Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High School

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT: Stock and Investment Talk

- Thread starter RU-05

- Start date

True.

The current EV battery market is supplied by LG, CATL, and Panasonic. If everyone is using the same cells, why is Tesla's battery technology and efficiency superior? What the "competitors" lack are the big engineering brains of Tesla. Huge overlooked advantage. And once again, that lead continues to grow.

Where do the best engineers want to work?

And what happens when Tesla starts using their own cells which are superior in range, energy density, power, charging speed, and cost compared to the 3 current suppliers? Which of the "competitors" are making their own cells? None. Which of the "competitors" have plans to make their own cells? None.

Right, the competition is coming.

If you haven’t already, I’d suggest reading up on the Chinese company BYD. It’s a stock I’ve owned for a little over 10 years, run by an incredibly intelligent man who employs a literal army of engineers from many of the top schools in China.

Last edited:

I think you get a discount if you pay with Bitcoin! :)Speaking of EVs, I’m looking at a 2 stage snowblower. Only 2 on the market and zero in stock. The biggest con is price. 45% prem.

Would love to see the reaction at Ace Hardware when I offer to pay in Bitcoins.I think you get a discount if you pay with Bitcoin! :)

Coinbase has terrible reviews on the app store. Lots of complaints about hidden fees and zero customer service. I'm looking elsewhere

I had a ton of issues with coinbase and landed on Gemini. Theyre not great, but theyre the best insured of the major exchanges and allow you to take self custodyof your coins....

...something that PayPal does not allow. setting up an account on gemini is not real hard.Is it worth “buying” bitcoin on PayPal (custodian)?

I want exposure to Bitcoin but don’t want to go through the trouble of opening accounts and personally storing coins.

If you just want exposure, go with gbtc, but you'll be paying a premium when you don't need to. Purchasing small amounts of btc is super simple.

if you can't purchase gbtc, purchase microstrategy stock, as about 600 mill of their cash reserves are held in btc

Just know that you're unnecessarily paying extra fees by buying via trusts.80% of my crypto portfolio is the coin (BTC and ETH) and I'm buying the dips (via the trusts :) ). I'm also looking for some low priced bolt-on support companies. Those can 10-20x more quickly than the coin. Swinging for the fences!

I'll check out the video. Happy to keep learning.

I keep hearing about MicroStrategy and Galaxy Digital Holdings. Any details on these companies? I believe MS is a data analytics company.I had a ton of issues with coinbase and landed on Gemini. Theyre not great, but theyre the best insured of the major exchanges and allow you to take self custodyof your coins....

...something that PayPal does not allow. setting up an account there is not real hard.

If you just want exposure, go with gbtc, but you'll be paying a premium when you don't need to. Purchasing small amounts of btc is super simple.

if you can't purchase gbtc, purchase microstrategy stock, as about 600 mill of their cash reserves are held in btc

I know, but as a super novice, it's worth the 2% fees for the convenience and security.Just know that you're unnecessarily paying extra fees by buying via trusts.

Amzn makes majority of their revenue from AWS and not retail. So comparing them to WMT is not exactly jus my based on retail. Amazon is much more diverse as a company.

that is the argument with TSLa as well. They are not just a car company

that is the argument with TSLa as well. They are not just a car company

I keep hearing about MicroStrategy and Galaxy Digital Holdings. Any details on these companies? I believe MS is a data analytics company.

The video I embedded on the last page is from the ceo of microstrategy. Give it a listenif you have a free hour

I was a new to this in 2020. I was the same way. It took me watching a friend buy $10 worth of bitcoin on the gemini app for me to have that holy shit this is easy moment.I know, but as a super novice, it's worth the 2% fees for the convenience and security.

If the events of this month have showed us anything its that our system is unstable. From the capital to gme, its crazy to see two historical events like this happen in a span of a month. So for me, having the ability to take self custody of my crypto is officially a must.

Seriously, nothing seems outside the realm of possibility anymore, which is both exciting... and frightening af.

