Didn't you ask about his bedrock investments?So... your portfolio comprises five equity positions and cash? That's the whole of it?

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT: Stock and Investment Talk

- Thread starter RU-05

- Start date

The market loves divided government! :)Market on a heck of a run this week, and it looks ready to continue today.

No tax hikes.

It was scary times but I held out and didn’t watch the market for a few days worried about how much I was down. Started looking at the accounts yesterday and started selling some techs today. Many of the tech went up 8-9% over the last 2 days. Hopefully, get the equity exposure down to 20% or less and wait again for the stocks to drop. GOOG reached new high.Right now, I have been trying to keep AMZN, FB, PYPL, AMD, NVDA. When they go up close to the high 5%, I ‘m selling in increments but will keep a smaller portion of stock in the portfolio and buy in increments when they drop again normally buying again with a 5-7% drop.

If the market really drops, buy and hold the market.

Last edited:

Ya someone mentioned how the market likes congressional grid lock the other day. Another of those new to me concepts that I find pretty interesting.The market loves divided government! :)

No tax hikes.

The market loves divided government! :)

No tax hikes.

Sometimes he's more interested in bombast than accuracy, but Cramer agrees and this time I think he's right.

https://www.cnbc.com/2020/11/04/jim-cramer-a-divided-congress-is-nirvana-for-growth-stocks.html

I was pretty far behind yesterdays run, as a lot of my infrastructure, value, and green energy plays, took a hit, but they are rebounding nicely today and I'm comfortably ahead of the indexes.

My bitcoin play, GBTC, keeps running as well. Up 7% today, and more importantly 41% since I bought in on Oct 8th. Have to give thanks to @ScarletNut on this one.

Looking back ScarletNut was also the one who made the call on a divided congress being good for the market. Well done.

My bitcoin play, GBTC, keeps running as well. Up 7% today, and more importantly 41% since I bought in on Oct 8th. Have to give thanks to @ScarletNut on this one.

Looking back ScarletNut was also the one who made the call on a divided congress being good for the market. Well done.

Last edited:

"Wider the base the higher the space"

Another of those concepts which I'm waiting to see how accurately that proves to be. Haven't bought in yet but JPM has been working on a $90-100 range base that goes back to March. Pre-Covid high of $140.

Another of those concepts which I'm waiting to see how accurately that proves to be. Haven't bought in yet but JPM has been working on a $90-100 range base that goes back to March. Pre-Covid high of $140.

Tech is blowing up since gridlock means that Trump or the liberal Dems can't take regulatory action against them.I was pretty far behind yesterdays run, as a lot of my infrastructure, value, and green energy plays, took a hit, but they are rebounding nicely today and I'm comfortably ahead of the indexes.

My bitcoin play, GBTC, keeps running as well. Up 7% today, and more importantly 41% since I bought in on Oct 8th. Have to give thanks to @ScarletNut on this one.

Looking back ScarletNut was also the one who made the call on a divided congress being good for the market. Well done.

Apparently higher taxes have a greater effect on growth stocks as well. So they liked the non blue wave.Tech is blowing up since gridlock means that Trump or the liberal Dems can't take regulatory action against them.

HII, a builder of ships for the Navy and Coast Gaurd looks like a good value play. PE of 11, EPS of 12. Beat on Rev's by a good margin on earnings today(so check back on those previous multiples). Was around $275 pre covid, currently $157. I guess it dropped post covid due to the thought of a blue wave, but Cramer likes to point out that Dems do like to spend on defense, so that drop, especially to that level, didn't appear warranted. Now factor in no blue wave, and maybe this one is ready to get rolling?

HII, a builder of ships for the Navy and Coast Gaurd looks like a good value play. PE of 11, EPS of 12. Beat on Rev's by a good margin on earnings today(so check back on those previous multiples). Was around $275 pre covid, currently $157. I guess it dropped post covid due to the thought of a blue wave, but Cramer likes to point out that Dems do like to spend on defense, so that drop, especially to that level, didn't appear warranted. Now factor in no blue wave, and maybe this one is ready to get rolling?

