Reports are that Tesla made more on their BTC purchase in a matter of weeks than they did on cars in 14 years.Heads Musk wins, Tails shareholders lose. What's the depreciation rate on their bitcoin holdings?

Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT: Stock and Investment Talk

- Thread starter RU-05

- Start date

I did notice that. Perhaps only the super smart money is on Galaxy? 😜Not liking the lack of volume in Galaxy.

Anyone have thoughts on that?

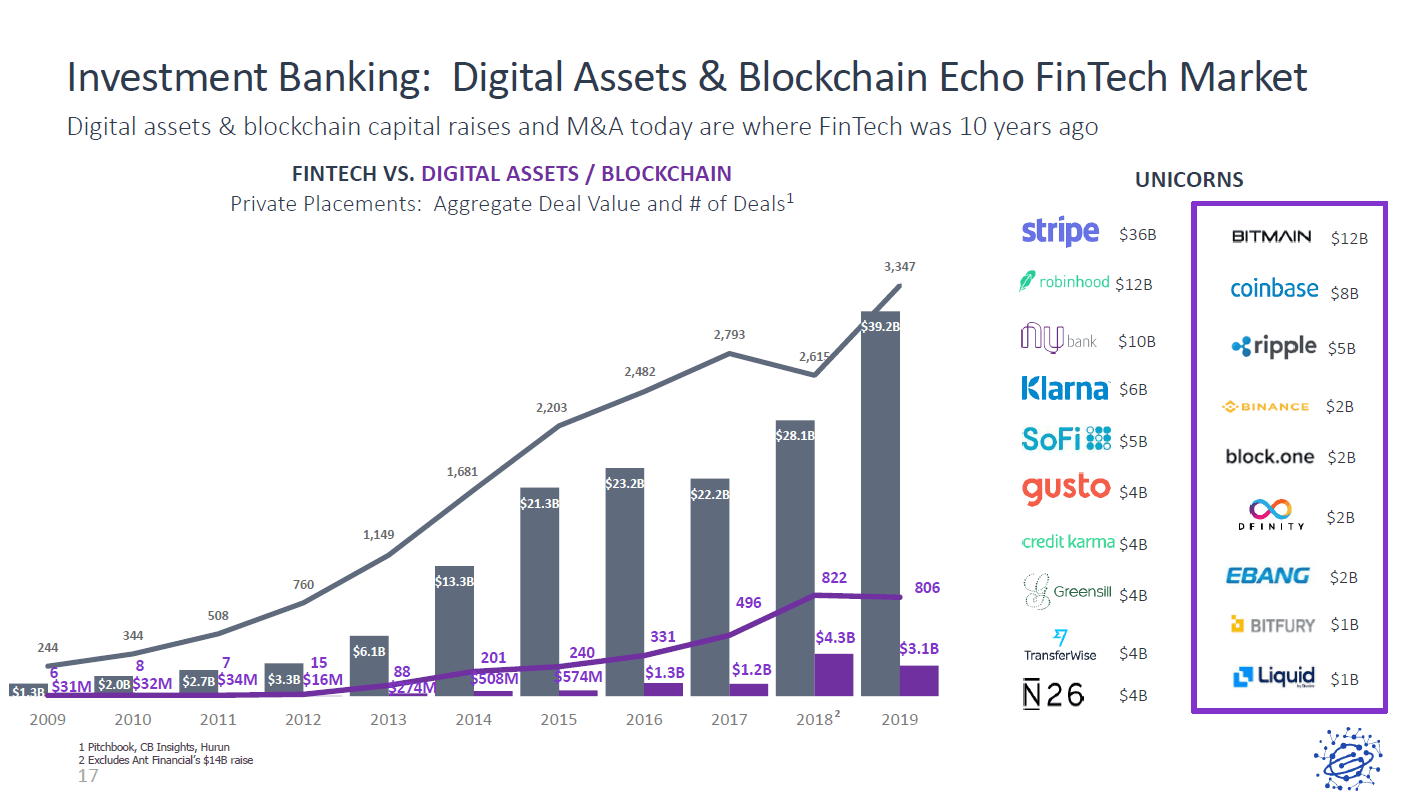

It has a nice position in the BLOK etf and Novogratz seems to be everywhere making deals and getting involved. He was a big part of the Microstrategy BTC event last week.

It is actually priced slightly under FMV as per Morningstar. I got mostly in at $7.50, but once I top off my CB should end up slightly over $8. Thought this was a nice piece on the company:

Galaxy Digital Is Carving Out A Lucrative Niche (OTCMKTS:BRPHF)

Cryptocurrencies used to be considered fringe assets, but are now becoming essential portfolio holdings for institutional investors.

SPACs are getting out of hand and reminiscent of 1999. When Colin Kap and Shaq have SPACs it’s time to worry...I got in on DNMR post merger, and even post initial run, and that one continues to do very well.

Less then 1% of portfolio allocation in these positions, so not a huge risk.

Even in the case of NKLA, or CLOV, it's not like the stocks totally collapsed. I'd actually like to be in on the former, was hoping it got down below $10 on it's most recent dip, but it rebounded. Currently around $22.

Wall Street’s New Favorite Deal Trend Has Issues

Known as SPACs, these shell companies allow businesses to sell shares to the public with different disclosure than usual. What could go wrong?

