We have been doing backdoor Roths for a long time. However, our retirement balance right now is about 12-15% Roth and 85-88% traditional. Would like to get that Roth portion up to at least 25%! That would cover any large capital purchases in retirement.Good plan. Keep in mind, though, that as a high income earner you may benefit from a mix of Roth and tIRA/401k, the latter giving you some tax deductibility in a high income year.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT: Stock and Investment Talk

- Thread starter RU-05

- Start date

The math never made sense for me. Are you guys using a calculator to figure out the math or is it just a gut feel.I will be moving to a Roth 401k option soon. Just waiting to see if the SECURE 2.0 act passes this summer, which would allow company matches to be paid out as after-tax Roth contributions. Also, we may transition our plan to Fidelity in a few months. Once the dust settles, we are going Roth.

For us, it's more about flexibility. We would like to have Roth money available for capital purchases (like a 2nd house) or perhaps a remodel or huge vacation. Having Roth money will allow us to spend as we see fit without having to worry about higher tax rates for a given year.The math never made sense for me. Are you guys using a calculator to figure out the math or is it just a gut feel.

Once again, our goal is about 25% Roth and 75% traditional for our retirement assets.

Don’t you factor in non-retirement accounts?For us, it's more about flexibility. We would like to have Roth money available for capital purchases (like a 2nd house) or perhaps a remodel or huge vacation. Having Roth money will allow us to spend as we see fit without having to worry about higher tax rates for a given year.

Once again, our goal is about 25% Roth and 75% traditional for our retirement assets.

No. Our cash is our cash and separate.Don’t you factor in non-retirement accounts?

Overall, ho-hum day for the market.

For us, we have more in tIRAs (mid seven figure) than Roth or taxable so when one of us dies the other will file as a single and be hit with heavy taxes when RMDs kick in. Also, I think it’s very possible that marginal tax rates will go up—in fact they are scheduled to do so in a few years. Finally, part of our motive is estate planning for our kids. Every situation is different and as you suggest, you have to make assumptions to cover various possible scenarios. I’d like to work toward a balance between Roth, tax deferred and taxable but we'll probably remain heavy on tax deferred due to where we are at this stage.The math never made sense for me. Are you guys using a calculator to figure out the math or is it just a gut feel.

Last edited:

Doesn’t make sense. What are the non-retirement accounts allocated for?No. Our cash is our cash and separate.

Overall, ho-hum day for the market.

Sorry, misread. We have 2 brokerage accounts. The main one is E-Trade and is considered retirement. Since it is a taxable account, we consider it non-Roth in that calculation.Doesn’t make sense. What are the non-retirement accounts allocated for?

The 2nd brokerage account is my fun account with those nutty leverage funds.

Last edited:

Russia controlled a portion of the territory they currently control before the invasion, and another large chunk was already contested. It's 4 months since the invasion and they have modest gains at best.

US citizens crowing about Russia's "success" in Ukraine is hard to understand.

Russians just took control of Severodonetsk.

Ukraine forces cant even communicate

They have been taking heavy casualties from prodigious shelling

At war's start Ukraine had success with Turkish drones and some NATO trained troops going up against Russian conscripts (considered disposable) and old equipment but that phase is long over

US paid equipment doesn't even get to the front

Between the oligarchs gifting, arms dealers stealing and disorganized forces unable to maintain supply routes the Zel is still badgering for more money and weapons .

War should be over already except for US keeping the blood running;

Its hive gaslighting to say people support Putin by wanting the war over

Ukraine isn't winning and (even the goofy pope knows the West and oligarchs provoked Putin) but the US wants a war to go on

Of course most people with family/friends in military don't want US in a European border war (spesh while US border gets invaded). with such inept leadership

Now Finland and Sweden get a NATO invite despite bringing nothing to the table - just another weak sister that wants to rattle cages in Europe with US as enabling ally.

