Regressive NJ policiesSenior citizens aren’t the ones that need help. Many are sitting on hundreds of thousands of dollars of assets not to mention SS income, perhaps pension income. It’s the working class dude making $20/hour at best at a warehouse raising a kid or two that needs some help. But as usual, everything the government does is backwards, especially in backwards NJ

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT: Property tax relief coming for those over 65

- Thread starter retired711

- Start date

- Status

- Not open for further replies.

Gramps can move to South Carolina if he wants to save $. If he wants to retire in NJ he needs to understand all the “benefits” he gets like access to NYC, AC, Philly, the shore, the great mountains of Sussex County where gramps can hike the trails ( after an hour drive) etc. This is kind of like reverse ageism.Senior citizens aren’t the ones that need help. Many are sitting on hundreds of thousands of dollars of assets not to mention SS income, perhaps pension income. It’s the working class dude making $20/hour at best at a warehouse raising a kid or two that needs some help. But as usual, everything the government does is backwards, especially in backwards NJ

If you are a public school teacher you cannot cash in your pension while working.I can take a lump sum with a 20 percent hit for taxes.

I have my ROTH IRA, traditional IRA, mutual funds, and I will have a matching program at my new school.

I have been debating if I keep the pension as just additional income with all the other funds I have (would be like 1500 a month when I retire) or take the lump sum out and roll it into other investments.

You have a restricted lump sum option when you retire but even that you can’t take the funds and invest them somewhere else.

If you quit teaching and remove yourself from the pension you can get that cash but staying in the pension is probably better unless you’re tier 5.

Senior citizens aren’t the ones that need help. Many are sitting on hundreds of thousands of dollars of assets not to mention SS income, perhaps pension income. It’s the working class dude making $20/hour at best at a warehouse raising a kid or two that needs some help. But as usual, everything the government does is backwards, especially in backwards NJ

Your fact situation assumes the seniors are all in Saddle River and the dude making $20./hr can even swing the down payment and the .mortgage. A lot of seniors may be sitting on hundreds of thousands, but may be home equity. You going to force them to move SC to tap into it? Want to lower the income limits to qualify? Fine. But this does not affect the "working class dude" buying in any way.

I've left public education for private school. So I have some options to play with.If you are a public school teacher you cannot cash in your pension while working.

You have a restricted lump sum option when you retire but even that you can’t take the funds and invest them somewhere else.

If you quit teaching and remove yourself from the pension you can get that cash but staying in the pension is probably better unless you’re tier 5.

I'm not tier 5, but I am vested.

My initial plan is leave my vested pension alone, dump money into my new matching plan, and continue to fund my other retirement options and just be diversified. I'm a long time from retirement though.

The legislature has just expanded the Senior Freeze program, which reimburses seniors for increases in property taxes over the "base year." The income limit used to be $100,000 -- it is now $150,000. The "base year" is the year of first eligibility, so I assume this means that seniors within the income limit will be reimbursed for future increases in property taxes. Note that this program and Stay New Jersey are conditioned on the state maintaining a specified level of surplus and on other requirements (I think full funding of state pensions is one of them.)The Governor and legislative leadership have reached agreement on a program to be called "Stay New Jersey." Those over 65 with incomes of $500,000 or less will receive an annual payment from the state of half their property taxes up to a limit of $6500 per year. I mention this because property taxes often come up in discussions on this board of why posters are planning to leave NJ upon retirement.https://nj.gov/governor/news/news/562023/approved/20230621a.shtml

Edit: the limit is $6500, not $6200 as I originally wrote.

God bless private schools.