In what congressional districts are they located?

Rumors of Tesla planning to invest in Bitcoin could further run up GBTC, which also acquired another big chunk of Bitcoin recently.I was pretty far behind yesterdays run, as a lot of my infrastructure, value, and green energy plays, took a hit, but they are rebounding nicely today and I'm comfortably ahead of the indexes.

My bitcoin play, GBTC, keeps running as well. Up 7% today, and more importantly 41% since I bought in on Oct 8th. Have to give thanks to @ScarletNut on this one.

Looking back ScarletNut was also the one who made the call on a divided congress being good for the market. Well done.

HQ is in VA.In what congressional districts are they located?

Growth/tech stocks blowing up! Mo money, less problems. :)Up 4.5% today. My best day by a good margin.

Feel like I should have trimmed given the run of this week.

Actually my tech's were laggards today.Growth/tech stocks blowing up! Mo money, less problems. :)

Good days for the likes of FB MSFT and AAPL, but I had some high flyers today.

Still I look around longingly at the the recent moves of NIO and GRWG, and wish I had bought in.

Actually my tech's were laggards today.

Good days for the likes of FB MSFT and AAPL, but I had some high flyers today.

Still I look around longingly at the the recent moves of NIO and GRWG, and wish I had bought in.

Alternative electricity generators went nuts after a slight dip interrupting a month or two of steady gains. NEE has been on fire for a year, CWEN and BEPC for a coupe of months.

Indexes and funds are your friend!Actually my tech's were laggards today.

Good days for the likes of FB MSFT and AAPL, but I had some high flyers today.

Still I look around longingly at the the recent moves of NIO and GRWG, and wish I had bought in.

Boring. 😀Indexes and funds are your friend!

I have a small position in SNDL which is up 50% today, was up 130% earlier in the day. That's the kind of action I'm looking for. Again 😀.

Take RU with the points this wkndBoring. 😀

I have a small position in SNDL which is up 50% today, was up 130% earlier in the day. That's the kind of action I'm looking for. Again 😀.

Luckily SNDL doesn't have to play Ohio State.Take RU with the points this wknd

Lets go Knights! But since this is an investment thread, lay the points and pad the portfolio...Take RU with the points this wknd

FGCKX is up 56.4% YTD. I'm happy. :)Boring. 😀

I have a small position in SNDL which is up 50% today, was up 130% earlier in the day. That's the kind of action I'm looking for. Again 😀.

More of a broader question, but now that it looks like Biden is the president the WEF/UN/IMF seem to be going full bore with this 2021 “great reset” and the US will follow in lockstep with whatever it ends up being. I’ve read up on it and it seems very broad and vague with no real plan to acheive these seemingly aggressive targets. Some of the plan seems to want to introduce a completely new monetary system worldwide that would move away from things like 401ks, IRAs, etc. Anyone else have any thoughts on how this so called “great reset” will affect long term investments?

www.weforum.org

www.weforum.org

The Great Reset

There is an urgent need for global stakeholders to cooperate in simultaneously managing the direct consequences of the COVID-19 crisis. To improve the state of the world, the World Economic Forum is starting The Great Reset initiative.

More of a broader question, but now that it looks like Biden is the president the WEF/UN/IMF seem to be going full bore with this 2021 “great reset” and the US will follow in lockstep with whatever it ends up being. I’ve read up on it and it seems very broad and vague with no real plan to acheive these seemingly aggressive targets. Some of the plan seems to want to introduce a completely new monetary system worldwide that would move away from things like 401ks, IRAs, etc. Anyone else have any thoughts on how this so called “great reset” will affect long term investments?

