I'm listening. Let me know if I need to get a job at Walmart or start delivering pizzas. That's the question I keep asking my broker and he laughs. I don't think he realizes it's a serious question.you and many really have no idea just how bad they are.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT: Stock and Investment Talk

- Thread starter RU-05

- Start date

It maybe bad news in the short term particularly if the earnings report show margin compression. However in the long term, it is good news particularly if TSLA can figure out a better way to monetize each car on the road.Nicely on track to exceed 2023 forecast of 1.8m EVs delivered. Well done TSLA!

Tesla reports 422,875 deliveries for first quarter of 2023

Tesla just posted its first-quarter vehicle production and deliveries report for 2023.www.cnbc.com

Here are the key numbers from the electric vehicle maker:

Total deliveries Q1 2023: 422,875

Total production Q1 2023: 440,808

Deliveries are the closest approximation of sales disclosed by Tesla and are not broken out by individual model or region.

The first quarter numbers represent a 36% increase in deliveries compared to the 310,048 reported during the same period a year earlier, and 4% growth in deliveries sequentially compared to the 405,278 they company reported in the last quarter of 2022.

Any one know any news about UNH is up $15 this morning? Sold some of my shares but expect to buy more later at a lower price. Stock was close to 52 week low.

Not sure, but that is about 3-3.5%. Perhaps an analyst upgrade? Don't see any significant news this morning on UNH (yet).Any one know any news about UNH is up $15 this morning? Sold some of my shares but expect to buy more later at a lower price. Stock was close to 52 week low.

Medicare projecting increased payments I believeAny one know any news about UNH is up $15 this morning? Sold some of my shares but expect to buy more later at a lower price. Stock was close to 52 week low.

Do you have any thoughts on CNC?On one of best fund managers of the last 10-15 years. His fund is the only one I own with bonds/fixed income as a significant portion of it (about 1/3). It's closed unless you have a T Rowe account, but it's worth finding a way to get into it:

How a Top T. Rowe Manager Keeps Beating the Markets

David Giroux’s contrarian approach has kept investors ahead of both the stock and bond market.www.morningstar.com

CNC has a very interesting business, focused on government programs (like Medicaid). This puts pressure on margins since they are dependent on government reimbursement rates, but on the positive, it is an established and growing segment of HC. Strong track record with nice forecasted earnings thru 2024. CNC is undervalued due to the recent HC dip. Can't go wrong with UNH or CNC (which essentially bookend the insurance space.....commercial and government).Do you have any thoughts on CNC?

CNC is a top-20 holding in my PRHSX at 1.7%.

From Morningstar:

Centene's Narrow Moat Intact Despite Recent Contract Uncertainty

Business Strategy and Outlook | Updated Dec 23, 2022

Centene aims to be the top provider of government-sponsored health plans. Although it has grown at a solid clip organically, the company also has made significant acquisitions—most notably WellCare—to meet that goal. Technology investments to boost efficiency have helped Centene prosper in this relatively low-margin managed-care sector, as well.

Centene leads the Medicaid managed-care business; those plans account for about two thirds of its medical membership. The Medicaid program is jointly funded by federal and state governments and primarily serves low-income individuals of any age and people with disabilities. The Affordable Care Act expanded the Medicaid population starting in 2014, and we think this program may be used in the future to expand insured rates further.

Centene boasts the leading franchise, Ambetter, on the individual exchanges. With its technology investments and scale-related advantages in local markets, Centene aims to remain the low-cost leader in this market. This business accounts for about 10% of Centene's medical membership and enjoys higher profit margin prospects than its other businesses. Also, demand for Centene's exchange-related plans could rise, as enhanced tax credits increase affordability on the exchanges and free plans may be offered to eligible Medicaid recipients in nonexpansion states.

Through the acquisition of WellCare in early 2020, Centene added to its Medicare-related capabilities, particularly in the fast-growing Medicare Advantage program. With positive demographic trends and increasing popularity relative to traditional Medicare plans, we see the Medicare Advantage program as one of the most attractive growth opportunities in health insurance in the long run. This opportunity largely explains the appeal of the WellCare deal, although WellCare also added to Centene's Medicaid footprint, too.

Fair Value and Profit Drivers | Updated Jan 03, 2023

We are maintaining our $87 fair value estimate, which implies a 14 times price/earnings multiple on 2023 expected earnings.

