I was thinking that over time they could leverage the mRNA approach for diseases other than Covid. Is that still in play down the road?Small step in the right direction for PFE:

Pfizer posts surprise profit as US returns fewer courses of COVID pill

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

OT: Stock and Investment Talk

- Thread starter RU-05

- Start date

It definitely is, but as of now, Moderna is way ahead on using mRNA for other diseases. I need to research what is in PFE's pipeline.I was thinking that over time they could leverage the mRNA approach for diseases other than Covid. Is that still in play down the road?

And it’s doing today what it normally does lol:Small step in the right direction for PFE:

Pfizer posts surprise profit as US returns fewer courses of COVID pill

Wow, MSFT crushed it:Double beats for MSFT and GOOGL. Earning calls should be good. What's the over/under for mentions of AI? LOL!

Microsoft

Here’s how the company performed:

Earnings: $2.93 per share. That may not compare with the $2.78 per share expected by LSEG.

Revenue: $62.02 billion. That may not compare with the $61.12 billion expected by LSEG.

Microsoft’s revenue increased 17% year over year in the year, which ended on Dec. 31, according to a statement. Net income, at $21.87 billion, or $2.93 per share, increased from $16.43 billion, or $2.20 per share.

The company’s Intelligent Cloud segment produced $25.88 billion in revenue, up 20% and above the $25.29 billion consensus among analysts surveyed by Refinitiv. The grouping contains Azure cloud infrastructure, SQL Server, Windows Server, Nuance, GitHub and enterprise services.

Microsoft earnings are out – here are the numbers

LOL! I was literally eyeing it at 3pm for a while. Not sure if to play the earnings report with options or just finally start a long position.Picked up some WOLF at today's close, in advance of earnings announcement tomorrow. JPM recently had a favorable assessment.

I've read WOLF has big exposure to EVs and autos, which is in a slump. Will this report be disappointing?

GOOGL down a bit, but the report looks great. Can't complain:

www.cnbc.com

www.cnbc.com

Alphabet shares slide on disappointing Google ad revenue

Alphabet reported earnings after the bell. Here are the results.