Unfortunately the US does nothing right anymore and that seems the goal more than an accident

https://www.msn.com/en-us/news/world/what-the-fall-of-severodonetsk-means-for-the-war/ar-AAYTyva

On Front Lines, Communication Breakdowns Prove Costly for Ukraine

The Ukrainian Army has tried to modernize, but still falls short in coordination among units, so they often fight independently of one another — with sometimes deadly results.

Russians just took control of Severodonetsk.

Ukraine forces cant even communicate

They have been taking heavy casualties from prodigious shelling

At war's start Ukraine had success with Turkish drones and some NATO trained troops going up against Russian conscripts (considered disposable) and old equipment but that phase is long over

US paid equipment doesn't even get to the front

Between the oligarchs gifting, arms dealers stealing and disorganized forces unable to maintain supply routes the Zel is still badgering for more money and weapons .

War should be over already except for US keeping the blood running;

Its hive gaslighting to say people support Putin by wanting the war over

Ukraine isn't winning and (even the goofy pope knows the West and oligarchs provoked Putin) but the US wants a war to go on

Of course most people with family/friends in military don't want US in a European border war (spesh while US border gets invaded). with such inept leadership

Now Finland and Sweden get a NATO invite despite bringing nothing to the table - just another weak sister that wants to rattle cages in Europe with US as enabling ally.

Unfortunately the US does nothing right anymore and that seems the goal more than an accident

https://www.msn.com/en-us/news/world/what-the-fall-of-severodonetsk-means-for-the-war/ar-AAYTyva

On Front Lines, Communication Breakdowns Prove Costly for Ukraine

The Ukrainian Army has tried to modernize, but still falls short in coordination among units, so they often fight independently of one another — with sometimes deadly results.www.nytimes.com

This war was caused by the West provoking Putin?

GIS another one of my staples names with nice earnings hit an ATH yesterday. Up 6% yesterday...some of these staples names have had some nice rebounds lately.

He’s a Russian soldier stationed in NYS. I’m surprised he didn’t blame China for starting the war in Ukraine.This war was caused by the West provoking Putin?

He’s a Russian soldier stationed in NYS. I’m surprised he didn’t blame China for starting the war in Ukraine.

Or all those civilians who had the nerve to get in the way of those Russian missiles.

Don't underestimate the Finns. Very capable military. Mandatory service. Small population but they can fight with the best of them. Solid addition to NATO and the Russians are pissed off by it. Right on their border.Of course most people with family/friends in military don't want US in a European border war (spesh while US border gets invaded). with such inept leadership

Now Finland and Sweden get a NATO invite despite bringing nothing to the table - just another weak sister that wants to rattle cages in Europe with US as enabling ally.

Unfortunately the US does nothing right anymore and that seems the goal more than an accident

Don't underestimate the Finns. Very capable military. Mandatory service. Small population but they can fight with the best of them. Solid addition to NATO and the Russians are pissed off by it. Right on their border.

And the Russians found out about that the hard way in '39-'40.

Don't underestimate the Finns. Very capable military. Mandatory service. Small population but they can fight with the best of them. Solid addition to NATO and the Russians are pissed off by it. Right on their border.

As Sweden's and Finland's NATO bids move forward, the alliance is already eyeing their fighter jets

Sweden and Finland will bring "quite a bit of capability and capacity to the alliance from Day One," the US's top general in Europe said this spring.

And some fighter jets.

Over 4 months in and Russia has paid a heavy price despite making only modest gains in the East.Russians just took control of Severodonetsk.

Ukraine forces cant even communicate

They have been taking heavy casualties from prodigious shelling

At war's start Ukraine had success with Turkish drones and some NATO trained troops going up against Russian conscripts (considered disposable) and old equipment but that phase is long over

US paid equipment doesn't even get to the front

Between the oligarchs gifting, arms dealers stealing and disorganized forces unable to maintain supply routes the Zel is still badgering for more money and weapons .

War should be over already except for US keeping the blood running;

Its hive gaslighting to say people support Putin by wanting the war over

Ukraine isn't winning and (even the goofy pope knows the West and oligarchs provoked Putin) but the US wants a war to go on

Of course most people with family/friends in military don't want US in a European border war (spesh while US border gets invaded). with such inept leadership

Now Finland and Sweden get a NATO invite despite bringing nothing to the table - just another weak sister that wants to rattle cages in Europe with US as enabling ally.

