that the S&P 500 would rise to between 3,500-3,600 points by the end of this year and then 3,750 by September 2021, representing a potential 10% rise from its last close at nearly 3,352 points.

In addition to technology and health care, Peters said this market rally would broaden out to other sectors such as industrial and construction material stocks.

“We think certainly that the U.S. markets can make new highs over the next 12 months … we still think the earnings picture for the U.S. corporate is very strong … and also it’s that broader economic backdrop when we look at equities relative to other asset classes,” she told CNBC.

“So U.S. equities to us, we can see around a 10% upside over a 12 month view,” she added.

Wharton Professor Jeremy Siegel says the stock market will surge next year regardless of election outcome

Siegel said the "tremendous burst of liquidity" from the Fed and Congress will likely support a bull market that continues into next year.

stock market higher regardless of the presidential election.

Higher higher with Trump, but still higher with Biden after some modest volatility. If the Feds keep interest rates so low, there is only 1 place for your money to make good returns.

Wharton Professor Jeremy Siegel says the stock market will surge next year regardless of election outcome

Siegel said the "tremendous burst of liquidity" from the Fed and Congress will likely support a bull market that continues into next year.markets.businessinsider.com

stock market higher regardless of the presidential election.

Stock markets always do better with Democrats than Republicans. That $2.5 trillion stimulus might even be higher with Biden in office.Higher higher with Trump, but still higher with Biden after some modest volatility. If the Feds keep interest rates so low, there is only 1 place for your money to make good returns.

Democratic presidents are better for the stock market and economy than Republicans, one study shows

The average annual US GDP growth rate under a Democratic president was 3.6%, compared to 2.6% for a Republican president, according to Liberum.

