SS should be optional. Could have done so much more with that money.

are beneficiaries

But who would pay for the beneficiaries who didn’t contribute?SS should be optional. Could have done so much more with that money.

SS should be optional. Could have done so much more with that money.

are beneficiaries

But who would pay for the beneficiaries who didn’t contribute?SS should be optional. Could have done so much more with that money.

If you decide to opt out of SS, you don't pay in or get any future benefits. You can invest your money as you see fit.But who would pay for the beneficiaries who didn’t contribute?

If you decide to opt out of SS, you don't pay in or get any future benefits. You can invest your money as you see fit.

That will just crash another system. Too many people rely on SS.If you decide to opt out of SS, you don't pay in or get any future benefits. You can invest your money as you see fit.

Current policies (state and federal) are costing local taxpayers a lot of money that is seldom reported in the news. A friend works in New Brunswick public schools where Illegal immigrants were still registering their kids as late as May. New Brunswick and every other city in every state can't afford to fund their schools when the majority of student families don't pay a nickel in taxes. State governments are sending more money to these districts which they take from suburban districts which results in large property tax increases for suburban residents. I live in Hillsborough which just got a huge reduction in state aid and will be raising local taxes as well as reducing staff.Two things:

The severe loss of state aid in many suburban districts is certainly not going to help the teacher shortage.

Toms River Regional has lost so many staff members. Jackson as well.

Two of my daughters are teachers. Their main complaint is having to be social worker as well as teacher while having little authority re discipline. Kids who have no respect are not removed from the classrooms. This disrupts the ability of the good kids to learn.

Yes, I understand that. But as things stand now, there are many folks who collect Social Security benefits who never contributed a nickel. For instance, dependent (children) benefits if a parent passes away.If you decide to opt out of SS, you don't pay in or get any future benefits. You can invest your money as you see fit.

Most SS costs are for the retirement benefits. Easy to opt out of those and use general tax revenue to support the other SS programs.Yes, I understand that. But as things stand now, there are many folks who collect Social Security benefits who never contributed a nickel. For instance, dependent (children) benefits if a parent passes away.

That has always been the case -- after all, social security benefits started in the 1930s for people who were eligible then and had never contributed a dime. Your social security taxes go to pay today's beneficiaries. The problem is that the birth rate is dropping and there will be fewer workers to support tomorrow's aged.Yes, I understand that. But as things stand now, there are many folks who collect Social Security benefits who never contributed a nickel. For instance, dependent (children) benefits if a parent passes away.

People are also living longerThat has always been the case -- after all, social security benefits started in the 1930s for people who were eligible then and had never contributed a dime. Your social security taxes go to pay today's beneficiaries. The problem is that the birth rate is dropping and there will be fewer workers to support tomorrow's aged.

Yes, I understand that. But as things stand now, there are many folks who collect Social Security benefits who never contributed a nickel. For instance, dependent (children) benefits if a parent passes away.

That has always been the case -- after all, social security benefits started in the 1930s for people who were eligible then and had never contributed a dime. Your social security taxes go to pay today's beneficiaries. The problem is that the birth rate is dropping and there will be fewer workers to support tomorrow's aged.

Yes. The projected decline in the number of young people and increase in the number of the aged is a real problem. It is worse elsewhere than here, because the United States is relatively open to immigrants as compared to European and Asian nations; immigrants tend to be young, and immigrant women tend to have higher birthrates than U.S. born women. See the link:People are also living longer

It used to be that benefits continued until age 22 if the child was in college. That ended somewhere along the line.But benefits stop when they reach 18.

Letting folks opt out and manage their own accounts sounds like a sensible proposition, but those folks will need to contribute to normal Social Security in some lesser way to keep it afloat in some fashion.That has always been the case -- after all, social security benefits started in the 1930s for people who were eligible then and had never contributed a dime. Your social security taxes go to pay today's beneficiaries. The problem is that the birth rate is dropping and there will be fewer workers to support tomorrow's aged.