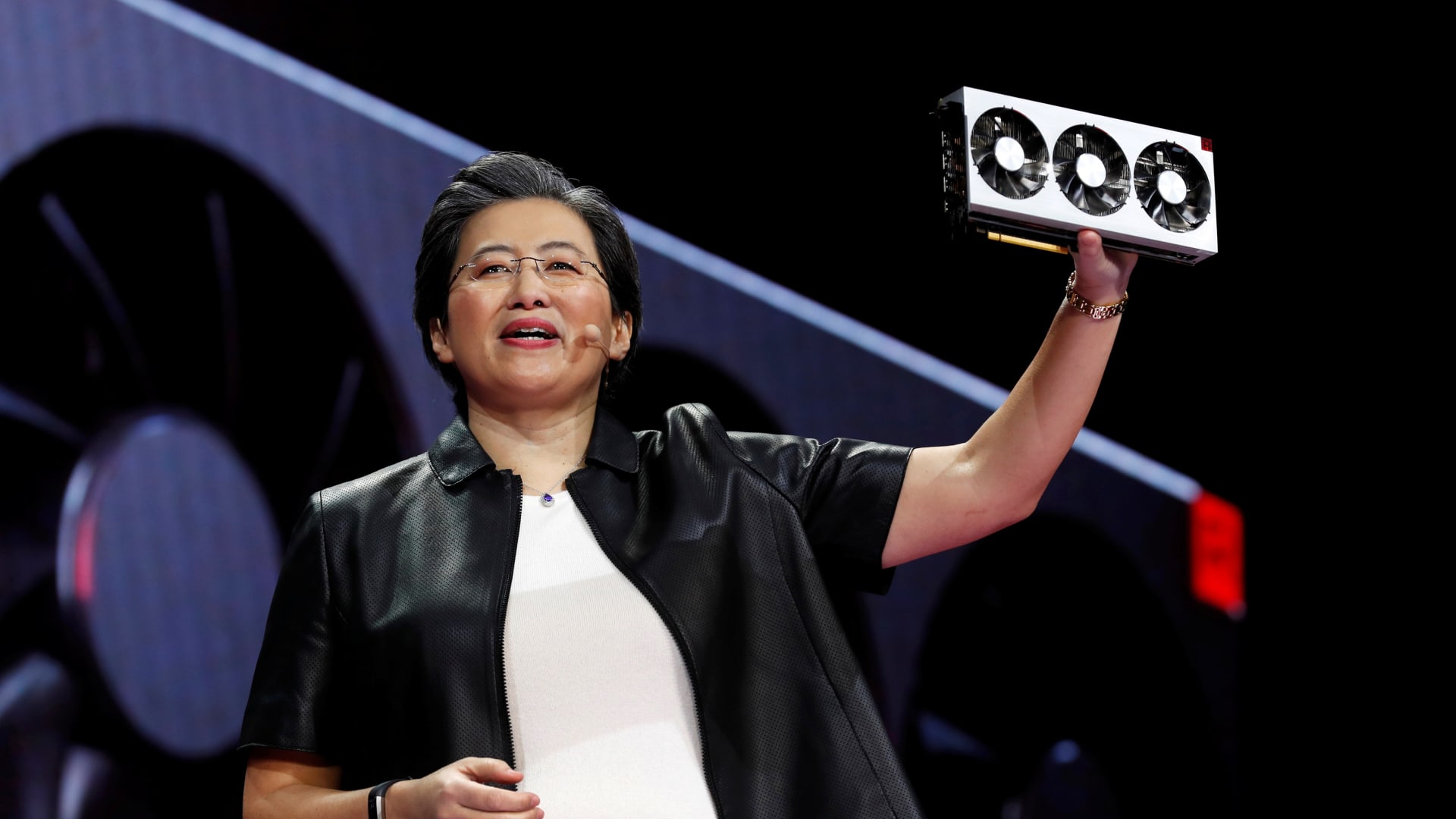

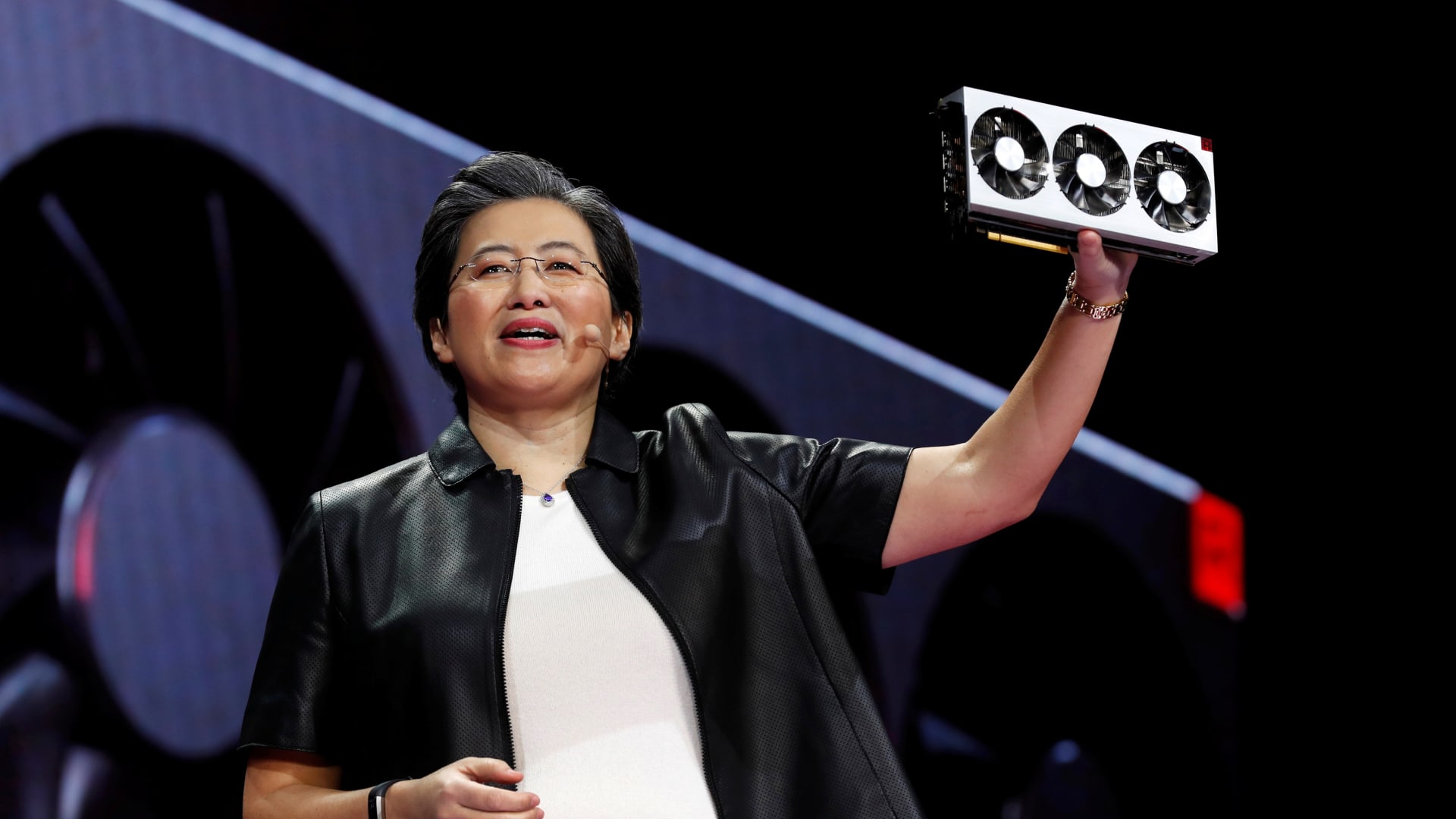

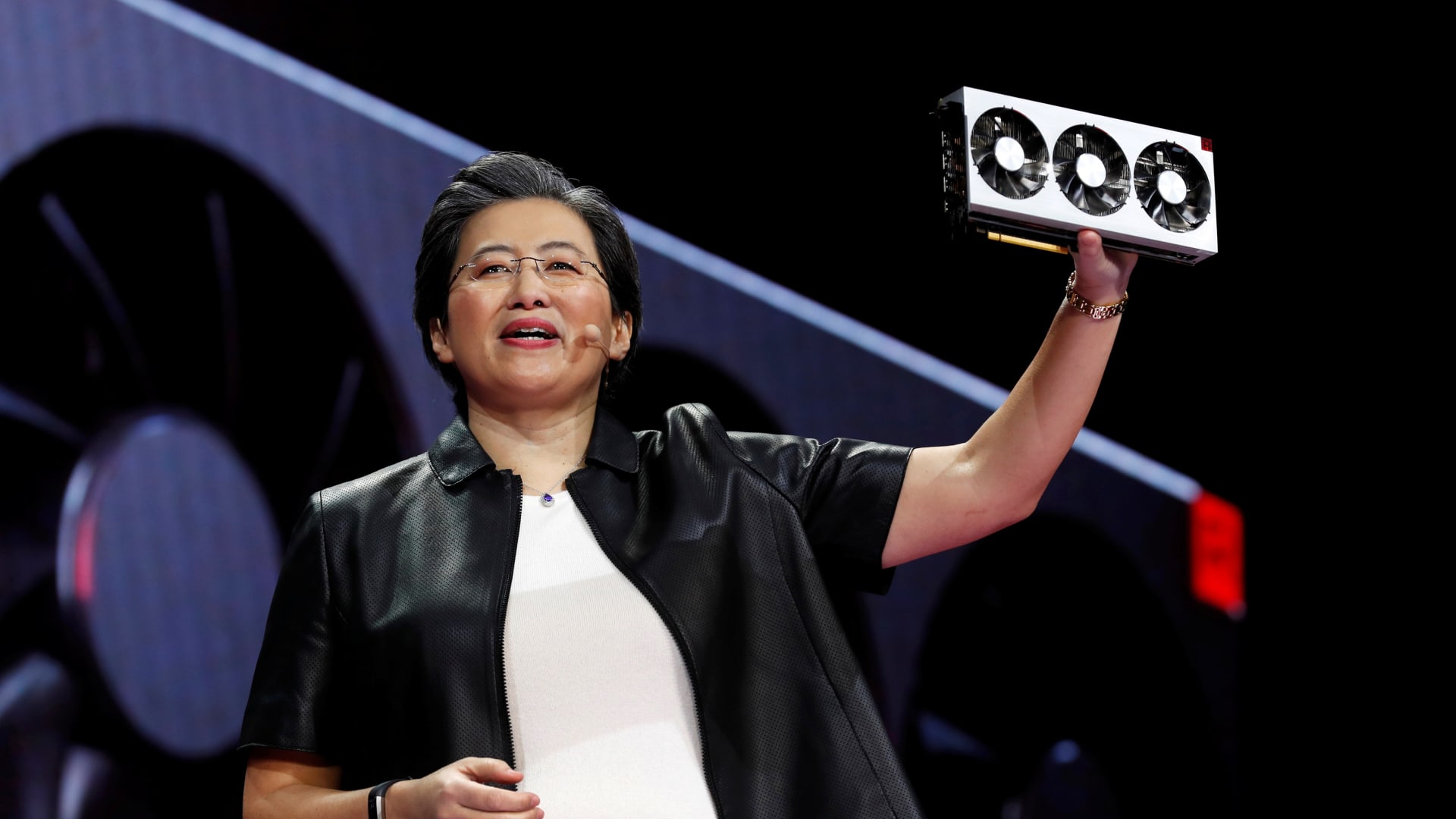

AMD

www.cnbc.com

www.cnbc.com

AMD shares fall as first-quarter forecast comes in light

AMD makes graphics processing units, or GPUs, which are needed to train and deploy generative artificial intelligence models.