Unfortunately the US does nothing right anymore and that seems the goal more than an accident

https://www.msn.com/en-us/news/world/what-the-fall-of-severodonetsk-means-for-the-war/ar-AAYTyva

On Front Lines, Communication Breakdowns Prove Costly for Ukraine

The Ukrainian Army has tried to modernize, but still falls short in coordination among units, so they often fight independently of one another — with sometimes deadly results.www.nytimes.com

Is Ukraine winning? Maybe not, but short of Ukraine driving Russia clear out of the country this could not have gone worse for Russia. And that includes Finland and Sweden joining NATO.

Excellent summary/analysis of Q2. Yikes:

www.morningstar.com

www.morningstar.com

14 Charts on the Market’s Second-Quarter Performance

For just the second time in 40 years, bonds and stocks both posted losses for two consecutive quarters.

Great summary. Don’t see a quick turnaround but here’s to hoping we are close to a bottom.Excellent summary/analysis of Q2. Yikes:

14 Charts on the Market’s Second-Quarter Performance

For just the second time in 40 years, bonds and stocks both posted losses for two consecutive quarters.www.morningstar.com

Best way to handle the past 3 months is to keep buying. Also, remember to rebalance your allocations. That would help capture as much of the turnaround as possible (whenever it happens). I continue to eye the S&P to see if it dips below the -25% mark. That's a nice mathematically level for a possible conversion to SSO. We shall see!Great summary. Don’t see a quick turnaround but here’s to hoping we are close to a bottom.

Investors will have 3 ideal entry points into the stock market over the next few months as bear attack lingers, according to BofA

"Stand your ground means sticking to your underlying investment philosophy, being opportunistic, and taking the long view," Bank of America said.

We see three entry points for investors, running from June/July as the bear market matures, in [the] third and fourth quarter as 2023 earnings are reset, and early next year when the Fed tightening cycle winds down," Quinlan said. "Stand your ground means sticking to your underlying investment philosophy, being opportunistic, and taking the long view."

+1

Investors will have 3 ideal entry points into the stock market over the next few months as bear attack lingers, according to BofA

"Stand your ground means sticking to your underlying investment philosophy, being opportunistic, and taking the long view," Bank of America said.www.yahoo.com

We see three entry points for investors, running from June/July as the bear market matures, in [the] third and fourth quarter as 2023 earnings are reset, and early next year when the Fed tightening cycle winds down," Quinlan said. "Stand your ground means sticking to your underlying investment philosophy, being opportunistic, and taking the long view."

Stand your ground, stick to your plan, and keep buying. The Fed is desperate to lighten-up on rate increase and looking for any excuse to do so. The market is so oversold that the rebound will likely happen in a blink of an eye. Gotta be positioned well in advance.

Not looking! LOL.Down 20.5% YTD. Ouch…..

But I normally beat the S&P in good times and do worse in bad times.

Probably shouldn’t have but have to take my medicine for future reference. I’m usually immune to paper loss but this one was a BIG number.Not looking! LOL.

But I normally beat the S&P in good times and do worse in bad times.

Crap, I looked at our biggest account (T Rowe). Down 20.9% YTD. So, a little worse than the S&P. No biggie. We were down more in March 2020 and probably down more at the end of 2018 from the peak (not YTD).Probably shouldn’t have but have to take my medicine for future reference. I’m usually immune to paper loss but this one was a BIG number.

This shows the importance of the bucket approach for retirement.

The bucket approach is something I posted a long time ago and is exactly how one of my financial advisor is handling one of my retirement accounts. Three buckets, one is a short term 3 year bucket for my distributions, the second is a 5-8 year bucket that replenishes my short term bucket, the third bucket is a 10+ year bucket that replenishes the second bucket. Since I've been retired and taking a 5% distribution from this account, the total value of that account has gained in value even with the market downturn.Crap, I looked at our biggest account (T Rowe). Down 20.9% YTD. So, a little worse than the S&P. No biggie. We were down more in March 2020 and probably down more at the end of 2018 from the peak (not YTD).