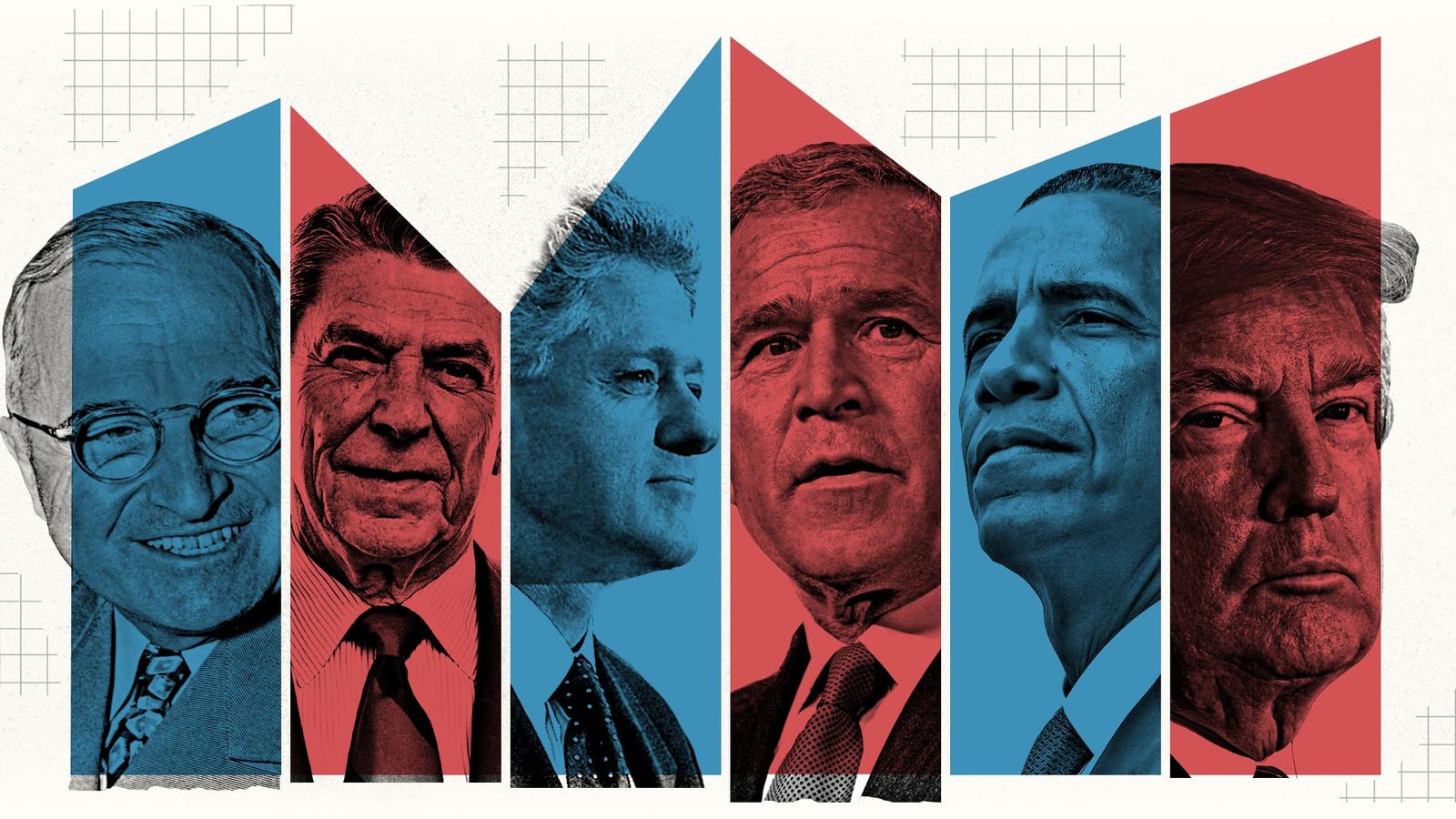

- Contrary to popular belief, the stock market and economy have performed better under Democratic presidents than it has under Republican presidents, according to data going back to 1946.

- Liberum, a UK-based investment bank, pointed to historical stock market returns and annual GDP growth to make the case that a Republican president's drive to cut taxes and reduce government spending often leads to lower economic expansion and stock market returns than when a Democratic president is in office.

- Since 1947, the S&P 500 has posted a total annual return of 10.8% under Democratic presidents, versus 5.6% under Republican presidents.

Not true. Since Trump was elected, the market has been amazing. He is the market king.Stock markets always do better with Democrats than Republicans. That $2.5 trillion stimulus might even be higher with Biden in office.

Speaking of Biden, some of his ideas regarding 401k plans. I do think this would make Roth 401k plans more attractive:

www.morningstar.com

www.morningstar.com

Biden's 401(k) Plan Is Vague, but Worth Paying Attention to

Joe Biden’s tax plan would overhaul retirement plan tax benefits.

All the initial vaccines will be out and given by summer, the economy of second half of 2021 will burst like the opening of the NYC marathon. People are going to be out and mingle. The return of normalcy will make people feel good and they will spend and eat and cruise and gamble. I have LCA soon to be GNOG

Last edited:

Better than expected jobs report!

www.cnbc.com

www.cnbc.com

Companies added better than expected 749,000 jobs amid jump in construction, hospitality, ADP says

Companies added jobs at a faster-than-expected pace in September due in good part to a surge in manufacturing hires, according to a report Wednesday from ADP.

Great buying oppurtunity. 👑Also, gold and silver have been tanking lately.

That's only for real investments. :)Great buying oppurtunity. 👑

I'm still hearing a lot of positive sentiment for precious metals. Maybe that doesn't come to pass, but maybe that sentiment is correct and the more recent downward trend is only because the preceding upward trend was so robust. I'm still holding.That's only for real investments. :)

I think the conclusion to be had is that party affiliation of the president doesn't have much sway of the overall markets.Not true. Since Trump was elected, the market has been amazing. He is the market king.

And even if you want to get into the details, who would have thought oil would have struggled under Trump while an EV play like Tesla went through the roof during his tenure?

Currently at $267.SNOW down to 214, roughly down 33% for those who bought yesterday at 319. 33% in a day. Caveat emptor.

Highest valued stock on the market in terms of price to sales. Yet Berkshire is the largest outside holder of the stock.

Lightweight analysis from UK's Liberum....Stock markets always do better with Democrats than Republicans. That $2.5 trillion stimulus might even be higher with Biden in office.

Democratic presidents are better for the stock market and economy than Republicans, one study shows

The average annual US GDP growth rate under a Democratic president was 3.6%, compared to 2.6% for a Republican president, according to Liberum.markets.businessinsider.com

- Contrary to popular belief, the stock market and economy have performed better under Democratic presidents than it has under Republican presidents, according to data going back to 1946.

- Liberum, a UK-based investment bank, pointed to historical stock market returns and annual GDP growth to make the case that a Republican president's drive to cut taxes and reduce government spending often leads to lower economic expansion and stock market returns than when a Democratic president is in office.