After a strong year on the top line but weak year on the bottom line in 2021, we expect those trends to largely reverse. Management is shooting for mid-single-digit revenue and midteens earnings per share growth from 2021 to 2024. While we see headwinds that make that goal look aggressive, especially in 2024, we project low-single-digit annualized revenue growth and 11% adjusted earnings growth annually through 2026.

By major segment, after a strong 2021 in Medicaid, we expect a mild contraction in revenue, as redeterminations may push some members off the rolls and employer-based medical plans recover following the pandemic, and as we incorporate potential market share losses of some of Centene's existing Medicaid contracts that recently have been awarded to other plans (particularly some important California counties). In Centene's smaller Medicare business, we expect midteens annualized revenue growth primarily as demographic trends and the increasing popularity of Medicare Advantage plans benefit that business. We expect mid-single-digit annualized growth from the company's commercial business during the next five years, primarily on continued expansion of the individual exchange business, which may pick up the slack for Medicaid after redeterminations begin again.

We expect adjusted net margin improvement that is slightly less than management's goal of 60-70 basis points of expansion from 2021 to 2024, given the recently announced Tricare West contract loss. However, we see significant margin improvement opportunities along with substantial share repurchase activities that could boost adjusted EPS growth, as well. In total, we expect 11% adjusted EPS growth compounded annually through 2026. We expect free cash flows to exceed $4.5 billion by 2026, up from $3.3 billion in 2021.

I have them circled as my healthcare portfolio pick; mainly on fundamentals.CNC has a very interesting business, focused on government programs (like Medicaid). This puts pressure on margins since they are dependent on government reimbursement rates, but on the positive, it is an established and growing segment of HC. Strong track record with nice forecasted earnings thru 2024. CNC is undervalued due to the recent HC dip. Can't go wrong with UNH or CNC (which essentially bookend the insurance space.....commercial and government).

CNC is a top-20 holding in my PRHSX at 1.7%.

From Morningstar:

Centene's Narrow Moat Intact Despite Recent Contract Uncertainty

Business Strategy and Outlook | Updated Dec 23, 2022

Centene aims to be the top provider of government-sponsored health plans. Although it has grown at a solid clip organically, the company also has made significant acquisitions—most notably WellCare—to meet that goal. Technology investments to boost efficiency have helped Centene prosper in this relatively low-margin managed-care sector, as well.

Centene leads the Medicaid managed-care business; those plans account for about two thirds of its medical membership. The Medicaid program is jointly funded by federal and state governments and primarily serves low-income individuals of any age and people with disabilities. The Affordable Care Act expanded the Medicaid population starting in 2014, and we think this program may be used in the future to expand insured rates further.

Centene boasts the leading franchise, Ambetter, on the individual exchanges. With its technology investments and scale-related advantages in local markets, Centene aims to remain the low-cost leader in this market. This business accounts for about 10% of Centene's medical membership and enjoys higher profit margin prospects than its other businesses. Also, demand for Centene's exchange-related plans could rise, as enhanced tax credits increase affordability on the exchanges and free plans may be offered to eligible Medicaid recipients in nonexpansion states.

Through the acquisition of WellCare in early 2020, Centene added to its Medicare-related capabilities, particularly in the fast-growing Medicare Advantage program. With positive demographic trends and increasing popularity relative to traditional Medicare plans, we see the Medicare Advantage program as one of the most attractive growth opportunities in health insurance in the long run. This opportunity largely explains the appeal of the WellCare deal, although WellCare also added to Centene's Medicaid footprint, too.

Fair Value and Profit Drivers | Updated Jan 03, 2023

We are maintaining our $87 fair value estimate, which implies a 14 times price/earnings multiple on 2023 expected earnings.

After a strong year on the top line but weak year on the bottom line in 2021, we expect those trends to largely reverse. Management is shooting for mid-single-digit revenue and midteens earnings per share growth from 2021 to 2024. While we see headwinds that make that goal look aggressive, especially in 2024, we project low-single-digit annualized revenue growth and 11% adjusted earnings growth annually through 2026.