Will watch it tonight after the little one goes to bed. I'm learning more about Galaxy Holding as well. Big thanks for all the help and info over the past several months!The video I embedded on the last page is from the ceo of microstrategy. Give it a listenif you have a free hour

I was a new to this in 2020. I was the same way. It took me watching a friend buy $10 worth of bitcoin on the gemini app for me to have that holy shit this is easy moment.

If the events of this month have showed us anything its that our system is unstable. From the capital to gme, its crazy to see two historical events like this happen in a span of a month. So for me, having the ability to take self custody of my crypto is officially a must.

Seriously, nothing seems outside the realm of possibility anymore, which is both exciting... and frightening af.

Currently the premium for GBTC is as low as it may ever get, as detailed in the article below. When compared to the fees charged by Coinbase, Square and Paypal (all around 1.5% for purchases over $1000), not a significant difference. This may be the lowest the premiums will ever be, at least until the OBTC ETF opens up (their fees are supposed to be 0.49%).Just know that you're unnecessarily paying extra fees by buying via trusts.

GBTC: Bitcoin For Boomers And Retirees (OTCMKTS:GBTC)

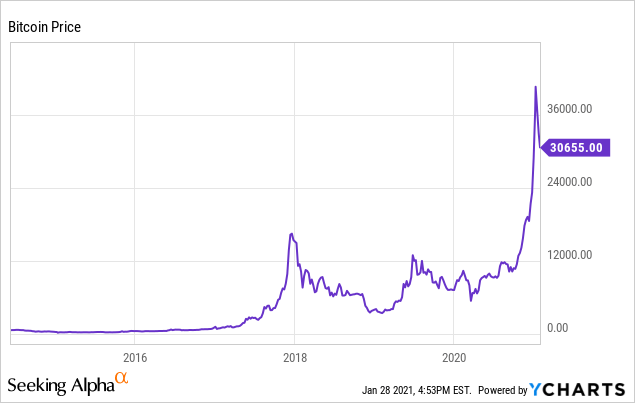

First, I'm going to very quickly discuss the price of Bitcoin. Second, I'm going to briefly showcase some price models. Third, I'm going to discuss Grayscale Bitcoin Trust (GBTC).

One of my rollover IRA accounts is managed by a firm that I've been using for years. Just noticed that they readjusted that portfolio and added almost 2% GBTC to it. Very interesting, especially if you extrapolate to money managers, retirement plans across the country.

Cathie Wood from ARK recently recommended that all investment accounts (and institutions) should hold 2.55% to 6.55% of BTC/GBTC based on the nature of the account.One of my rollover IRA accounts is managed by a firm that I've been using for years. Just noticed that they readjusted that portfolio and added almost 2% GBTC to it. Very interesting, especially if you extrapolate to money managers, retirement plans across the country.

Please see my post earlier. A lot of incorrect info here. Biggest one is TSLA is not just a car company. Feel free to prove me wrong by showing me how diverse is their revenue income.Amzn makes majority of their revenue from AWS and not retail. So comparing them to WMT is not exactly jus my based on retail. Amazon is much more diverse as a company.

that is the argument with TSLa as well. They are not just a car company

She got the pump part down. The dump part will come.Cathie Wood from ARK recently recommended that all investment accounts (and institutions) should hold 2.55% to 6.55% of BTC/GBTC based on the nature of the account.

AMC/GME TO THE MOON! Buy one stock of each and hold it until the day you die... It'll cost you about $350 at this point to be a part of the single greatest F*ckover in History.

I'm seeing many people comment about how the redditors are going to lose their rears... You are missing the point. This isn't about making money. This is about getting back to the a**holes on wallstreet who in 2008 f*cked over all of us and got baile out by the Gov't. GME by itself if people hold could cost the Hedge's over $100 BILLION! I got HARD writing that.

Get on the train, we're taking this baby TO THE MOON!

I'm seeing many people comment about how the redditors are going to lose their rears... You are missing the point. This isn't about making money. This is about getting back to the a**holes on wallstreet who in 2008 f*cked over all of us and got baile out by the Gov't. GME by itself if people hold could cost the Hedge's over $100 BILLION! I got HARD writing that.

Get on the train, we're taking this baby TO THE MOON!