Nothing wrong with that report. AMD and the two big boys all had strong results and guidance.AMD

AMD shares fall as first-quarter forecast comes in light

AMD makes graphics processing units, or GPUs, which are needed to train and deploy generative artificial intelligence models.www.cnbc.com

Yep, market cap only down about $100 billion in after hours. 🤣 But as big as that sounds, it’s minor compared to the recent run-up.GOOGL down a bit, but the report looks great. Can't complain:

Alphabet shares slide on disappointing Google ad revenue

Alphabet reported earnings after the bell. Here are the results.www.cnbc.com

I’ve been DCA’ing WOLF - definitely miscalculated the exposure to EVs/autos. I’m sticking with it long term and will buy more if it’s gets beat up on earnings.I've read WOLF has big exposure to EVs and autos, which is in a slump. Will this report be disappointing?

Down a $100 billion, up a $100 billion, not a big deal for one of the big boys! In other news, MSFT looks flat, which is fine. Their report justified the recent rally. Consolidate for a bit and then start running again.Yep, market cap only down about $100 billion in after hours. 🤣 But as big as that sounds, it’s minor compared to the recent run-up.

Walmart announces 3-for-1 stock split as shares hover below all-time high

Walmart's shares hit their all-time high last year.

At $150'ish, does it really need to split now?

Walmart announces 3-for-1 stock split as shares hover below all-time high

Walmart's shares hit their all-time high last year.www.cnbc.com

Others are saying the same thing I’ve been reading. I did read they did it as a way to reward there employees who participate in the stock purchase plan. I worked for them last time it split I believe around $90 something in 1999 I think. I’m Still holding my shares from thenAt $150'ish, does it really need to split now?

Yes, apparently it’s all about employees and the ability to take advantage of stock plans in terms of buying and selling. I will continue to DRIP Walmart in my IRA until I’m an old man and beyond. It’s a retail behemoth that appeals to everyone (rich, poor, people of all races, etc.).Others are saying the same thing I’ve been reading. I did read they did it as a way to reward there employees who participate in the stock purchase plan. I worked for them last time it split I believe around $90 something in 1999 I think. I’m Still holding my shares from then

I wonder if they want to keep the price "low" to maintain the walmart low price image.At $150'ish, does it really need to split now?

I just saw an article that managers can earn $400k without a college degree working at Walmart. Might include the stock options and Dam inflation.Others are saying the same thing I’ve been reading. I did read they did it as a way to reward there employees who participate in the stock purchase plan. I worked for them last time it split I believe around $90 something in 1999 I think. I’m Still holding my shares from then

Makes more sense than any other reason!I wonder if they want to keep the price "low" to maintain the walmart low price image.

You know, I'm not sure bank "issues" even matter anymore. Last March, the Fed, Treasury, and FDIC essentially established a new policy that depositors will never lose principle again in the US. Everything is covered.Regional Bank issues have returned:

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

Sure, it would suck to hold debt or stock in a bank having trouble, but it is the depositors that create runs. That risk is pretty much gone now.

You know, I'm not sure bank "issues" even matter anymore. Last March, the Fed, Treasury, and FDIC essentially established a new policy that depositors will never lose principle again in the US. Everything is covered.

Sure, it would suck to hold debt or stock in a bank having trouble, but it is the depositors that create runs. That risk is pretty much gone now.

Maybe, but how long can they do that? Seems like its a limited strategy to me.

SOFI has given up a significant portion of their upward move post earnings, but after bottoming in late 2022, the upward trend since looks solid, even if, as a $8b market cap company it can be pretty volatile.

A little pricey by bank standards, but continued rev growth in the 20% range helps support those valuations. This past qtr was it's first that was profitable, and 2024 it is expected to be it's first profitable year.

A little pricey by bank standards, but continued rev growth in the 20% range helps support those valuations. This past qtr was it's first that was profitable, and 2024 it is expected to be it's first profitable year.

Fed support, and some big bank swoops in and picks up the assets for a song.You know, I'm not sure bank "issues" even matter anymore. Last March, the Fed, Treasury, and FDIC essentially established a new policy that depositors will never lose principle again in the US. Everything is covered.

Sure, it would suck to hold debt or stock in a bank having trouble, but it is the depositors that create runs. That risk is pretty much gone now.