By major segment, after a strong 2021 in Medicaid, we expect a mild contraction in revenue, as redeterminations may push some members off the rolls and employer-based medical plans recover following the pandemic, and as we incorporate potential market share losses of some of Centene's existing Medicaid contracts that recently have been awarded to other plans (particularly some important California counties). In Centene's smaller Medicare business, we expect midteens annualized revenue growth primarily as demographic trends and the increasing popularity of Medicare Advantage plans benefit that business. We expect mid-single-digit annualized growth from the company's commercial business during the next five years, primarily on continued expansion of the individual exchange business, which may pick up the slack for Medicaid after redeterminations begin again.

We expect adjusted net margin improvement that is slightly less than management's goal of 60-70 basis points of expansion from 2021 to 2024, given the recently announced Tricare West contract loss. However, we see significant margin improvement opportunities along with substantial share repurchase activities that could boost adjusted EPS growth, as well. In total, we expect 11% adjusted EPS growth compounded annually through 2026. We expect free cash flows to exceed $4.5 billion by 2026, up from $3.3 billion in 2021.

Up $22 today 5%. It will probably goes up right before their earning.Any one know any news about UNH is up $15 this morning? Sold some of my shares but expect to buy more later at a lower price. Stock was close to 52 week low.

200 of CNC @64.50.I have them circled as my healthcare portfolio pick; mainly on fundamentals.

I brought 100 today. Most of the drugs stocks are going up also. I’m selling most of them in the next two weeks before the bank earning season starts.200 of CNC @64.50.

Didn't buy anything today, but I have been bullish on HC and biotech for a while. I have significant positions of CURE at $86 and LABU at $4.4. I traded LABU a few times already and done okay (looking for a big win this time). Just gotta be patient.I brought 100 today. Most of the drugs stocks are going up also. I’m selling most of them in the next two weeks before the bank earning season starts.