Exactly why Murphy lifted the 2% cap on school budget increases. He's putting the tax burden on suburban residents to educate illegal immigrant kids in urban areas whose parents don't pay a dime. Freehold just announced an over 8% increase in their budget to make up for the shortfall of state money they used to get.Current policies (state and federal) are costing local taxpayers a lot of money that is seldom reported in the news. A friend works in New Brunswick public schools where Illegal immigrants were still registering their kids as late as May. New Brunswick and every other city in every state can't afford to fund their schools when the majority of student families don't pay a nickel in taxes. State governments are sending more money to these districts which they take from suburban districts which results in large property tax increases for suburban residents. I live in Hillsborough which just got a huge reduction in state aid and will be raising local taxes as well as reducing staff.

Respectfully disagree. Most people are terrible savers and have little understanding of investing. You will have more people in welfare in retirement age.Letting folks opt out and manage their own accounts sounds like a sensible proposition, but those folks will need to contribute to normal Social Security in some lesser way to keep it afloat in some fashion.

I don’t see them offering to opt out, either cut benefits or increase social security tax or a combination of both. You know I see what people are making now a days and they can afford to pay more.Letting folks opt out and manage their own accounts sounds like a sensible proposition, but those folks will need to contribute to normal Social Security in some lesser way to keep it afloat in some fashion.

I agree with this take on the issue.Respectfully disagree. Most people are terrible savers and have little understanding of investing. You will have more people in welfare in retirement age.

Bad decisions of some shouldn't impact everyone. America 101.Respectfully disagree. Most people are terrible savers and have little understanding of investing. You will have more people in welfare in retirement age.

Education aid was increased this year by over 900 million. Over 400 districts received an increase. Monmouth and Ocean county schools have received flat aid for most of the last few years but if you do a search you can find articles that claims under the Christie administration received excess aid that came at the expense of Middlesex county schools like Woodbridge and Edison. The formula was supposedly corrected so that certain schools were brought up to their correct amount while the schools that had received excess were frozen not cut for several budgets.Exactly why Murphy lifted the 2% cap on school budget increases. He's putting the tax burden on suburban residents to educate illegal immigrant kids in urban areas whose parents don't pay a dime. Freehold just announced an over 8% increase in their budget to make up for the shortfall of state money they used to get.

A bunch of Middlesex county towns were crushed with school aid cuts. East Brunswick and South Brunswick were in the news a lot due to their budget/headcount reductions. Seems like Trenton gave mostly suburban schools the middle finger.Education aid was increased this year by over 900 million. Over 400 districts received an increase. Monmouth and Ocean county schools have received flat aid for most of the last few years but if you do a search you can find articles that claims under the Christie administration received excess aid that came at the expense of Middlesex county schools like Woodbridge and Edison. The formula was supposedly corrected so that certain schools were brought up to their correct amount while the schools that had received excess were frozen not cut for several budgets.

Jackson where I live was one of those towns. Add in our student population decline and increased busing expense and our budget is stressed.

423 towns saw an increase while 140 received a decrease.A bunch of Middlesex county towns were crushed with school aid cuts. East Brunswick and South Brunswick were in the news a lot due to their budget/headcount reductions. Seems like Trenton gave mostly suburban schools the middle finger.

Their aid was cut 1.3 and 1.4 million.A bunch of Middlesex county towns were crushed with school aid cuts. East Brunswick and South Brunswick were in the news a lot due to their budget/headcount reductions. Seems like Trenton gave mostly suburban schools the middle finger.