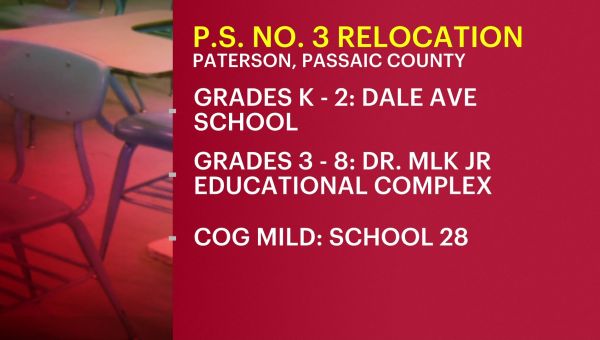

Paterson school closing due to safety concerns after ceiling collapse last month

Built in 1899, the Public School No. 3 building in Paterson is over 100 years old and "will need abatement in order to become usable again."

newjersey.news12.com

Higher taxes for those under 65 .

Murphynomics is a failure.

NJ has one of the strongest economies in America. Murphy is over 50% approval.

Cry more and move to a state with banned books and AP class, tons of violence and no freedom. You have your pick in the former Confederacy.

So strong people over 65 need tax relief.NJ has one of the strongest economies in America. Murphy is over 50% approval.

Cry more and move to a state with banned books and AP class, tons of violence and no freedom. You have your pick in the former Confederacy.

Who will pay the offset? People under 65.

Unlike @NotInRHouse, I sympathize with your position -- even though I, as a "senior" (I hate that word; are young people called "junior citizens?") will benefit. The only defense I can give is that the relief is contingent on the continuation of a large budget surplus here in New Jersey, and that, because the credit comes from the state, it will not cause increases in local property taxes. TBH, I think the surplus will not continue for very long, and so the program may be of limited duration.Higher taxes for those under 65 .

Murphynomics is a failure.

Isn't the state billions in the hole on pensions?Unlike @NotInRHouse, I sympathize with your position -- even though I, as a "senior" (I hate that word; are young people called "junior citizens?") will benefit. The only defense I can give is that the relief is contingent on the continuation of a large budget surplus here in New Jersey, and that, because the credit comes from the state, it will not cause increases in local property taxes. TBH, I think the surplus will not continue for very long, and so the program may be of limited duration.

Any surplus is probably creative accounting.

The state claims to now be making the contribution called for by its actuaries. That is supposed to continue. The size of the hole depends on how the stock market does.Isn't the state billions in the hole on pensions?

Any surplus is probably creative accounting.

There is indeed a "funny money" component to the surplus. The Covid aid packages gave Federal money to the states to make up for a predicted drop in state tax revenues due to Covid. But the states did just fine, and now have money to spare. I doubt that will continue.

Unlike @NotInRHouse, I sympathize with your position -- even though I, as a "senior" (I hate that word; are young people called "junior citizens?") will benefit. The only defense I can give is that the relief is contingent on the continuation of a large budget surplus here in New Jersey, and that, because the credit comes from the state, it will not cause increases in local property taxes. TBH, I think the surplus will not continue for very long, and so the program may be of limited duration.

As you know I'm far south of 65, but also realize most people over 65 don't work. Or at least shouldn't be.

You're right . . .but an increasing number of Americans over 65 work. In 2000, less than a quarter of those over 65 worked; now it's over a third. At the same time, the percentage over 16-19 years who work has declined. Those over 65 are actually more likely to have jobs than those aged 16-19. https://www.minneapolisfed.org/arti..., that was,artifact happening at the extremes.As you know I'm far south of 65, but also realize most people over 65 don't work. Or at least shouldn't be.

The state claims to now be making the contribution called for by its actuaries. That is supposed to continue. The size of the hole depends on how the stock market does.

There is indeed a "funny money" component to the surplus. The Covid aid packages gave Federal money to the states to make up for a predicted drop in state tax revenues due to Covid. But the states did just fine, and now have money to spare. I doubt that will continue.

The old joke about chemist, lawyer and the actuary. Someone asked each how 1+1 is. The chemist said 2. The lawyer said generally 2 except for a statute in Humbolt Cty California making it pi when Venus is raising in Sagittarius. The actuary leaned forward and in a quiet voice said "how much do you want it to be?"

I think the point of $500K was to keep these taxpayers in the state.It's a good idea, but people making 500K a year certainly don't need property tax relief. I would have set it at 150K and lower.