Could we see MS, GS or JPM buy up NYCB at some point?

Anecdotally, I have a friend who has worked in regional banking for 15-20 years. He was laid off and chose to sit out for almost two years while interviewing with the big four. He’d been through too many acquisitions, reorganizations, etc so he waited it out before landing with BOAFed support, and some big bank swoops in and picks up the assets for a song.

Could we see MS, GS or JPM buy up NYCB at some point?

They would love that! Big gets bigger. :)Fed support, and some big bank swoops in and picks up the assets for a song.

Could we see MS, GS or JPM buy up NYCB at some point?

UNH,

Basing in the $475-$550 range, rejected at $550 multiple times for 2 years.

Rev growth of about 8%. EPS growth of about 10-15% in the 2 year trailing-2 year fwd time frame.

Only 1.5% div, if it were higher I'd be quicker to jump in given it's been stuck in a range, but that div has seen excellent growth over the past 5 years.

Currently 21x PE which is about average over the last 10 years. Did trade significantly cheaper post GFC but that probably isn't very representative of where it should trade.

Basing in the $475-$550 range, rejected at $550 multiple times for 2 years.

Rev growth of about 8%. EPS growth of about 10-15% in the 2 year trailing-2 year fwd time frame.

Only 1.5% div, if it were higher I'd be quicker to jump in given it's been stuck in a range, but that div has seen excellent growth over the past 5 years.

Currently 21x PE which is about average over the last 10 years. Did trade significantly cheaper post GFC but that probably isn't very representative of where it should trade.

Last edited:

This is a beautiful buy the dip opportunity. Powell essentially foreshadowed a May cut, which is what the market was expecting anyway. Tom Lee will be issuing a report soon. He has been saying look for a 5-7% dip in Q1 and then off to the races. Get ready to buy, buy, buy!Rug pull.

Is the Fed today?

I have a little money. I should move some over from my no interest banking account.

Double beat for QCOM:

www.cnbc.com

www.cnbc.com

Qualcomm earnings beat estimates as smartphone chip sales suggest recovery

Under CEO Cristiano Amon, Qualcomm has been working to apply its chip technology to markets beyond smartphones.

BDX made its numbers and increased year end forecast. Because of MSFT and GOOG, I Sold most of BDX yesterday when up over 3 points and brought some after their earning announcement after the drop. Did the same for MSFT. Generally, I think stocks tend to peak before earning comes out and drop after earning especially when they are near their high.

Not always but often it depends on the momentum going into earnings.BDX made its numbers and increased year end forecast. Because of MSFT and GOOG, I Sold most of BDX yesterday when up over 3 points and brought some after their earning announcement after the drop. Did the same for MSFT. Generally, I think stocks tend to peak before earning comes out and drop after earning especially when they are near their high.

If it’s been riding high, there’s a decent chance for sell the news after the reports unless you get a big beat and more importantly very good guidance.

But then after some time, if fundamentals are good the stock can resume the trend.

Reverse can be said too. If something is way oversold and earnings aren’t as bad or some sliver of good news can be found in them, you can get a quick bounce. But there too if fundamentals overall haven’t turned positive enough then the same bad trend will likely follow.

I would think it about 65-75% drop after the news and the drop in lot a cases are significant, not worth keeping or you can buy after hours if you’re wrong. Just my experience.Not always but often it depends on the momentum going into earnings.

If it’s been riding high, there’s a decent chance for sell the news after the reports unless you get a big beat and more importantly very good guidance.

But then after some time, if fundamentals are good the stock can resume the trend.

Reverse can be said too. If something is way oversold and earnings aren’t as bad or some sliver of good news can be found in them, you can get a quick bounce. But there too if fundamentals overall haven’t turned positive enough then the same bad trend will likely follow.

$29-ish late today. Added a bit more just now.I’ve been DCA’ing WOLF - definitely miscalculated the exposure to EVs/autos. I’m sticking with it long term and will buy more if it’s gets beat up on earnings.

Amazon

www.cnbc.com

www.cnbc.com

Amazon earnings are out — here are the numbers

Amazon reported earnings after the bell. Here are the results.

Just bought after the close! You better be right. :)$29-ish late today. Added a bit more just now.

Bigger META news:

Meta is paying first-ever dividend, authorizes $50 billion buyback!

KABOOM!!!!! Spiked up 11%.

Similar threads

- Replies

- 10

- Views

- 7K

- Replies

- 18

- Views

- 923

- Replies

- 0

- Views

- 723

- Replies

- 34

- Views

- 2K

ADVERTISEMENT

ADVERTISEMENT