A

anon_0k9zlfz6lz9oy

Guest

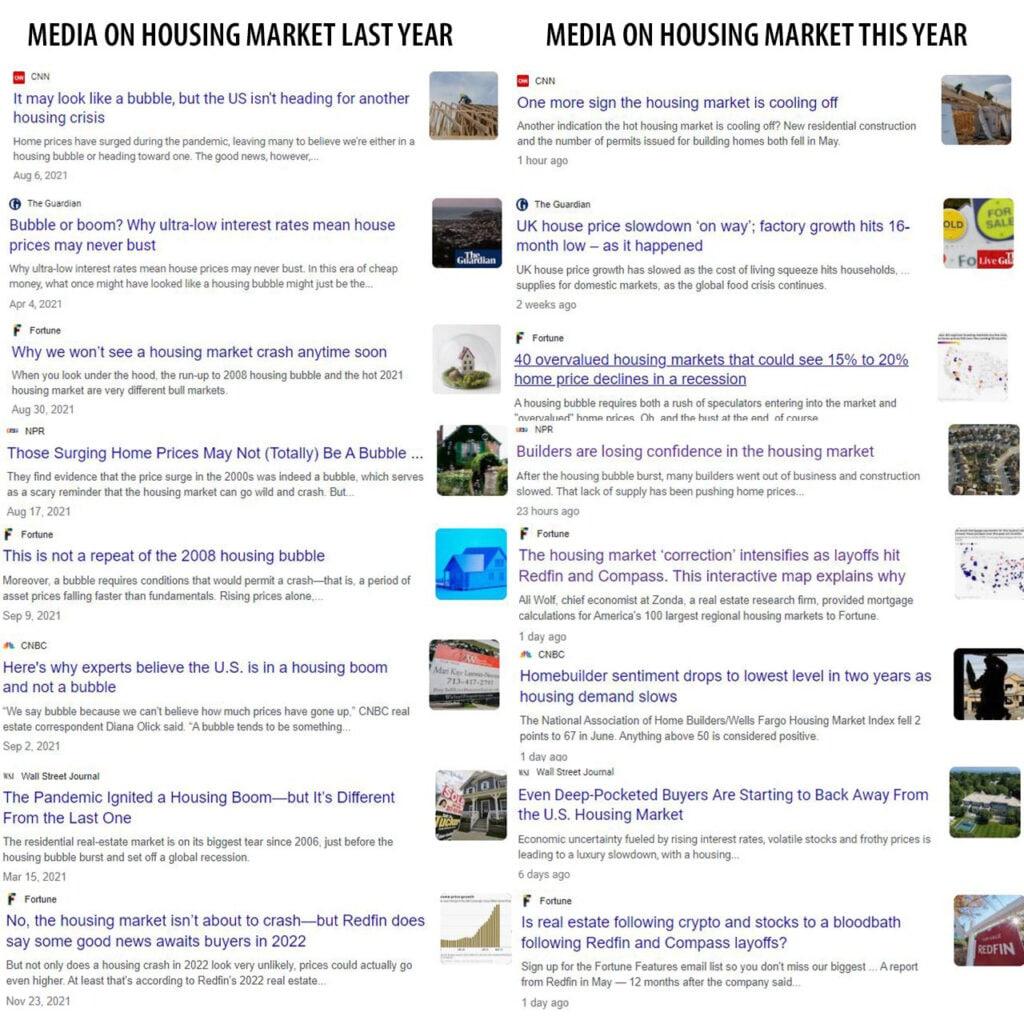

Did you even read this? The economists base case is 0% price growth YOY. As ive said I expect 0-3% YOY. His worst case is 5% price reduction. Hardly a bubble. Headlines sell thoRight on cue.....

