Picked up MARA calls on the dump! FYI, BTC normally dumps after a new ATH due to sell orders and leverage. I think it has dropped 10-20% four of the last five times.Way to put the T2K whammy on Bitcoin. 😉

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT: Bitcoin, Altcoins, NFT's & All Things Crypto

- Thread starter bob-loblaw

- Start date

Well, Pomp said this morning that 3 of the last 4 times an ATH was reached, Bitcoin at least doubled in an average of 18 days after reaching the high. Hold on to your seats….. I guess. Will history repeat itself?Picked up MARA calls on the dump! FYI, BTC normally dumps after a new ATH due to sell orders and leverage. I think it has dropped 10-20% four of the last five times.

That's true as well! BTC is a fun asset. :)Well, Pomp said this morning that 3 of the last 4 times an ATH was reached, Bitcoin at least doubled in an average of 18 days after reaching the high. Hold on to your seats….. I guess. Will history repeat itself?

Good decision. Watching the daily crypto video from FS Insights and they show pretty clearly what happened today. Tons of standing sell orders at the new ATH level took out morons that went full leverage over the past week or two during the pump. Very typical of the market. LOL!I kept my GBTC shares when they went to an ETF. They’re outperforming my FBTC shares I own in another account. I didn’t buy FBTC on its first day since it was way over the price of GBTC at that time. When it dropped to GBTC’s level I went in

Thanks-I always wondered how people were tracking their cost basis through multiple swaps etc. Definitely not worth being sketchy and risking the IRS.I get the airdrop in my Metmask wallet. I swap them for USDC and send it to my Coinbase account. They (Coinbase) don’t send any 1099’s to the IRS but they put out an up to date short term and longterm profit/loss report that I give to my accountant. I don’t like to mess with the IRS so I’ll pay whatever taxes are due even though I probably could get away without paying any taxes. But if you get caught then they’ll throw the hammer at you

I think MSTR would be best. Miners and COIN are fine, but their normal business operations factor into their stock prices. I think MSTR is a pure BTC play since they are holding so much.if you had an IRA that didn't support a bitcoin ETF, how would you get exposure to this run (without just moving the IRA)? miners, COIN, MSTR?

But call and bitch! Everyone should offer BTC ETFs.

It was crazy. Didn’t want to swap GBTC that was in the 30’s for FBTC that opened in the 50’s. Now they’re both almost identically pricedThanks-I always wondered how people were tracking their cost basis through multiple swaps etc. Definitely not worth being sketchy and risking the IRS.

Every investment firm has different fiduciary restrictions. Ameriprise won’t let you buy the BTC ETFs or miners in their retirement accounts. Fidelity will let you I believe. My RothIRA is in a private wealth management account that uses Fidelity as their clearinghouse and never prohibited me buying GBTC when it was a trust and no problems buying the minersif you had an IRA that didn't support a bitcoin ETF, how would you get exposure to this run (without just moving the IRA)? miners, COIN, MSTR?

I am curious how much in terms of dollars everyone has invested in Crypto

I have about $50k cost basis invested in BTC and FBTC in Fidelity account. Doesn't seem like a lot and as always wish I had invested more.

At one point in the past 3yrs I had 10 ETH and 2 BTC which I sold at losses. kicking myself of course. Never had altcoins

I have about $50k cost basis invested in BTC and FBTC in Fidelity account. Doesn't seem like a lot and as always wish I had invested more.

At one point in the past 3yrs I had 10 ETH and 2 BTC which I sold at losses. kicking myself of course. Never had altcoins

More bullish news:

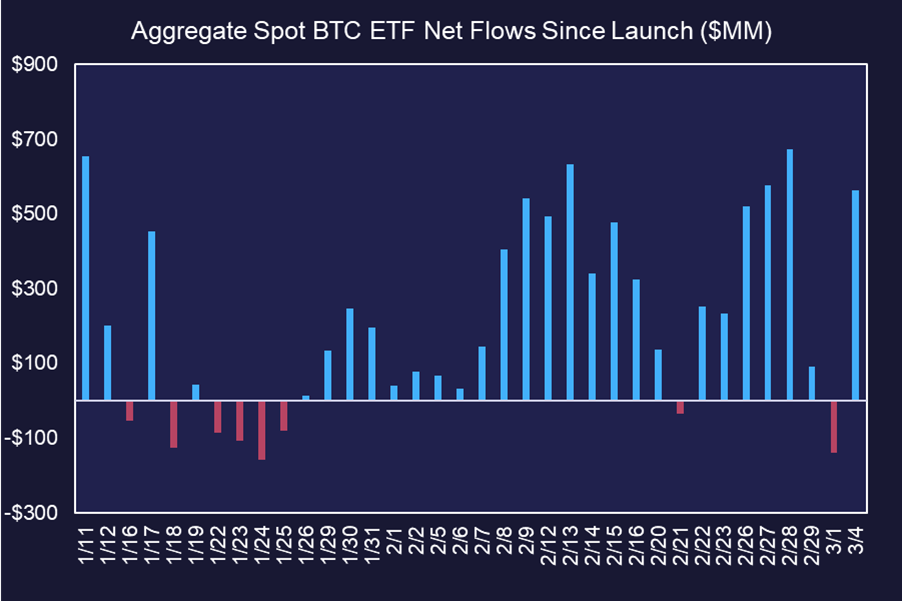

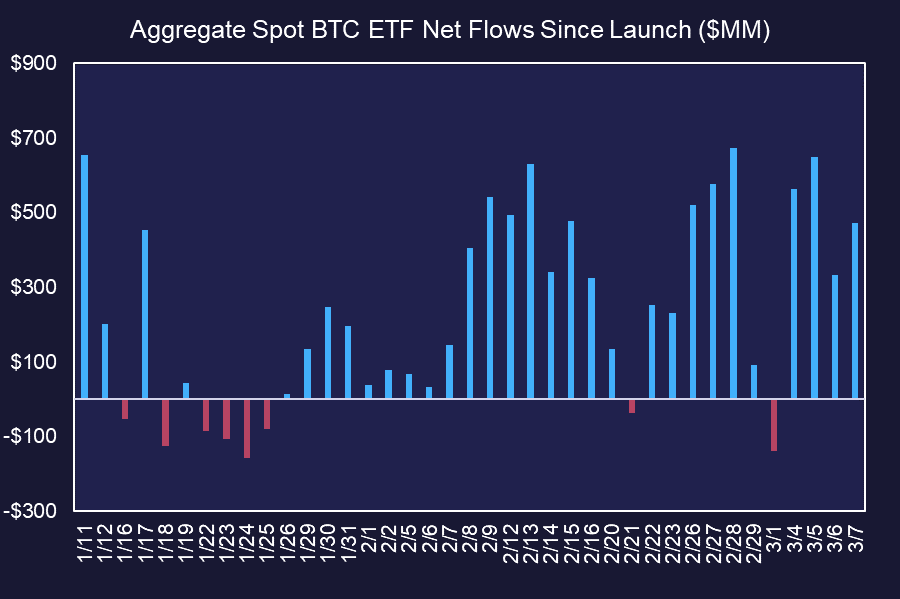

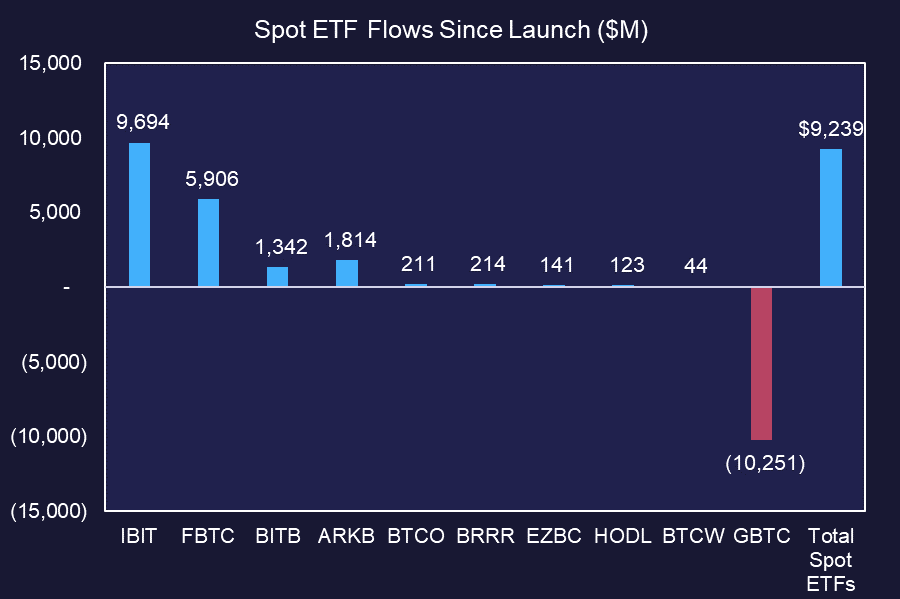

This week, the Bitcoin ETFs have witnessed remarkable flows again, amassing over $2 billion in aggregate net inflows. BlackRock's IBIT led the charge, bringing in $1.7 billion, and Fidelity's FBTC was not far behind, securing $1.2 billion in inflows. Since their inception nearly two months ago, all BTC ETFs have collectively attracted over $9 billion in net inflows, vastly surpassing most initial forecasts. A pivotal evolution in the Bitcoin ETF narrative is unfolding as these products begin to be integrated into broader investment strategies. A prime illustration of this trend emerged yesterday when BlackRock announced an update to its filing with the SEC, expressing an intention to incorporate spot Bitcoin ETFs into its Global Allocation Fund, which boasts nearly $18 billion in assets. This movement towards embedding Bitcoin ETFs into diverse ETF offerings is poised to persist, heralding a new era of demand for these ETFs.

This week, the Bitcoin ETFs have witnessed remarkable flows again, amassing over $2 billion in aggregate net inflows. BlackRock's IBIT led the charge, bringing in $1.7 billion, and Fidelity's FBTC was not far behind, securing $1.2 billion in inflows. Since their inception nearly two months ago, all BTC ETFs have collectively attracted over $9 billion in net inflows, vastly surpassing most initial forecasts. A pivotal evolution in the Bitcoin ETF narrative is unfolding as these products begin to be integrated into broader investment strategies. A prime illustration of this trend emerged yesterday when BlackRock announced an update to its filing with the SEC, expressing an intention to incorporate spot Bitcoin ETFs into its Global Allocation Fund, which boasts nearly $18 billion in assets. This movement towards embedding Bitcoin ETFs into diverse ETF offerings is poised to persist, heralding a new era of demand for these ETFs.

Interesting that many thought GBTC would sink with all the new ETFs. Despite billions in outflows to other ETFs, it has performed equally if not better than the newbies.

Just saw! Down goes the old ATH resistance. Peaked above $72k. STX pumping. ETH over $4k. Exciting times!71.6k. Gooooood morning

Where are those idiots who were calling btc to go to zero? lol