The Great Reset

There is an urgent need for global stakeholders to cooperate in simultaneously managing the direct consequences of the COVID-19 crisis. To improve the state of the world, the World Economic Forum is starting The Great Reset initiative.www.weforum.org

It looks like the Senate will either be 50-50 or Republican controlled. If 50-50, all it takes is Joe Mancin to prevent anything this radical from being passed. Things would change, but not this much.

It looks like the Senate will either be 50-50 or Republican controlled. If 50-50, all it takes is Joe Mancin to prevent anything this radical from being passed. Things would change, but not this much.

Right, but my question is what would change. The only way to acheive some of these goals is mass wealth confiscation or the end of central reserve banking, neither of which are going to happen.

Right, but my question is what would change. The only way to acheive some of these goals is mass wealth confiscation or the end of central reserve banking, neither of which are going to happen.

No point in speculating until the final Senate election results come in.

It will be R controlled, which is why the market is booming. The market loves divided government and the fact that there won't be massive tax hikes by the Dems.It looks like the Senate will either be 50-50 or Republican controlled. If 50-50, all it takes is Joe Mancin to prevent anything this radical from being passed. Things would change, but not this much.

And very low/zero interest rates helped as well.Did anyone see the story/analysis that QE had on stocks

The report reasons that the S&P 500 would be around 1800 instead of 3300 without QE

This will have no effect on long term investments in the near term. Check back in a decade but at the moment this is a non story.More of a broader question, but now that it looks like Biden is the president the WEF/UN/IMF seem to be going full bore with this 2021 “great reset” and the US will follow in lockstep with whatever it ends up being. I’ve read up on it and it seems very broad and vague with no real plan to acheive these seemingly aggressive targets. Some of the plan seems to want to introduce a completely new monetary system worldwide that would move away from things like 401ks, IRAs, etc. Anyone else have any thoughts on how this so called “great reset” will affect long term investments?

The Great Reset

There is an urgent need for global stakeholders to cooperate in simultaneously managing the direct consequences of the COVID-19 crisis. To improve the state of the world, the World Economic Forum is starting The Great Reset initiative.www.weforum.org

My penny stock play of the week.

ABML.

Miner of lithium which has recently begun construction on a lithium battery recycling plant in Nevada.

Currently trading at just under 17 cents per share.

What did it do last week? In the meantime my investment in ALB soared last week. Definately not a penny stock and I'm not sure I'd buy immediately after the jump, but a lithium play worth keeping an eye on.

This week not much. But it was at .10 in late Sept, and .05 in late May. So it has begun to move upward.What did it do last week? In the meantime my investment in ALB soared last week. Definately not a penny stock and I'm not sure I'd buy immediately after the jump, but a lithium play worth keeping an eye on.

It was as high as .24 in July of 2019 and .35 in January 19. Could it reach those levels again? Given the tailwinds behind lithium I think it's a good bet.

ALB is certainly a much more established company, and likewise a safer bet, but as you say might not be a great time to buy given it's very recent run.

Also looking at PLL, which recently inked a 5 year deal(with an option for an additional 5) with Tesla. Shot up from around $6, up over $40off the news, and has since backed off to $22.

The world is going to be leaning heavily on batteries in the upcoming years so I want to establish a decent lithium foothold.

KABOOM!!!!!

Dow futures jump 1,200 points as Pfizer, BioNtech say Covid-19 vaccine is 90% effective

More:

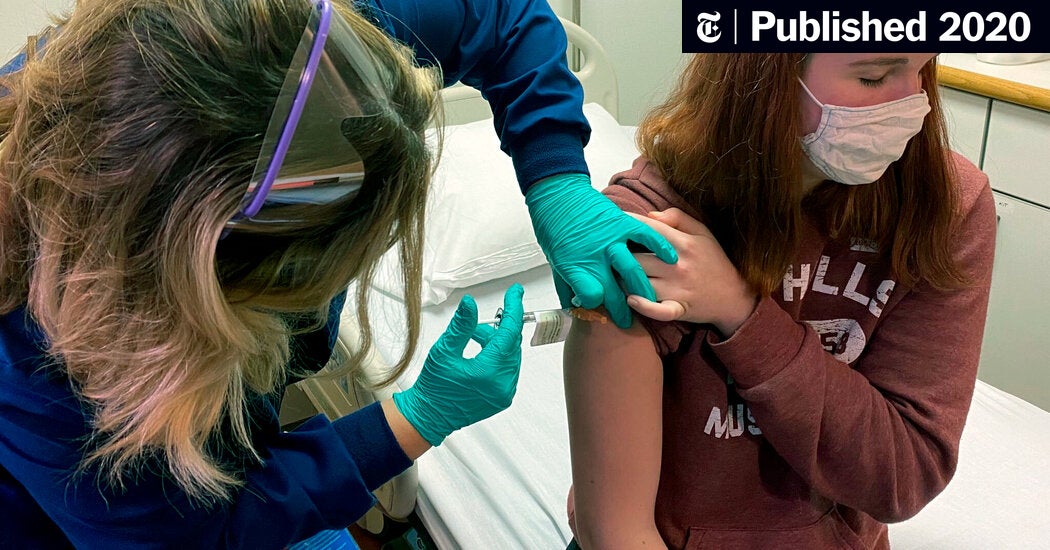

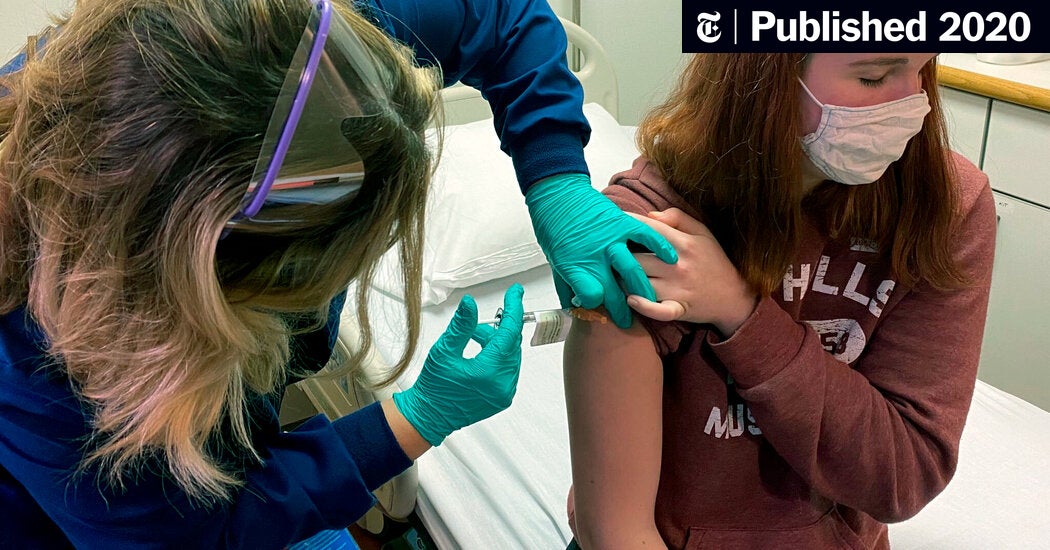

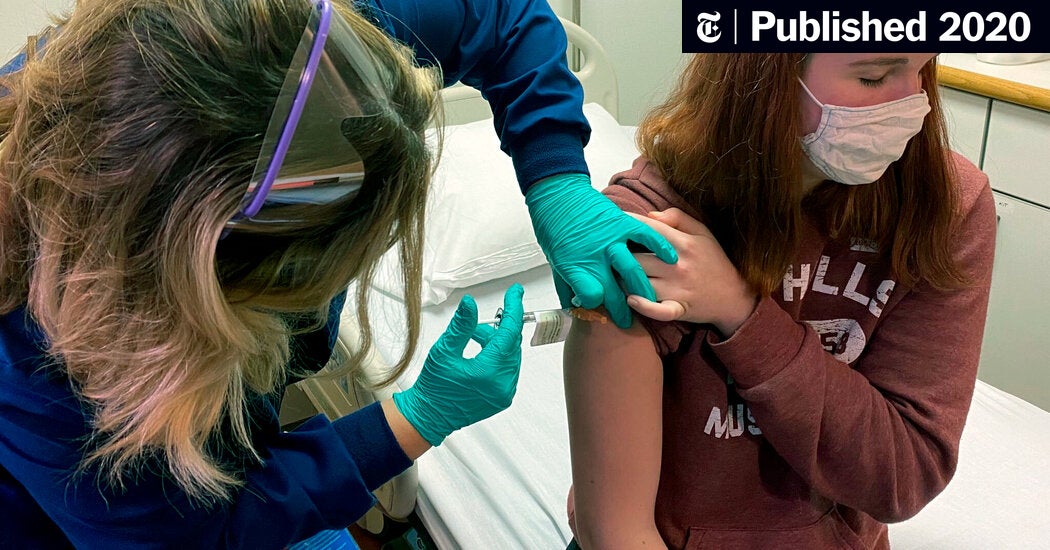

www.nytimes.com

www.nytimes.com

Dow futures jump 1,200 points as Pfizer, BioNtech say Covid-19 vaccine is 90% effective

More:

Pfizer’s Early Data Shows Vaccine Is More Than 90% Effective (Published 2020)

Pfizer announced positive early results from its coronavirus vaccine trial, cementing the lead in a frenzied global race that has unfolded at record-breaking speed.

Last edited:

Good news hopefully it's confirmed at the end of the trial.KABOOM!!!!!

Dow futures jump 1,200 points as Pfizer, BioNtech say Covid-19 vaccine is 90% effective

More:

Pfizer’s Early Data Shows Vaccine Is More Than 90% Effective (Published 2020)

Pfizer announced positive early results from its coronavirus vaccine trial, cementing the lead in a frenzied global race that has unfolded at record-breaking speed.www.nytimes.com

GE/BA up big 14-15% premarket for obvious reasons....of course any step in the direction to normalcy in airline travel will boost them. I'm sure the airlines, hotel and other travel related stocks all most be similar.

On the flipside, took a look at a consumer company with their cleaning products like CLX which has been on a tear through this whole ordeal down about 4% and other consumer products companies up but a bit more muted than the overall market. Probably not helpful to a GILD too cause a questionable remdemsivir will be less necessary if a vaccine works well. Tech down or up more muted as well.