It looks a lot like a housing bubble. How your local housing market compares to 2007, as told by 4 interactive charts

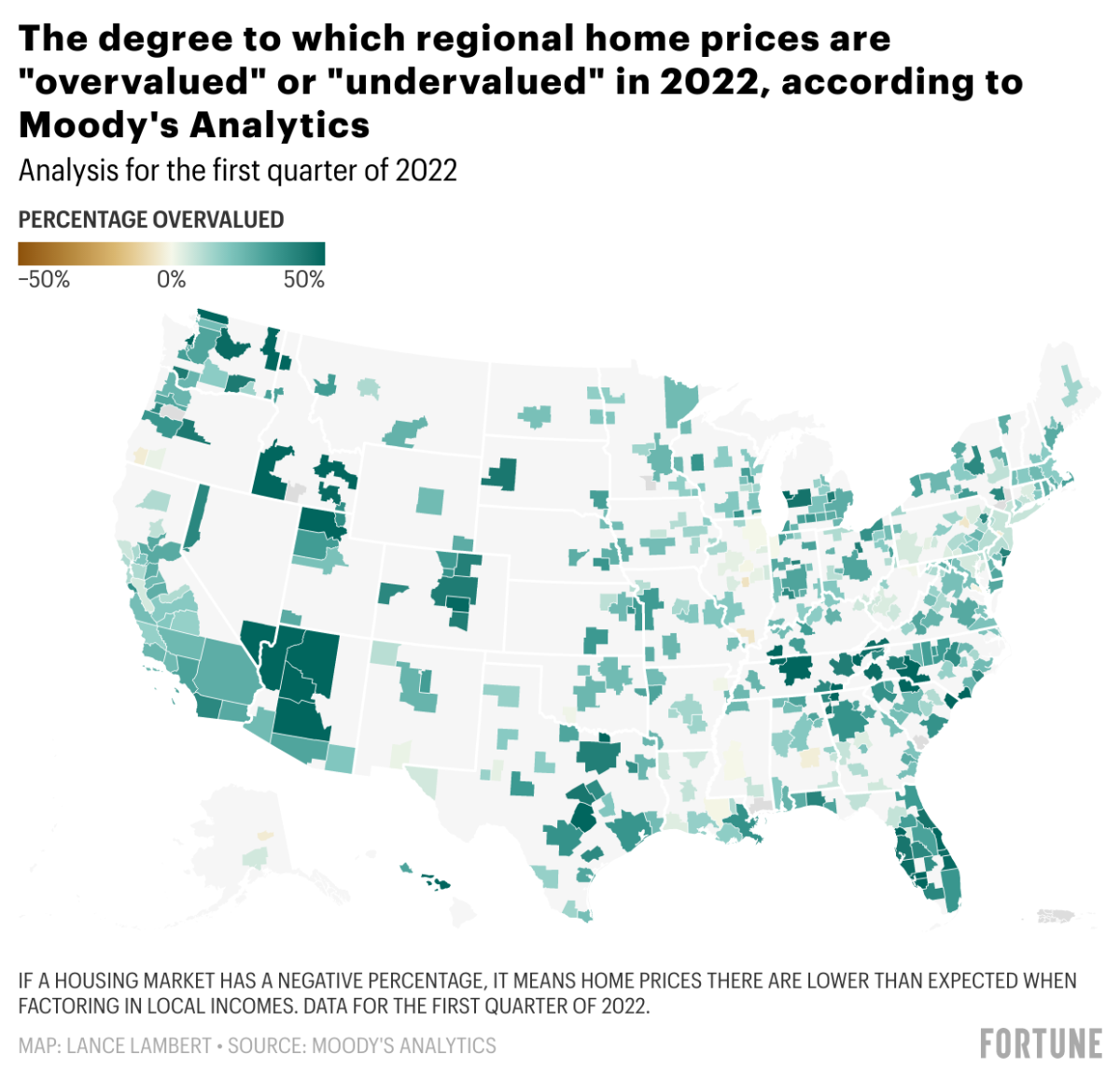

Among the nation’s largest housing markets, Moody’s Analytics finds 344 are “overvalued” by more than 10%. Back in 2007, 261 markets were “overvalued” by 10% or more.www.yahoo.com