I believe the idea in part is to keep high earning taxpayers in the state to remain in NJ.It's a good idea, but people making 500K a year certainly don't need property tax relief. I would have set it at 150K and lower.

The NJ Tax Rate for a 65+ $500,000. income joint return is approximately $28,000.

This would qualify for a $6,500, Property Tax rebate.

Each 65+ person with $500,000 income that leaves the state would decrease the state income tax receipts.

I assume the decision is to keep 65+ high earners in the state (and give them a property rebate) is to financially subsidize the 65+ property tax rebate plan for lower income earners that are retired.

Is there going to be an anchor program payment this year? 2024?One source of the money is going to be unspent federal Covid-19 stimulus funds. So taxpayers all over the nation are paying for New Jerseyans to have this program.

I should add that NJ Anchor program will stay in place for the next couple of years; the benefit level will be increased over this last year to a range of $1250 to $1750.

Yes, the Anchor program will remain in place under the state budget just signed into law by the Governor. Skip the quotes and go to the paragraph under the subheading "increasing affordability." BTW, if you look further down, it appears that there was a substantial increase in funding for higher education, including four year schools like Rutgers.Is there going to be an anchor program payment this year? 2024?

https://nj.gov/governor/news/news/562024/approved/20240628b.shtml

The logic of simple addition and subtraction is amazing, right?Where is the money coming from? Presumably other taxpayers will pick up the tab.

At the end of the day, spending and taxing are the same things. Without spending cuts there are no tax cuts.

I hope more of the American public catches onto this simple reasoning whenever any group at the national, state, or local level claims to be the great tax cut champions…without changing spending at all to further mortgage the future of our kids that none of us will see.

YepThe poor baby boomers. They had it so hard. Guess you are all for social security too.

Boomers still getting bailed out by the wealth their parents accumulated.

Smaller families, families with 2 working parents, larger inheritances (financial & retirement assets, property) for survivors.

From what I have seen, boomers with their own earned monies are bailing out their childrenYep

Boomers still getting bailed out by the wealth their parents accumulated.

Many younger people that are buying houses these days are using parent money.From what I have seen, boomers with their own earned monies are bailing out their children

As a senior I am for social security, because the government made me pay into it for numerous decadesThe poor baby boomers. They had it so hard. Guess you are all for social security too.

Do you expect seniors to be against it? , if so, don't make us pay into it In the first place

Exactly, that hits very close to home for meMany younger people that are buying houses these days are using parent money.

There is some sort of opinion that boomers are greedy

and sucking,off the system

That goes completely opposite of what I have experienced

and seen with people I know

SS should be optional. Could have done so much more with that money.As a senior I am for social security, because the government made me pay into it for numerous decades

Do you expect seniors to be against it? , if so, don't make us pay into it In the first place

There's been financial research over the past few years that show Boomers are not spending as expected. The generation acquired unprecedented wealth, but are essentially "afraid" to spend and run out of it. This underspend means more money going to the kids.Exactly, that hits very close to home for me

There is some sort of opinion that boomers are greedy

and sucking,off the system

That goes completely opposite of what I have experienced

and seen with people I know

Last edited:

As a senior I am for social security, because the government made me pay into it for numerous and decades

Do you expect seniors to be against it? , if so, don't make us pay into it In the first place

I've paid in for 56 years and continue to pay in now that I'm receiving benefits. I'm supposed to get nothing? To those who say no "screw you!!"

Yes that too.From what I have seen, boomers with their own earned monies are bailing out their children

I friggin wish I were one of those younger people.Many younger people that are buying houses these days are using parent money.

It should be an option as it was intended.SS should be optional. Could have done so much more with that money.

One safety net in a network.

The complaint is that we might get more out than we put inI've paid in for 56 years and continue to pay in now that I'm receiving benefits. I'm supposed to get nothing? To those who say no "screw you!!"