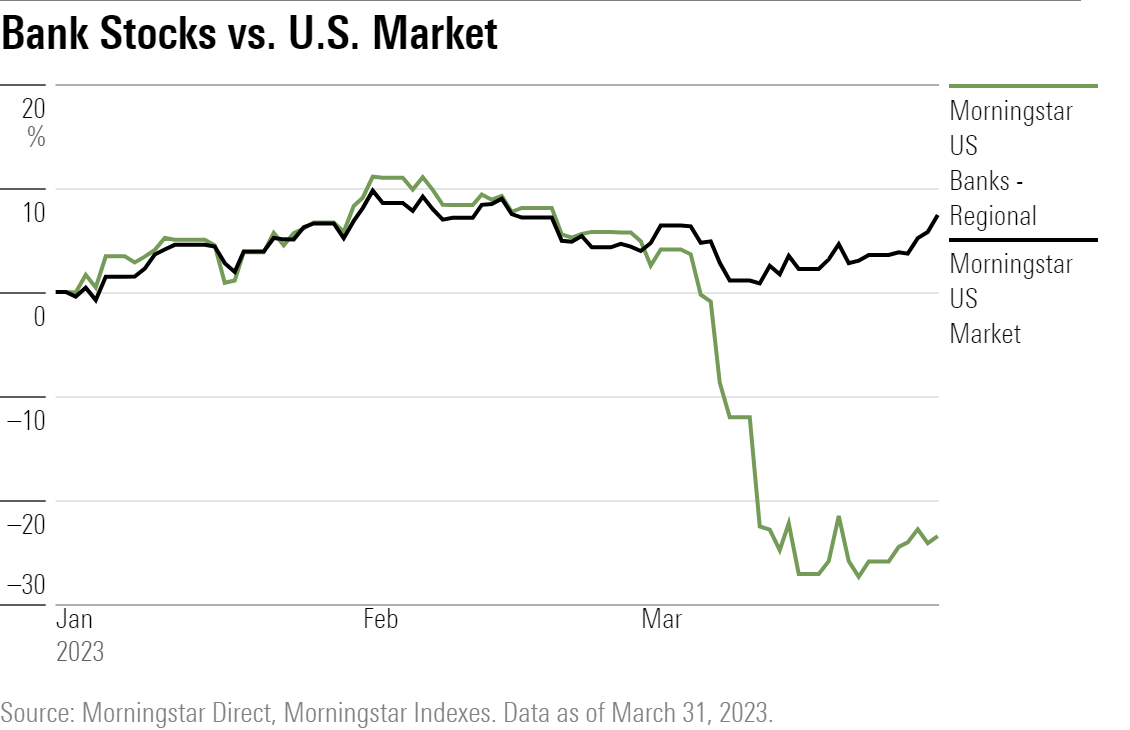

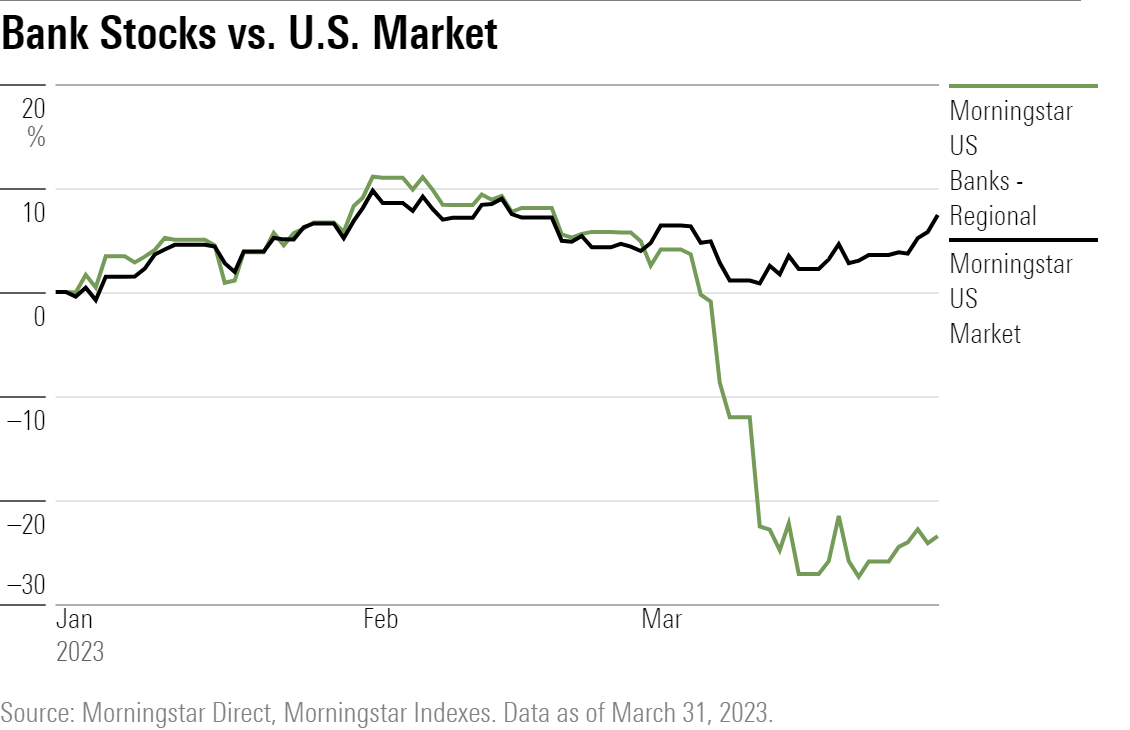

Great chart. The Market says....."what bank crisis?":

Q1 Recap:

www.morningstar.com

www.morningstar.com

Q1 Recap:

14 Charts on the Q1 2023 Whiplash Market Performance

Big swings in expectations around Fed policy dominated stock and bond market returns.

You should really post your trades in real time to be taken seriously. Your claims of buying these highly volatile stocks at the absolute bottom is otherwise not believable.Didn't buy anything today, but I have been bullish on HC and biotech for a while. I have significant positions of CURE at $86 and LABU at $4.4. I traded LABU a few times already and done okay (looking for a big win this time). Just gotta be patient.

That is gutsy. Are you hoping that it gets bought out. I am out of that name after taking a loss.Bought 1000 FRC at 14.15 this morning

Up 9% in Q1. not bad

Expected folks to be much higher especially the penchant to play leveraged ETF's by traders on this forum.Looks like I'm up about 12% in Q1.....thanks to my leveraged plays. Up about 40% in my fun account. :)

LABU. What is a "big win"? What's your "out" price or % here?Didn't buy anything today, but I have been bullish on HC and biotech for a while. I have significant positions of CURE at $86 and LABU at $4.4. I traded LABU a few times already and done okay (looking for a big win this time). Just gotta be patient.

Looks like you bought it last on March 24. 5.14 at the moment in pre-market. So a 17% gain, at the moment.