You forgot BBNY, KOSS, NOK, BB. To the moon.AMC/GME TO THE MOON! Buy one stock of each and hold it until the day you die... It'll cost you about $350 at this point to be a part of the single greatest F*ckover in History.

I'm seeing many people comment about how the redditors are going to lose their rears... You are missing the point. This isn't about making money. This is about getting back to the a**holes on wallstreet who in 2008 f*cked over all of us and got baile out by the Gov't. GME by itself if people hold could cost the Hedge's over $100 BILLION! I got HARD writing that.

Get on the train, we're taking this baby TO THE MOON!

It seems there are many people in this thread relatively new to investing. As such, I think it’s a good idea to post this now rather old (can’t believe that’s the case) speech given by Warren Buffett in 1999 at Deer Valley. The room was full of executives, including a number of founders and leaders of new technology companies. The entire speech is well worth reading, but in particular I think the final portion regarding investor returns in emerging industries that transform society is thought provoking.

Although I agree that there shouldn't have been a stop on the little guys (retail investors) from buying these stocks, you're wrong if you think you're screwing the Wall Street guys. Yes, some individual billionaires will lose money but the spillover to selling positions to cover their losses will hurt thousands or maybe millions of little guys whose pensions, 401k's and IRA's will lose money because of these selloffs.AMC/GME TO THE MOON! Buy one stock of each and hold it until the day you die... It'll cost you about $350 at this point to be a part of the single greatest F*ckover in History.

I'm seeing many people comment about how the redditors are going to lose their rears... You are missing the point. This isn't about making money. This is about getting back to the a**holes on wallstreet who in 2008 f*cked over all of us and got baile out by the Gov't. GME by itself if people hold could cost the Hedge's over $100 BILLION! I got HARD writing that.

Get on the train, we're taking this baby TO THE MOON!

The little guys outsmarted the big guys who took on too much risk. Good for all of you. When the squeeze is over, some little guys are gonna get hurt too. So yeah, you and others feel free to keep buying, I'm all for freedom of choice when it comes to your money, but losing your money to screw The Man isn't gonna break him. Hopefully though, it'll change the rules on short selling such as shorting more than the available float of stock at the very least.

Well you see what' also happening is it's creating a drop in the market and making stocks that we know will rebound more affordable. But more than that those who have cashed out have some of the most amazing things they are doing with the money. Paying off student loans, donating Millions to St. Jude. Best one I saw was a guy sold his Gamestop Stock and went to his local gamestop and spent his earning on their entire stock of Nintendo Switches that he donated to his local Hospital...Although I agree that there shouldn't have been a stop on the little guys (retail investors) from buying these stocks, you're wrong if you think you're screwing the Wall Street guys. Yes, some individual billionaires will lose money but the spillover to selling positions to cover their losses will hurt thousands or maybe millions of little guys whose pensions, 401k's and IRA's will lose money because of these selloffs.

The little guys outsmarted the big guys who took on too much risk. Good for all of you. When the squeeze is over, some little guys are gonna get hurt too. So yeah, you and others feel free to keep buying, I'm all for freedom of choice when it comes to your money, but losing your money to screw The Man isn't gonna break him. Hopefully though, it'll change the rules on short selling such as shorting more than the available float of stock at the very least.

You are completely missing the point. This isn't about making money. I don't care whatsoever if both stocks go to Zero, neither do the redditors who are feuling this. And with all due respect a potential $100 Billion loss to Hedge funds would absolutely bankrupt multiple Investment firms who signed up for Shorts, F*ck them! F*ck the assholes who ruined the market in 2008 and got bailed out while we were left holding the bag. Every dollar a hedge loses from this short an angel gets its wings...

Thanks for the link, this quote popped:It seems there are many people in this thread relatively new to investing. As such, I think it’s a good idea to post this now rather old (can’t believe that’s the case) speech given by Warren Buffett in 1999 at Deer Valley. The room was full of executives, including a number of founders and leaders of new technology companies. The entire speech is well worth reading, but in particular I think the final portion regarding investor returns in emerging industries that transform society is thought provoking.