This shows the importance of the bucket approach for retirement.

Excellent approach. Safe short term money to live on. Enough long-term money to grow and invest without fear (of inflation or a bear market).The bucket approach is something I posted a long time ago and is exactly how one of my financial advisor is handling one of my retirement accounts. Three buckets, one is a short term 3 year bucket for my distributions, the second is a 5-8 year bucket that replenishes my short term bucket, the third bucket is a 10+ year bucket that replenishes the second bucket. Since I've been retired and taking a 5% distribution from this account, the total value of that account has gained in value even with the market downturn.

Bold call by Citi:

Citi says oil could fall to $65 or lower in a recession.

The price of oil has pulled back considerably in recent weeks after such a strong start to the year, driven largely by concerns of a looming recession. Economic slowdowns, after all, have historically led to lower oil demand.

A new note Tuesday from Citigroup analysts examines that historical link and suggests “in a recessionary scenario” this time around, the price of Brent crude could end the year around $65 per barrel; it could potentially fall even lower to $45 by the end of 2023, they say.

Citi says oil could fall to $65 or lower in a recession.

The price of oil has pulled back considerably in recent weeks after such a strong start to the year, driven largely by concerns of a looming recession. Economic slowdowns, after all, have historically led to lower oil demand.

A new note Tuesday from Citigroup analysts examines that historical link and suggests “in a recessionary scenario” this time around, the price of Brent crude could end the year around $65 per barrel; it could potentially fall even lower to $45 by the end of 2023, they say.

So LIV golf folds a year earlier than I expectedBold call by Citi:

Citi says oil could fall to $65 or lower in a recession.

The price of oil has pulled back considerably in recent weeks after such a strong start to the year, driven largely by concerns of a looming recession. Economic slowdowns, after all, have historically led to lower oil demand.

A new note Tuesday from Citigroup analysts examines that historical link and suggests “in a recessionary scenario” this time around, the price of Brent crude could end the year around $65 per barrel; it could potentially fall even lower to $45 by the end of 2023, they say.

Well that would certainly help with inflation in general but I doubt any prices come down as a result. Seems to be completely opposite of what JPM was predicting with barrels at $320Bold call by Citi:

Citi says oil could fall to $65 or lower in a recession.

The price of oil has pulled back considerably in recent weeks after such a strong start to the year, driven largely by concerns of a looming recession. Economic slowdowns, after all, have historically led to lower oil demand.

A new note Tuesday from Citigroup analysts examines that historical link and suggests “in a recessionary scenario” this time around, the price of Brent crude could end the year around $65 per barrel; it could potentially fall even lower to $45 by the end of 2023, they say.

We do have to allow for the $110-$120 oil prices of previous months to work their way through the system, but if oil stays below $100, or goes even lower, then eventually we will see prices start to come in.Well that would certainly help with inflation in general but I doubt any prices come down as a result. Seems to be completely opposite of what JPM was predicting with barrels at $320

Oil is down a bit today, which is surprising imo based off yesterday's big down move. Edit: WTI August contracts down to $95. That's another 4%.

And yes super interesting to see one side call for potential of $320, while the other side is expecting $65.

Last edited:

Could we see .5 as opposed to the expected .75 at the next meeting.+1

Stand your ground, stick to your plan, and keep buying. The Fed is desperate to lighten-up on rate increase and looking for any excuse to do so. The market is so oversold that the rebound will likely happen in a blink of an eye. Gotta be positioned well in advance.

Many pundits currently saying we should.