I don’t play leveraged ETF. Been chasing yield with duration. Haven’t added to equities outside of the 401k stuff. I’m happy with 9% in Q1 with a larger cash and fixed income allocation.Expected folks to be much higher especially the penchant to play leveraged ETF's by traders on this forum.

I took a big rip in it last month.That is gutsy. Are you hoping that it gets bought out. I am out of that name after taking a loss.

I think that it has stabilized. I have a tight stop loss so I’m essentially risking $1500 v a hopeful $5000 on a bounce back.

At this point, it doesn’t looked like a distressed sale buyout.

Bull turns into bear;

finance.yahoo.com

finance.yahoo.com

JPMorgan Warns Stocks Are in ‘Calm Before the Storm’

(Bloomberg) -- A risk-on mood fueling this year’s equities rally is likely to falter, with headwinds from bank turbulence, an oil shock and slowing growth poised to send stocks back toward their 2022 lows, according to JPMorgan strategist Marko Kolanovic.Most Read from BloombergWarner Bros...

Yup, looking at my Fidelity account now, bought on 3/24 at $4.38 - says it's up 15.98% based on yesterday's close. I did this while on vacation in WDW! Dedication. :)LABU. What is a "big win"? What's your "out" price or % here?

Looks like you bought it last on March 24. 5.14 at the moment in pre-market. So a 17% gain, at the moment.

As for out price, LABU is the 3x of XBI which is now $77. It peaked at $175 during COVID. Maintained a range around $130 for a while before dumping to today's range. Once the market gets moving, especially small caps, you can see XBI easily getting back to $100 and maybe a bit higher. This would be a good time to consider ending the trade.

Not when you are only playing with a small portion of your portfolio. I thought nearly doubling the return of the S&P 500 was pretty darn good! :)Expected folks to be much higher especially the penchant to play leveraged ETF's by traders on this forum.

Since you like hearing about leveraged ETFs, my long hold TQQQ position is still in play. Bought first in May at $30. Bought down in June and bought very heavy in Oct at $17. Current CB is little north of $20. I would love to add to this since I'm a big believer in QQQ, but have been maintaining CB discipline. Was waiting for it a get into the $15 range, but it never did.

Taking some profit on my PG and BDX but still expecting increasing till their earnings. Just buy these quality stocks when they come close to their 52 week low and wait for them to rise, normally during earning season.

Nice of you to post your trade, but still posting “after the fact”. I am still waiting on real-time posts. Anyone can look backwards at the chart and find buying points.Not when you are only playing with a small portion of your portfolio. I thought nearly doubling the return of the S&P 500 was pretty darn good! :)

Since you like hearing about leveraged ETFs, my long hold TQQQ position is still in play. Bought first in May at $30. Bought down in June and bought very heavy in Oct at $17. Current CB is little north of $20. I would love to add to this since I'm a big believer in QQQ, but have been maintaining CB discipline. Was waiting for it a get into the $15 range, but it never did.

I’m not waiting been slowly selling DCA as it creeps higher. I have a smaller quantity like all the FANG but after earning will just buy them back, everything a trade at this point. In the positive for MSFT, AMZN, APPL, META but still waiting for GOOG to go higher.Will Jesus push MSFT to 300 by Easter? AI GPT is now truly omniscient (almost).

I just don’t see MSFT breaking 300 so soon. It already went up 40 points 246 to 286 (16%) since March 1,2023.

Last edited:

Sorry, don't have the time to post all trades in real time. I assume you don't either. Right? Just can do the best I can.Nice of you to post your trade, but still posting “after the fact”. I am still waiting on real-time posts. Anyone can look backwards at the chart and find buying points.

MSFT + AI to the moon! :)Will Jesus push MSFT to 300 by Easter? AI GPT is now truly omniscient (almost).

For someone who posts 24-7 on this forum, I am surprised you don't have time to post your trades. But I digress. I don't expect you to be honest with your trades and I don't particularly care when you post your trades, but I don't appreciate the name calling. You call folks on this forum all sorts of names (chicken little, bears etc). For someone who isn't a good trader, that is not acceptable behavior.Sorry, don't have the time to post all trades in real time. I assume you don't either. Right? Just can do the best I can.