"I won't dwell on other glamorous businesses that dramatically changed our lives but concurrently failed to deliver rewards to U.S. investors: the manufacture of radios and televisions, for example. But I will draw a lesson from these businesses: The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage. The products or services that have wide, sustainable moats around them are the ones that deliver rewards to investors."

You don't get it. Whose money is in those investment firms that you want to "f**k? Could be your retirement fund, may be your parent's money. Do you think all those on Reddit are doing this just to screw Wall Street? A bunch of them are in it just to make money (full disclosure, I went in and out 2 days ago on NAKD and made a few bucks) and the last ones holding when its all over will be screwed too. Did they ruin the market in 2008? Are they gonna be bailed out? To repeat, I'm not against anyone piling on a short squeeze, its perfectly legal and should not be curtailed for the benefit of one side. I'm just hoping everyone goes with their eyes wide open and that short selling rules are changed to prevent such one sided fiascos that ultimately will hurt little guys on both sides of the trade. The big guys will always make a comeback.Well you see what' also happening is it's creating a drop in the market and making stocks that we know will rebound more affordable. But more than that those who have cashed out have some of the most amazing things they are doing with the money. Paying off student loans, donating Millions to St. Jude. Best one I saw was a guy sold his Gamestop Stock and went to his local gamestop and spent his earning on their entire stock of Nintendo Switches that he donated to his local Hospital...

You are completely missing the point. This isn't about making money. I don't care whatsoever if both stocks go to Zero, neither do the redditors who are feuling this. And with all due respect a potential $100 Billion loss to Hedge funds would absolutely bankrupt multiple Investment firms who signed up for Shorts, F*ck them! F*ck the assholes who ruined the market in 2008 and got bailed out while we were left holding the bag. Every dollar a hedge loses from this short an angel gets its wings...

One other thing. the short squeeze isn't necessary to make stocks drop and "more affordable". Stocks always go through up and down cycles for buying opportunities. The sudden drops/crashes also hurt the little guys who panic and sell. Your thought process on that point is pretzel logic.Well you see what' also happening is it's creating a drop in the market and making stocks that we know will rebound more affordable. But more than that those who have cashed out have some of the most amazing things they are doing with the money. Paying off student loans, donating Millions to St. Jude. Best one I saw was a guy sold his Gamestop Stock and went to his local gamestop and spent his earning on their entire stock of Nintendo Switches that he donated to his local Hospital...

You are completely missing the point. This isn't about making money. I don't care whatsoever if both stocks go to Zero, neither do the redditors who are feuling this. And with all due respect a potential $100 Billion loss to Hedge funds would absolutely bankrupt multiple Investment firms who signed up for Shorts, F*ck them! F*ck the assholes who ruined the market in 2008 and got bailed out while we were left holding the bag. Every dollar a hedge loses from this short an angel gets its wings...

Well you see what' also happening is it's creating a drop in the market and making stocks that we know will rebound more affordable. But more than that those who have cashed out have some of the most amazing things they are doing with the money. Paying off student loans, donating Millions to St. Jude. Best one I saw was a guy sold his Gamestop Stock and went to his local gamestop and spent his earning on their entire stock of Nintendo Switches that he donated to his local Hospital...

You are completely missing the point. This isn't about making money. I don't care whatsoever if both stocks go to Zero, neither do the redditors who are feuling this. And with all due respect a potential $100 Billion loss to Hedge funds would absolutely bankrupt multiple Investment firms who signed up for Shorts, F*ck them! F*ck the assholes who ruined the market in 2008 and got bailed out while we were left holding the bag. Every dollar a hedge loses from this short an angel gets its wings...

I’ll offer a few thought to consider if you’re intention is to, in essence, exact revenge on parties responsible for the great financial crisis of 09.

Recall that the issue that caused the crisis, and one that tends to recur with financial crises, was the use of leverage to increase the returns generated by seemingly safe assets. Mortgages were considered to be that super secure asset, because the prevailing wisdom at the time was home prices have never and would never, decline on a nationwide basis. So, to juice the yield, leverage was applied generously through a variety of mechanisms including the ultimate form through complex derivatives. The institutions needing capital were not hedge funds, but large financial institutions who owned assets that turned out to be unsafe and had lots of debt against them to boot. See Lehman. And fwiw, stockholders of Lehman saw their investments go to zero.