It's a simple supply and demand issue now. Demand is increasing and new supply will decrease next month. Sure, there will be bumps in the road, but we all know where things are heading.Where are those idiots who were calling btc to go to zero? lol

By the way, watched an interview over the weekend and the guest (forgot his name, ETF expert) said.....paraphrase: Blackrock isn't screwing around and their goal for IBIT is $100B AUM. It's rare to launch an ETF for a new asset class and they want to be the clear winner. Huge sales force pushing IBIT and they will be adding it to as many other investment vehicles as possible.

Damn.

The current demand is 9000 BTC per day for the ETFs and only 900 are being mined. Next month that mining number will be 450 a day. JP Morgan, despite Dimon's protestation is gearing up for their own access to BTC for their clients. Microstrategy continues to buy almost monthly, millions of dollars of BTC. No matter your thoughts on bitcoin itself, it is now mainstream and heavily in demand. Those that continue to view it as rat poison are free to continue to do so. Just wait until rates get cut, demand will increase even more. I would expect a selloff when the halving occurs next month. That is the time to enter this market if you are not already in it.It's a simple supply and demand issue now. Demand is increasing and new supply will decrease next month. Sure, there will be bumps in the road, but we all know where things are heading.

By the way, watched an interview over the weekend and the guest (forgot his name, ETF expert) said.....paraphrase: Blackrock isn't screwing around and their goal for IBIT is $100B AUM. It's rare to launch an ETF for a new asset class and they want to be the clear winner. Huge sales force pushing IBIT and they will be adding it to as many other investment vehicles as possible.

Damn.

Agreed. Great post!The current demand is 9000 BTC per day for the ETFs and only 900 are being mined. Next month that mining number will be 450 a day. JP Morgan, despite Dimon's protestation is gearing up for their own access to BTC for their clients. Microstrategy continues to buy almost monthly, millions of dollars of BTC. No matter your thoughts on bitcoin itself, it is now mainstream and heavily in demand. Those that continue to view it as rat poison are free to continue to do so. Just wait until rates get cut, demand will increase even more. I would expect a selloff when the halving occurs next month. That is the time to enter this market if you are not already in it.