I understand that complaint, but you don't go back on a promise and a plan

What you do is tweak the system going forward for those not retired yet

You have to figure in inflation. SS wasn’t an investment, it is mandatory. And like many others, I’m going to be 50+ years in.The complaint is that we might get more out than we put in

I understand that complaint, but you don't go back on a promise and a plan

What you do is tweak the system going forward for those not retired yet

And some entitled punk, earlier said AB’s had it easy?

I bet he will only work remote and wants his job to be ok with a side gig on their time…

The complaint is that we might get more out than we put in

I understand that complaint, but you don't go back on a promise and a plan

What you do is tweak the system going forward for those not retired yet

My full benefits started a year later than my parent's. My younger sister's benefits will start 6 months later than mine.

Get more than I put in? You think the pittance (matched by the employer) working over Christmas vacation 1968 should merely be returned?

The people that got a real break were our grandparents or great grandparents generation when SS was indexed for inflation in the 70s and the amount subject to withholding fell way short. The system would have gone bankrupt in the 80s before Reagan and O'Neill bought us a generation except for the fact that most of those evil Boomers were working and paying in.

If you want to really dig into it the system had been woefully mismanaged for the last 75 years by both parties. A majority the individuals responsible are long gone. But the flavor of the week (or decade) is to blame the boomers

It’s funny- us boomers worked 60 hrs a week to spoil our millennial and whatever this next group of kids are. And they are blaming us for something- maybe they needed us to kick their asses like our parents did to us.My full benefits started a year later than my parent's. My younger sister's benefits will start 6 months later than mine.

Get more than I put in? You think the pittance (matched by the employer) working over Christmas vacation 1968 should merely be returned?

The people that got a real break were our grandparents or great grandparents generation when SS was indexed for inflation in the 70s and the amount subject to withholding fell way short. The system would have gone bankrupt in the 80s before Reagan and O'Neill bought us a generation except for the fact that most of those evil Boomers were working and paying in.

If you want to really dig into it the system had been woefully mismanaged for the last 75 years by both parties. A majority the individuals responsible are long gone. But the flavor of the week (or decade) is to blame the boomers

And I can’t imagine what the next group is going to say about them, oh wait, is “them” allowed? Lol

Boomers = worst parents everIt’s funny- us boomers worked 60 hrs a week to spoil our millennial and whatever this next group of kids are. And they are blaming us for something- maybe they needed us to kick their asses like our parents did to us.

And I can’t imagine what the next group is going to say about them, oh wait, is “them” allowed? Lol

Discuss! :)

Apparently, your math skills stopped at first grade.The SPIKING OF TEACHER SHORTAGES IS RELATIVELY NEW!!!! That’s the correlation! That’s the common denominator! Come on now, I know I’m not the only Rutgers Grad on this board, let’s use our critical thinking skills together, parants bitching at school board meetings and taking them over spiking in the last few years, simultaneously teacher shortages have spiked over the SAME TIME PERIOD. Now let’s put one and one together…

Covid does not explain why there are so many less college students pursuing the career. How does Covid still effect the HS Senior discussing their major now choosing something other that education?

Two things:

The severe loss of state aid in many suburban districts is certainly not going to help the teacher shortage.

Toms River Regional has lost so many staff members. Jackson as well.

Two of my daughters are teachers. Their main complaint is having to be social worker as well as teacher while having little authority re discipline. Kids who have no respect are not removed from the classrooms. This disrupts the ability of the good kids to learn.

The severe loss of state aid in many suburban districts is certainly not going to help the teacher shortage.

Toms River Regional has lost so many staff members. Jackson as well.

Two of my daughters are teachers. Their main complaint is having to be social worker as well as teacher while having little authority re discipline. Kids who have no respect are not removed from the classrooms. This disrupts the ability of the good kids to learn.

- Status

- Not open for further replies.

Similar threads

- Replies

- 29

- Views

- 1K

- Replies

- 138

- Views

- 7K

- Replies

- 28

- Views

- 2K

ADVERTISEMENT

ADVERTISEMENT