Point is this. If you really want to exact revenge against guilty parties from 2008, you’re focused on the wrong folks. You’re effort is better spent backing Elizabeth Warren and Sherrod Brown. legislation and regulation they advocate would put a hurt on those you want to penalize. Going long GME isn’t really hurting anyone that you’d like to hurt. So, maybe make sure you take some profits, particularly if they really can make a difference to you, and Either donate to politicians who are like minded or invest your time to support them and their proposals.

You don't get it. Whose money is in those investment firms that you want to "f**k? Could be your retirement fund, may be your parent's money. Do you think all those on Reddit are doing this just to screw Wall Street? A bunch of them are in it just to make money (full disclosure, I went in and out 2 days ago on NAKD and made a few bucks) and the last ones holding when its all over will be screwed too. Did they ruin the market in 2008? Are they gonna be bailed out? To repeat, I'm not against anyone piling on a short squeeze, its perfectly legal and should not be curtailed for the benefit of one side. I'm just hoping everyone goes with their eyes wide open and that short selling rules are changed to prevent such one sided fiascos that ultimately will hurt little guys on both sides of the trade. The big guys will always make a comeback.

See here’s the other part... this is being fueled by Gen z and millennials, to quote what you will find from the now almost 7 million subs on WallStreetBets are people 18-45 who mostly own less than 5 total shares who do not give a hoot about ‘boomers’ retirements. Just being honest. Not saying I necessarily agree with that point but I’m 31, my parents are fine, I’m quite happily with my portfolio and it’s performance which have nothing to do with gme or amc. Eventually the market will rebound, always does, but for now with each passing day we are costing the hedges potentially BILLIONS of dollars every day. Bunch of apes on that page, proud apes with diamond hands who are in this for the greater good.

See here’s the other part... this is being fueled by Gen z and millennials, to quote what you will find from the now almost 7 million subs on WallStreetBets are people 18-45 who mostly own less than 5 total shares who do not give a hoot about ‘boomers’ retirements. Just being honest. Not saying I necessarily agree with that point but I’m 31, my parents are fine, I’m quite happily with my portfolio and it’s performance which have nothing to do with gme or amc. Eventually the market will rebound, always does, but for now with each passing day we are costing the hedges potentially BILLIONS of dollars every day. Bunch of apes on that page, proud apes with diamond hands who are in this for the greater good.

You’ll have to explain how these altruistic “proud apes” are in it for the greater good yet don’t give a hoot about older people’s secure retirement.

Beat me to it.You’ll have to explain how these altruistic “proud apes” are in it for the greater good yet don’t give a hoot about older people’s secure retirement.

Buy one stock of each? Lol. May as well go all the way and call them stonks.AMC/GME TO THE MOON! Buy one stock of each and hold it until the day you die... It'll cost you about $350 at this point to be a part of the single greatest F*ckover in History.

I'm seeing many people comment about how the redditors are going to lose their rears... You are missing the point. This isn't about making money. This is about getting back to the a**holes on wallstreet who in 2008 f*cked over all of us and got baile out by the Gov't. GME by itself if people hold could cost the Hedge's over $100 BILLION! I got HARD writing that.

Get on the train, we're taking this baby TO THE MOON!

You’re really gonna crap on VW’s numbers? They sold over 9M vehicles which last time I counted was about 8.5M more than Tesla. They sold over 200K EVs with little or no effort. They have over 70 EV models hitting the market in the next 5 years. And, if you think that Joe Farmer in Des Moines, IA is gonna buy a Tesla over GM or Ford once they ramp up EVs you are living in Lala-land. I don’t know the exact number, but close to 50% of all Tesla’s are sold in CA. Yeah, sounds like a car worshipped by the masses.Come on, be serious. VW plans on producing 1.5 million vehicles by 2025. Tesla will do that in 2022. That's a shrinking lead? Wanna guess what Tesla's 2025 numbers will be?