I think it’s rat poison, and bought in to ride the wave….. I’m up 50% in a matter of weeks. When people like meThe current demand is 9000 BTC per day for the ETFs and only 900 are being mined. Next month that mining number will be 450 a day. JP Morgan, despite Dimon's protestation is gearing up for their own access to BTC for their clients. Microstrategy continues to buy almost monthly, millions of dollars of BTC. No matter your thoughts on bitcoin itself, it is now mainstream and heavily in demand. Those that continue to view it as rat poison are free to continue to do so. Just wait until rates get cut, demand will increase even more. I would expect a selloff when the halving occurs next month. That is the time to enter this market if you are not already in it.

are buying it, we can’t be too far from the top.

Welcome to the future! :)I think it’s rat poison, and bought in to ride the wave….. I’m up 50% in a matter of weeks. When people like me

are buying it, we can’t be too far from the top.

Seriously, I know a few people that hate crypto, don't understand it, but bought in last year after the Grayscale court decision for as they call it....."idiot insurance". Put in not enough to worry about losing it, but enough to have skin in the game so if it does goes to $1m they won't be some of the biggest idiots on the planet for completely missing out. That's a good plan!

I assume you just bought BTC. If you tell me you opened a Coinbase account and started to ape into random meme and altcoins, then I will be worried. LOL!

Congrats! if you feel concerned, take your profit and get out.

I will say, 72k and hardly a peep out of MSM. You're still early.

I will say, 72k and hardly a peep out of MSM. You're still early.

Same philosphy. I use a software called Koinly that tracks everything.I get the airdrop in my Metmask wallet. I swap them for USDC and send it to my Coinbase account. They (Coinbase) don’t send any 1099’s to the IRS but they put out an up to date short term and longterm profit/loss report that I give to my accountant. I don’t like to mess with the IRS so I’ll pay whatever taxes are due even though I probably could get away without paying any taxes. But if you get caught then they’ll throw the hammer at you

I put in a lot and yet it feels like not enough. I've been responsibly gambling on shitcoins the last two weeks and said responsibility has cost me some crazy gains. Stick to the plan and it will even itself out.I am curious how much in terms of dollars everyone has invested in Crypto

I have about $50k cost basis invested in BTC and FBTC in Fidelity account. Doesn't seem like a lot and as always wish I had invested more.

At one point in the past 3yrs I had 10 ETH and 2 BTC which I sold at losses. kicking myself of course. Never had altcoins

Just made a 75% pump on AERO in the past few days. It's a micro-cap alt, but has a legit story behind it. Coinbase's BASE L2 will not issue a new coin due to SEC concerns. Instead, it invested $100m to AERO (Aerodrome Finance) to serve as its defacto finance governance token. If Coibase pushes it, AERO can quickly become a mid-cap network. Even after the pump, still very low market cap. $200-250m.I put in a lot and yet it feels like not enough. I've been responsibly gambling on shitcoins the last two weeks and said responsibility has cost me some crazy gains. Stick to the plan and it will even itself out.

Wish I bought more! :)

The small market cap coins are the ones that are extremely volatile. You can lose it all overnight. I would stick to the larger tokens with a billion or more market cap. If you use Coinbase Advanced trading, I would put a stop loss on itJust made a 75% pump on AERO in the past few days. It's a micro-cap alt, but has a legit story behind it. Coinbase's BASE L2 will not issue a new coin due to SEC concerns. Instead, it invested $100m to AERO (Aerodrome Finance) to serve as its defacto finance governance token. If Coibase pushes it, AERO can quickly become a mid-cap network. Even after the pump, still very low market cap. $200-250m.

Wish I bought more! :)

Yes, already moved up my stop loss to ensure a 50% profit. AERO hanging in there overnight, still up 70%. If it keeps pumping, I will keep adjusting the order upwards.The small market cap coins are the ones that are extremely volatile. You can lose it all overnight. I would stick to the larger tokens with a billion or more market cap. If you use Coinbase Advanced trading, I would put a stop loss on it

Another major factor in determining which altcoin to buy is circulating tokens vs total supply. Your token has 339 million in circulation which is only about 33% of the total supply. The founders will probably dump some at a certain price and you will be deflated. Just be careful.Yes, already moved up my stop loss to ensure a 50% profit. AERO hanging in there overnight, still up 70%. If it keeps pumping, I will keep adjusting the order upwards.