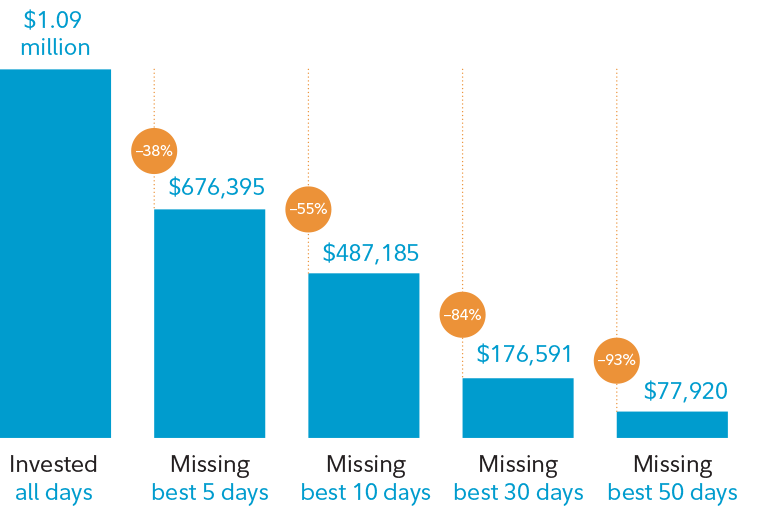

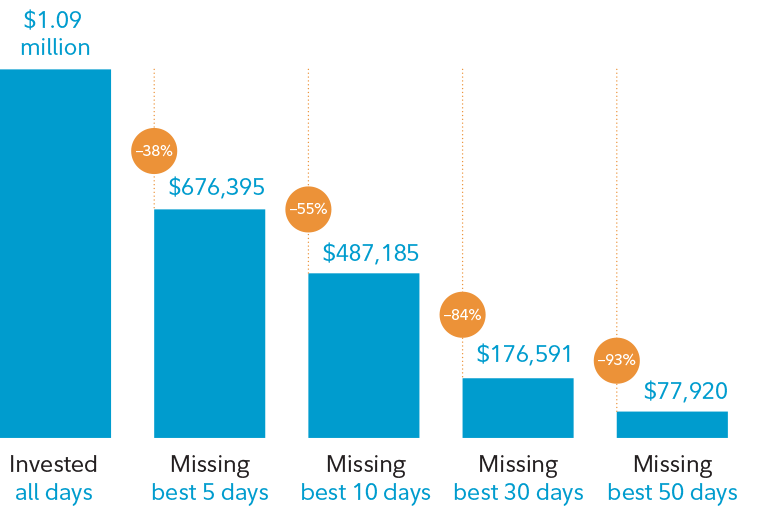

The importance of staying in the market:Could we see .5 as opposed to the expected .75 at the next meeting.

Many pundits currently saying we should.

Missing out on best days can be costly

Hypothetical growth of $10,000 invested in the S&P 500 Index, January 1, 1980–March 31, 2021

Hope so:

Is inflation peaking?

There are signs that you may get some sustained relief soon from higher prices.

Is inflation peaking?

There are signs that you may get some sustained relief soon from higher prices.

Inflation peaking | Inflation and stocks | Fidelity

There are signs that you may get some sustained relief soon from higher prices.

www.fidelity.com

The importance of staying in the market:

Missing out on best days can be costly

Hypothetical growth of $10,000 invested in the S&P 500 Index, January 1, 1980–March 31, 2021

You are correct about staying in the market, but reducing exposure when nearing retirement saved me a few extra years of work. Also, much of that gain is pre-2000. $10,000 invested in the S&P on 1/1/2000 is worth only $44,220.

You should use the bucket approach for retirement.....see posts above.You are correct about staying in the market, but reducing exposure when nearing retirement saved me a few extra years of work. Also, much of that gain is pre-2000. $10,000 invested in the S&P on 1/1/2000 is worth only $44,220.

Also, quality funds are up 8-10x since 1/1/2000. Indexes are great, but everyone needs exposure to managed funds as well.

Last edited:

Similar threads

- Replies

- 0

- Views

- 538

- Replies

- 44

- Views

- 2K

- Replies

- 0

- Views

- 303

- Replies

- 1

- Views

- 370

ADVERTISEMENT

ADVERTISEMENT