Missed deliveries? By 50 vehicles? During a global pandemic with 2 factory shutdowns?

You're a clown 🤡

You’ll have to explain how these altruistic “proud apes” are in it for the greater good yet don’t give a hoot about older people’s secure retirement.

We are talking about hedge funds here, are we not? We aren't talking the nj teachers union 401k plan.

And I'll lob that question back at you...

Did john Paulson or goldman give 2 damns when they tranched up the lowest grade mortgages they could into MBS and then created a synthetic CDO based on it? Did they give a crap about the retirees of this country?

The funds gotta swallow this bitter pill. Anything short of that and the lessons dont get learned.

We are talking about hedge funds here, are we not? We aren't talking the nj teachers union 401k plan.

And I'll lob that question back at you...

Did john Paulson or goldman give 2 damns when they tranched up the lowest grade mortgages they could into MBS and then created a synthetic CDO based on it? Did they give a crap about the retirees of this country?

The funds gotta swallow this bitter pill. Anything short of that and the lessons dont get learned.

Many of the limited partners in hedge funds are pension and retirement plans. Not 401k, but that’s not the point. So, yeah, you actually are talking about the retirement plans for the benefit of individuals.

John Paulson never “tranched up” subprime mortgages, nor did he create synthetic CDOs. He did bet that the underlying credit quality of subprime mortgages would deteriorate, and he was right. Goldman is not a hedge fund.

Further, I was responding to another poster who specifically said those on WSB don’t care about the retirement accounts of older people. That poster also stated these same WSB members were interested in the greater good.

Seems lots of people are angry. They just don’t know who to be angry with.

Many of the limited partners in hedge funds are pension and retirement plans. Not 401k, but that’s not the point. So, yeah, you actually are talking about the retirement plans for the benefit of individuals.

John Paulson never “tranched up” subprime mortgages, nor did he create synthetic CDOs. He did bet that the underlying credit quality of subprime mortgages would deteriorate, and he was right. Goldman is not a hedge fund.

Seems lots of people are angry. They just don’t know who to be angry with.

Paulson created Abacus. Did he not?

Paulson created Abacus. Did he not?

No. That was created by Goldman.

Cmon man. Cmon. Don't be obtuse. They created it bc Paulson came to them with the idea. That was Paulsons hedge fund that led to Abacus in the first place.No. That was created by Goldman.

And they all settled. Of course.

Goldman Sachs, Paulson settle fraud lawsuit over Abacus

Goldman Sachs Group Inc <GS.N> has settled a 2011 lawsuit claiming the investment bank fraudulently induced a bond insurer to guarantee payments on the doomed Abacus collateralized debt obligation ahead of the financial crisis.

Cmon man. Cmon. Don't be obtuse. They created it bc Paulson came to them with the idea. That was Paulsons hedge fund that led to Abacus in the first place.

And they all settled. Of course.

Goldman Sachs, Paulson settle fraud lawsuit over Abacus

Goldman Sachs Group Inc <GS.N> has settled a 2011 lawsuit claiming the investment bank fraudulently induced a bond insurer to guarantee payments on the doomed Abacus collateralized debt obligation ahead of the financial crisis.www.reuters.com

I am not being obtuse. The fact is that Goldman created Abacus, Paulson did not develop the idea of synthetic CDOs. The idea that led to their creation was from Michael Burry.

We oughta get you lobbying for big tobacco. You are a killer!

And you are passionately angry about topics which you lack knowledge, Ill refer you to my post directed at yessir earlier In this thread so you can more properly channel your anger. You’re welcome,

Sounds like you got it all figured out. Love how you exonerated paulson in abacus. well done. Youve got zero credibility after that one.And you are passionately angry about topics which you lack knowledge, Ill refer you to my post directed at yessir earlier In this thread so you can more properly channel your anger. You’re welcome,

Similar threads

- Replies

- 237

- Views

- 9K

- Replies

- 596

- Views

- 14K

- Replies

- 33

- Views

- 799

- Replies

- 16

- Views

- 9K

ADVERTISEMENT

ADVERTISEMENT