Yes, very interesting thoughts. Some of the stocks that boomed due to the "new-normally" will likely be negatively impacted once the vaccine is widely available and life really goes back to normal.Good news hopefully it's confirmed at the end of the trial.

GE/BA up big 14-15% premarket for obvious reasons....of course any step in the direction to normalcy in airline travel will boost them. I'm sure the airlines, hotel and other travel related stocks all most be similar.

On the flipside, took a look at a consumer company with their cleaning products like CLX which has been on a tear through this whole ordeal down about 4% and other consumer products companies up but a bit more muted than the overall market. Probably not helpful to a GILD too cause a questionable remdemsivir will be less necessary if a vaccine works well. Tech down or up more muted as well.

Yea noticed a diagnostic company like ABT down cause the demand for tests would be down if less people get sick or the stay at home stocks like exercise etc...Restaurants and movie theater stocks up.Yes, very interesting thoughts. Some of the stocks that boomed due to the "new-normally" will likely be negatively impacted once the vaccine is widely available and life really goes back to normal.

I don’t know when next year but some time next year is the target for things to get closer to normal. Some of these companies and businesses need to muddle through a bit more. Hopefully they can manage.

Similar threads

- Replies

- 0

- Views

- 582

- Replies

- 32

- Views

- 990

- Replies

- 77

- Views

- 2K

ADVERTISEMENT

ADVERTISEMENT