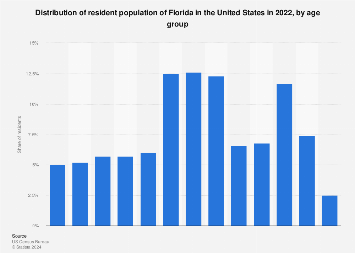

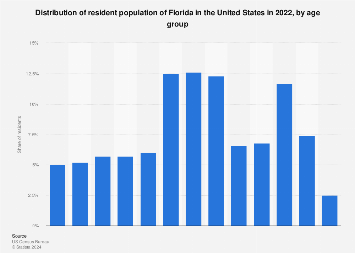

You don't think wealthy retirees relocate to Florida, Texas, Tennessee for tax reasons? You bet they do. No only no state income tax, but inheritance tax issues too.You really believe that Florida’s increase in population is due to ‘Ultra wealthy Families’ moving in and not due to retirees???? Huuuuuuboy that’s comically innacurate. Oh Florida and specifically Ron Desantis’ attack on teachers have them in a situation more dire than anyone in the country. #1 in the country in teacher vacancies. Why is he popular in Florida? Take a look at the age demographics of Florida’s compared to the rest of the country….

Florida: share of population by age group U.S. 2023 | Statista

In 2023, about 12.4 percent of the population in Florida was between 25 and 34 years old.www.statista.com

Pay special attention to the 45-54 demographics, 55-64 demographics, then the SPIKE in 65-74. That is retirees!!! The population of the country is much higher in the 45-64 age demographic than 65-74 (old people die). In conclusion if it were the ultra millionaire families as you suggested those numbers in the 45-64 age demographic would outweigh 65-74. They don’t..

But keep blaming everything else.

2024 is truly going to be hilarious.

It was one question that was answered right away. Now there is all this new reading material lolIs there going to be an anchor program payment this year? 2024?

All educational.It was one question that was answered right away. Now there is all this new reading material lol

You really believe that Florida’s increase in population is due to ‘Ultra wealthy Families’ moving in and not due to retirees???? Huuuuuuboy that’s comically innacurate. Oh Florida and specifically Ron Desantis’ attack on teachers have them in a situation more dire than anyone in the country. #1 in the country in teacher vacancies. Why is he popular in Florida? Take a look at the age demographics of Florida’s compared to the rest of the country….

Florida: share of population by age group U.S. 2023 | Statista

In 2023, about 12.4 percent of the population in Florida was between 25 and 34 years old.www.statista.com

Pay special attention to the 45-54 demographics, 55-64 demographics, then the SPIKE in 65-74. That is retirees!!! The population of the country is much higher in the 45-64 age demographic than 65-74 (old people die). In conclusion if it were the ultra millionaire families as you suggested those numbers in the 45-64 age demographic would outweigh 65-74. They don’t..

But keep blaming everything else.

2024 is truly going to be hilarious.

Lots of layoffs in those districts. Sad to see Trenton with so much hate for suburban towns. Over in Somerset County, Hillsborough was crushed.Their aid was cut 1.3 and 1.4 million.

Long Branch was cut $10 million. Jackson $4.4 million. Asbury Park and Neptune also were districts at the top of the cut in aid.

Some of the 140 who were cut received reduced aid cuts of $5,000 or less. Many less than $25,000.

illegal immigrants do indeed pay taxes. They may not pay property taxes, but that's true of all tenants.Exactly why Murphy lifted the 2% cap on school budget increases. He's putting the tax burden on suburban residents to educate illegal immigrant kids in urban areas whose parents don't pay a dime. Freehold just announced an over 8% increase in their budget to make up for the shortfall of state money they used to get.

Illegal immigrants do pay sales tax, gas tax and have housing expense. I work in a county welfare office. The vast majority work off the books and pay no income tax. The ones that report their earnings are reporting such low income that their US born children are receiving food stamps and taxpayer paid medical care in the form of medicaid. Medical care is also taxpayer paid for every pregnant woman. Many women are claiming to not know the whereabouts of their children's father who is living with them and working. Without reporting that income, they become eligible for a higher level of food stamps and a monthly cash allotment. So yes, it's true that illegal immigrants pay some tax. It's also true that they cost taxpayers far more than they pay and that's before you figure in the cost of educating their children who while receiving food stamps, also get their breakfast and lunch provided by schools.illegal immigrants do indeed pay taxes. They may not pay property taxes, but that's true of all tenants.

https://apnews.com/article/fact-check-immigrants-taxes-rent-vaccine-requirements-983035929946

He does have it wrong. I don’t know if you hate Schiano but you definitely don’t like him.Lol, so you’ve never seen me post. Because I’m the single biggest Schiano hater in this board.

