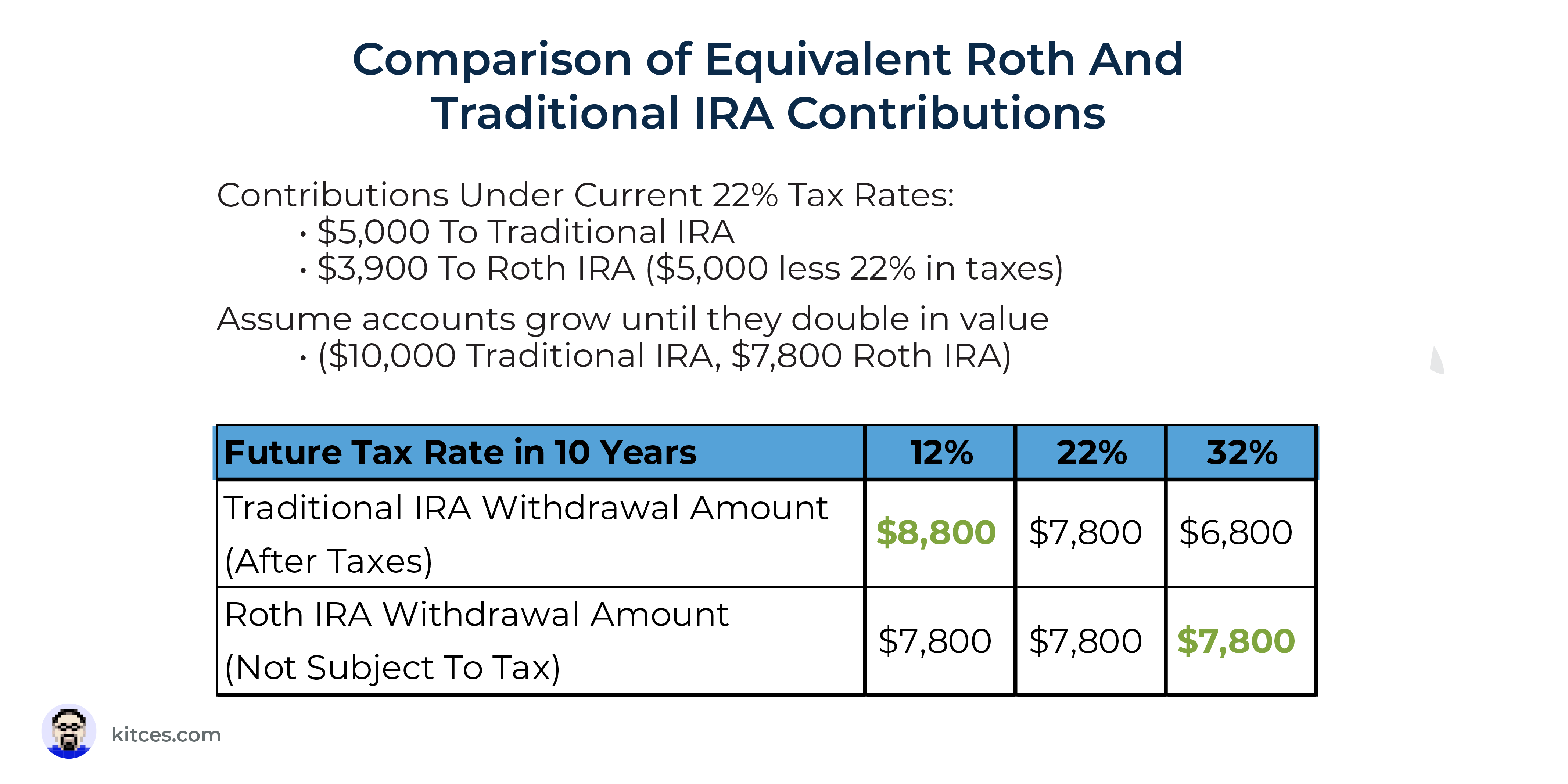

This is a good article for those folks that are doing or considering doing conversions from tIRA money to a Roth IRA. Essentially, the point is that market declines are often good opportunities for conversions.

A market downturn could present an opportunity to convert a higher percentage of a pre-tax account to a Roth account for the same amount of taxable income.

www.kitces.com

Edit: I should mention that two points the article doesn’t adequately address are that your marginal tax rate could increase down the road either because the government raises rates and/or you or your spouse passes leaving the survivor with a higher single marginal rate and possible large RMDs.

www.morningstar.com

www.morningstar.com