I like projects with a clear story. A partnership with COIN and their BASE L2 sounds promising. I will look up their unlock schedule and adjust accordingly.Another major factor in determining which altcoin to buy is circulating tokens vs total supply. Your token has 339 million in circulation which is only about 33% of the total supply. The founders will probably dump some at a certain price and you will be deflated. Just be careful.

Seems like a good play but I wouldn't bet against Coinbase dropping their own coin once the lawsuits all go away.I like projects with a clear story. A partnership with COIN and their BASE L2 sounds promising. I will look up their unlock schedule and adjust accordingly.

Good point. I'll keep on eye on that. This is not a long-term hold like BTC.Seems like a good play but I wouldn't bet against Coinbase dropping their own coin once the lawsuits all go away.

Good essay on what is seen as major flaw in cyber-accounting based on janky electric grids increasingly under attack (as even ineffective US agencies describe). I remember when NYSE went down for half a day and a "faulty processor" was blamed (laughable excuse).

"When the grid fails, what happens to your Bitcoin."

" Imagine: Bitcoin shoots up to a million dollars. You’re a zillionaire! Uh Oh. . . somewhere outside Zaneseville, Ohio, a squirrel takes a final chaw through some old insulation on a wire coming out of a transformer. His head blows up in a blue arc flash, and in a few seconds all the electricity goes out from Chicago to Boston. It turns out that seventeen substations in ten states have blown relays, transformers, and switchgear. Some of those components were forty years old and are now manufactured twelve thousand miles away in a country that doesn’t like us anymore. The replacement parts get held up in a Chinese port. The power doesn’t come back on for weeks. Nobody who lives in the eastern USA can get to his Bitcoin wallet, which is just a virtual entity made of computer code residing in a digital “cloud,” i.e., nowhere real."

"When the grid fails, what happens to your Bitcoin."

" Imagine: Bitcoin shoots up to a million dollars. You’re a zillionaire! Uh Oh. . . somewhere outside Zaneseville, Ohio, a squirrel takes a final chaw through some old insulation on a wire coming out of a transformer. His head blows up in a blue arc flash, and in a few seconds all the electricity goes out from Chicago to Boston. It turns out that seventeen substations in ten states have blown relays, transformers, and switchgear. Some of those components were forty years old and are now manufactured twelve thousand miles away in a country that doesn’t like us anymore. The replacement parts get held up in a Chinese port. The power doesn’t come back on for weeks. Nobody who lives in the eastern USA can get to his Bitcoin wallet, which is just a virtual entity made of computer code residing in a digital “cloud,” i.e., nowhere real."

https://kunstler.com/cluster****-nation/twilight-of-the-blobs/

SOL has some juice today.Seems like a good play but I wouldn't bet against Coinbase dropping their own coin once the lawsuits all go away.

Even in this bizarro and highly unlikely scenario, you are talking about a couple weeks without access. Not a big deal in the grand scheme.Good essay on what is seen as major flaw in cyber-accounting based on janky electric grids increasingly under attack (as even ineffective US agencies describe). I remember when NYSE went down for half a day and a "faulty processor" was blamed (laughable excuse).

"When the grid fails, what happens to your Bitcoin."

" Imagine: Bitcoin shoots up to a million dollars. You’re a zillionaire! Uh Oh. . . somewhere outside Zaneseville, Ohio, a squirrel takes a final chaw through some old insulation on a wire coming out of a transformer. His head blows up in a blue arc flash, and in a few seconds all the electricity goes out from Chicago to Boston. It turns out that seventeen substations in ten states have blown relays, transformers, and switchgear. Some of those components were forty years old and are now manufactured twelve thousand miles away in a country that doesn’t like us anymore. The replacement parts get held up in a Chinese port. The power doesn’t come back on for weeks. Nobody who lives in the eastern USA can get to his Bitcoin wallet, which is just a virtual entity made of computer code residing in a digital “cloud,” i.e., nowhere real."

Yearly high incoming. ATH in the next 90 days, then price discovery.SOL has some juice today.

Exactly, or just hold your own wallet.Even in this bizarro and highly unlikely scenario, you are talking about a couple weeks without access. Not a big deal in the grand scheme.

Similar threads

- Replies

- 81

- Views

- 2K

- Replies

- 46

- Views

- 2K

- Replies

- 8

- Views

- 606

ADVERTISEMENT

ADVERTISEMENT