- Since 1947, the S&P 500 has posted a total annual return of 10.8% under Democratic presidents, versus 5.6% under Republican presidents.

Forbes does a real analysis of comparing the stock markets under US Presidents taking into account economic and geopolitical events-like the 1990's tech revolution-that really drove stocks in those periods. Clinton's 8 years of the tech boom and Eastern European rebuild--after Reagan-Bush won the Cold War--will go down as a once-in-a lifetime economic supernova. Any one of the 3 Stooges could have run the US economy then. Unfortunately Bush Jr. was left with the bills. Also note that the foundation for the economic recovery after the '08 Great Recession was already set before Obama even walked into the Oval Office,

- While Clinton ran his campaign with the promise of reinvigorating the economy, he “inherited ideal economic conditions” for a stock market boom in the 1990s with inflation falling to less than 3%, Stack says. Clinton pushed a tax hike through Congress early in his first term, and the Fed hiked the federal funds rate from 3.25% in January 1994 to 5% in February 1995. Economic growth cooled, and inflation remained in check. “By putting a cap on inflation pressures, it really allowed for the possibility of the first decade-long expansion in Wall Street history,” Stack says. (Though the expansion technically began under his predecessor's watch.) The explosion in technology, including the birth of companies like Amazon and Google, helped boost the stock market to record highs, creating a massive bubble. Fed chair Alan Greenspan warned about “irrational exuberance on Wall Street” in 1996, several years before the internet stock bubble popped, but the Fed didn’t respond fast enough. The bubble and subsequent collapse of the Nasdaq led to a bear market in 2000.

- When President Obama came into office, the country was ready for a rebound from the depths of the Great Recession. By the end of Bush’s term, interest rates had already been slashed, the Fed was increasing its balance sheet with massive monetary injections into the economy and Congress had passed massive bailouts. By mid 2009, the U.S. had recovered from the financial crisis, setting the stage for the longest bull market in history over the following eight years. The lengthy period of expansion under Obama’s tenure was marked by a surge in technology innovation, earnings and reduction of interest rates that in turn caused the stock market to skyrocket to new highs.

We Looked At How The Stock Market Performed Under Every U.S. President Since Truman — And The Results Will Surprise You

Biden versus Trump. Some speculate that the future of the republic hinges on the outcome of the next election. But for smart investors it doesn't really matter who wins.

www.forbes.com

www.forbes.com

Instead of going directly in SNOW I've been thinking about going heavier on Berkshire B.

Similarly instead of going heavier on the Airlines(currently have some small positions) been thinking of buying GE, which apparently is in the midst of a large overall turnaround of it's own. Currently trading at $6.26, consider that GE was selling at $30 in 2017. Some parallels to Ford imo with the EV play for Ford akin to the Aviation play for GE.

Similarly instead of going heavier on the Airlines(currently have some small positions) been thinking of buying GE, which apparently is in the midst of a large overall turnaround of it's own. Currently trading at $6.26, consider that GE was selling at $30 in 2017. Some parallels to Ford imo with the EV play for Ford akin to the Aviation play for GE.

Also looking at Suburban Propane, an NJ company, as a Covid play. Outdoor heaters. It's been running the past couple days, so I don't want to chase it, so looking for a dip in the next day or two..

Still about 40% off it's precovid levels, and it pays an 8% dividend.

Still about 40% off it's precovid levels, and it pays an 8% dividend.

August pending home sales soar to a record high, fueled by rock-bottom mortgage rates

Pending home sales rose 8.8% in August, reaching a record high pace, according to the National Association of Realtors survey, which dates to January 2001. Sales were 24.2% higher than August 2019.

Well 4-6 weeks is well below 6 months. We did way more damage by not closing for 4-6 weeks. Most of the Asians countries shut down completely for 4 weeks. Our will continue for at least another 6 months at this slow pace.

As Biden keeps saying, we can't fix the economy until we get the virus under control.

That’s true.As Biden keeps saying, we can't fix the economy until we get the virus under control.

As Biden keeps saying, we can't fix the economy until we get the virus under control.

We can't get the virus under control and allow dentists offices to open? I'd could go on from there but I won't.

I wonder what the numbers would have been if fraternity parties had been shut down and places like Washington Square had not into open air crowded parties. But this justifies shutting down dentists, barbers and small businesses practicing social distancing?

Similar threads

- Replies

- 12

- Views

- 2K

- Replies

- 31

- Views

- 2K

ADVERTISEMENT