^^^^^ Sounds like a sensitive chicken little. LOL!For someone who posts 24-7 on this forum, I am surprised you don't have time to post your trades. But I digress. I don't expect you to be honest with your trades and I don't particularly care when you post your trades, but I don't appreciate the name calling. You call folks on this forum all sorts of names (chicken little, bears etc). For someone who isn't a good trader, that is not acceptable behavior.

Sorry if being called a bear or CL is scarring. Haven't called anyone CL in a long time, so I guess it did bother you. My apologies.

For 3-4 years, he was abusing people especially me since he only thought you can make money by buying and holding mutual funds and ETF. Any time anyone traded, he would call them names. Now that he’s a little more educated, he’s been trading stocks and using 3x ETF. Everybody situation isn’t the same, I have been retired for 13 years and don’t have more cash income coming in every month to claim I’m buying this week. I have to selling stocks to buy other stocks to maximize my profit. I think as he progress and his assets continue to grow, a higher % of his assets will be used for trading and not only buy and hold.For someone who posts 24-7 on this forum, I am surprised you don't have time to post your trades. But I digress. I don't expect you to be honest with your trades and I don't particularly care when you post your trades, but I don't appreciate the name calling. You call folks on this forum all sorts of names (chicken little, bears etc). For someone who isn't a good trader, that is not acceptable behavior.

The creation of my fun account has broadened my horizons, but our 2 largest accounts remain buy/hold and where most of our new money lands (minus normal allocation adjustments). Beyond my fun account, I have started to use our Fidelity Rollover IRA account (3rd largest) for some longer term moves. This is where I converted VB to UWM and hold my CURE and LABU plays. Obviously, this is nice for tax purposes.For 3-4 years, he was abusing people especially me since he only thought you can make money by buying and holding mutual funds and ETF. Any time anyone traded, he would call them names. Now that he’s a little more educated, he’s been trading stocks and using 3x ETF. Everybody situation isn’t the same, I have been retired for 13 years and don’t have more cash income coming in every month to claim I’m buying this week. I have to selling stocks to buy other stocks to maximize my profit. I think as he progress and his assets continue to grow, a higher % of his assets will be used for trading and not only buy and hold.

Stopped playing with individual stocks once I learned about leveraged ETFs. That is much more my style.

Probably best to ignore most of what he says. It is mostly all made up nonsense with very little understanding of the market. For guys like him, the best thing that can happen to them is buy and hold.For 3-4 years, he was abusing people especially me since he only thought you can make money by buying and holding mutual funds and ETF. Any time anyone traded, he would call them names. Now that he’s a little more educated, he’s been trading stocks and using 3x ETF. Everybody situation isn’t the same, I have been retired for 13 years and don’t have more cash income coming in every month to claim I’m buying this week. I have to selling stocks to buy other stocks to maximize my profit. I think as he progress and his assets continue to grow, a higher % of his assets will be used for trading and not only buy and hold.

Negative news for J&J, but stock is up after hours on the clarity:

www.cnbc.com

www.cnbc.com

Johnson & Johnson to pay $8.9 billion to settle talc cancer claims

Johnson & Johnson said it would pay an $8.9 billion settlement over claims that its talc-based baby powder caused cancer.

They must have expected a higher settlement, up $4.5 after hours. Great, going to trim some of my holding tomorrow.Negative news for J&J, but stock is up after hours on the clarity:

Johnson & Johnson to pay $8.9 billion to settle talc cancer claims

Johnson & Johnson said it would pay an $8.9 billion settlement over claims that its talc-based baby powder caused cancer.www.cnbc.com

If you like the current price, you can trim after hours (if your brokerage allows it).They must have expected a higher settlement, up $4.5 after hours. Great, going to trim some of my holding tomorrow.

Actually I was thinking the stock probably going a lot higher since this is the first day. Yea, I sometimes trade afterhours.If you like the current price, you can trim after hours (if your brokerage allows it).

Up $6.14 now

Last edited:

Why not just play with options?I took a big rip in it last month.

I think that it has stabilized. I have a tight stop loss so I’m essentially risking $1500 v a hopeful $5000 on a bounce back.

At this point, it doesn’t looked like a distressed sale buyout.

Similar threads

- Replies

- 0

- Views

- 474

- Replies

- 44

- Views

- 2K

- Replies

- 0

- Views

- 281

- Replies

- 1

- Views

- 366

- Replies

- 77

- Views

- 3K

ADVERTISEMENT

ADVERTISEMENT