Remember when everyone ran for TP and paper towels? This is basically happening in all companies that have a supply chain for product they sell. Everyone is buying spares, attempting to be prepared further stressing the supply demand equation and creating temporary bidding wars while supply is stressed. This whipsaw sooner than later in various commodities and products. My first guess will be gloves and chemicals.

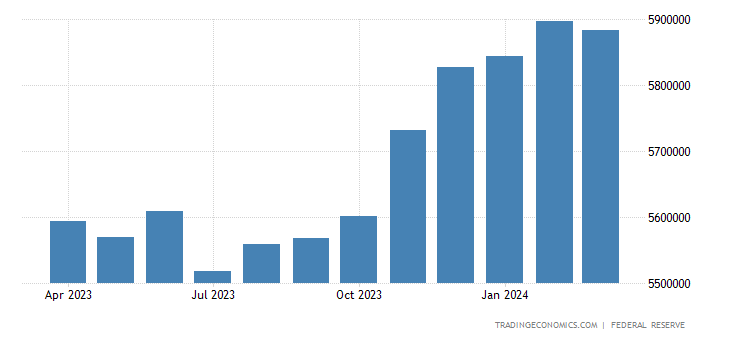

The supply chain issues you mention may be transitory but I am referring to inflation in the long term not for a few months. Inflation is happening all around. Stocks, bitcoin, real estate, used cars, etc. Looking at the feds inflation numbers only tells you part of the big picture. I think it will be a rocky road, but the trend will continue at a much higher rate than the Fed expectations.