It doesn't seem to be true that "the vast majority work off the books and pay no income tax." I don't see an exact number that I trust, but many work on fake social security numbers,which means they are paying taxes and social security. It is also estimated that illegals pay far more in social security taxes than they take out -- remember, they are young. (This estimate, contained in the AP source I cited above, comes from a professor at George Mason, not exactly a hotbed of liberalism). It may well be true that they cost more than they pay, but it is an exaggeration to say, as a poster did above, that they pay no taxes.Illegal immigrants do pay sales tax, gas tax and have housing expense. I work in a county welfare office. The vast majority work off the books and pay no income tax. The ones that report their earnings are reporting such low income that their US born children are receiving food stamps and taxpayer paid medical care in the form of medicaid. Medical care is also taxpayer paid for every pregnant woman. Many women are claiming to not know the whereabouts of their children's father who is living with them and working. Without reporting that income, they become eligible for a higher level of food stamps and a monthly cash allotment. So yes, it's true that illegal immigrants pay some tax. It's also true that they cost taxpayers far more than they pay and that's before you figure in the cost of educating their children who while receiving food stamps, also get their breakfast and lunch provided by schools.

But after paying SS for ?years, the parent that passed away will collect nothing.Yes, I understand that. But as things stand now, there are many folks who collect Social Security benefits who never contributed a nickel. For instance, dependent (children) benefits if a parent passes away.

They work by filing an I-9 formIt doesn't seem to be true that "the vast majority work off the books and pay no income tax." I don't see an exact number that I trust, but many work on fake social security numbers,which means they are paying taxes and social security. It is also estimated that illegals pay far more in social security taxes than they take out -- remember, they are young. (This estimate, contained in the AP source I cited above, comes from a professor at George Mason, not exactly a hotbed of liberalism). It may well be true that they cost more than they pay, but it is an exaggeration to say, as a poster did above, that they pay no taxes.

https://www.nbcnews.com/politics/do...-illegal-immigration-cost-america-not-n950981

They work by getting cash payments.They work by filing an I-9 form

They work by filing an I-9 form

They work by getting cash payments.

I can only speak to my experience and what I see with my own eyes. As far as any news article that's written about this, I'd question where they're getting their information from. These articles usually refer to "studies" conducted by some progressive group with an agenda or they're written by someone attempting to portray something as fact when the facts don't exist. It is true that some use fake SS#'s so those people are paying SS tax.It doesn't seem to be true that "the vast majority work off the books and pay no income tax." I don't see an exact number that I trust, but many work on fake social security numbers,which means they are paying taxes and social security. It is also estimated that illegals pay far more in social security taxes than they take out -- remember, they are young. (This estimate, contained in the AP source I cited above, comes from a professor at George Mason, not exactly a hotbed of liberalism). It may well be true that they cost more than they pay, but it is an exaggeration to say, as a poster did above, that they pay no taxes.

https://www.nbcnews.com/politics/do...-illegal-immigration-cost-america-not-n950981

I see that you work at a county welfare office but I am not sure how you know they underreport their income and do not declare cash they receive. If you had actual documentation of that and not just feelings wouldn’t you have the ability to use that information in the welfare calculation?I can only speak to my experience and what I see with my own eyes. As far as any news article that's written about this, I'd question where they're getting their information from. These articles usually refer to "studies" conducted by some progressive group with an agenda or they're written by someone attempting to portray something as fact when the facts don't exist. It is true that some use fake SS#'s so those people are paying SS tax.

You think illegal immigrants are declaring cash to pay taxes? LOL! Let's keep this a serious conversation.I see that you work at a county welfare office but I am not sure how you know they underreport their income and do not declare cash they receive. If you had actual documentation of that and not just feelings wouldn’t you have the ability to use that information in the welfare calculation?