Same, unless you really love the company. Even then, there seems to be a cooling period before it begins to normalize as the new ticker/company. Only one I've really held on to through the process was Draftkings, which I believed in regardless.In my experience, if I like a SPAC, I'll sell right before it merges. I may miss out on some huge gains but the ones I've sold seem to go down after the mergers. I'm all for singles and doubles, not always swinging for the fences.

Well, it's a bs argument only used by the TSLAQ boys, aka the dumbest investors on Wall St. Reg credits didn't seem to stop Tesla's inclusion into the S&P. Knowing that Tesla is a growth co, I suspect you know it's bs too.

Musk said, "We want to be profitable, but only slightly profitable. We want to maximize growth and try to make our products as affordable as possible"

Not sure that I want the CEO of a company I own or lend to saying this. The equity is priced such that they must earn wide profit margins. He is unorthodox, that's for sure. And it has been working so far.

Why can't Shaq, or anyone who has a ton of money, be in on a Spac?SPACs are getting out of hand and reminiscent of 1999. When Colin Kap and Shaq have SPACs it’s time to worry...

Wall Street’s New Favorite Deal Trend Has Issues

Known as SPACs, these shell companies allow businesses to sell shares to the public with different disclosure than usual. What could go wrong?www.nytimes.com

Kapernicks spac, in my guess, would probably be a solid esg play.

But the market has preferred growth for over a decade.Not sure that I want the CEO of a company I own or lend to saying this. The equity is priced such that they must earn wide profit margins. He is unorthodox, that's for sure. And it has been working so far.

As I suspected. Unfortunately your shit experience in the 80s and 90s is not representative big the vehicles they are producing today.LIfelong experience with GM, Ford and Chrysler. You can buy one if you want.

I do hope you evaluate the build quality yourself and review the known issues of ANY car you consider buying.

My Bro in Law bought a 3 and was so giddy when it arrived he lost any sense of objectivity. I pointed out the shoddy panel gaps, and many other finish issues inside. The worst ones being that his nearly $60k vehicle had a trunk and frunk that closed with such harsh clunks, the car was closer to the quality of yugo than a 3 series. He was not happy and spent the next 8 months trying to get repairs.

https://cleantechnica.com/2021/02/09/brooklyn-getting-usas-1st-ev-fast-charging-superhub/

Tesla builds Supercharger stations across the world with dozens of supercharging stalls at many new stations. However, EV charging stations from other companies often just have a few. In the US, Electrify America is now typically putting in stations with several stalls, but not dozens. An e-mobility company in New York is going that route, though.

The company, Revel, is putting 30 EV fast chargers into a “Superhub” in Brooklyn, New York. It is a record-breaking facility, in fact. “The site will be the largest universal fast charging depot in North America, with 30 chargers open to the public on a 24/7 basis and accessible to owners of any electric vehicle brand,” Tritium writes.

Wait, who mentioned Tritium? Well, as is the case in many charging networks and projects, Tritium is providing the charging stations. The RTM75 is being used for the first 10 stations, expected to be operational in the spring. A RTM75 charging station can reportedly supply 100 miles of range in 20 minutes.

Tesla builds Supercharger stations across the world with dozens of supercharging stalls at many new stations. However, EV charging stations from other companies often just have a few. In the US, Electrify America is now typically putting in stations with several stalls, but not dozens. An e-mobility company in New York is going that route, though.

The company, Revel, is putting 30 EV fast chargers into a “Superhub” in Brooklyn, New York. It is a record-breaking facility, in fact. “The site will be the largest universal fast charging depot in North America, with 30 chargers open to the public on a 24/7 basis and accessible to owners of any electric vehicle brand,” Tritium writes.

Wait, who mentioned Tritium? Well, as is the case in many charging networks and projects, Tritium is providing the charging stations. The RTM75 is being used for the first 10 stations, expected to be operational in the spring. A RTM75 charging station can reportedly supply 100 miles of range in 20 minutes.

But the market has preferred growth for over a decade.

Apple is growing and highly profitable. Growth for the sake of growth doesn't produce valuable cash flows.

If TSLA ever wants to get to Apple's level of earnings, they need to grow their foot print dramatically first.Apple is growing and highly profitable. Growth for the sake of growth doesn't produce valuable cash flows.

The big factor for flying cars is battery energy density. The current best high cycle batteries are at ~300 Wh/kg. Flying cars you'd need at least 400 Wh/kg. If/when they get developed, they're not going to be cheap, at least at first. By the time this happens, robotaxi should be well established and very affordable(maybe 10¢/mile) for the masses.@BellyFullOfWhiteDogCrap

Guess we are not skipping flying cars. Not sure if this will hurt the robotaxi plan for TSLA.

Bloomberg - Are you a robot?

www.bloomberg.com

So I hold to my original opinion that a flying car, or VTOL, while possible, will be a toy for the wealthy. I'd still love to see it someday.

As I suspected. Unfortunately your shit experience in the 80s and 90s is not representative big the vehicles they are producing today.

I do hope you evaluate the build quality yourself and review the known issues of ANY car you consider buying.

My Bro in Law bought a 3 and was so giddy when it arrived he lost any sense of objectivity. I pointed out the shoddy panel gaps, and many other finish issues inside. The worst ones being that his nearly $60k vehicle had a trunk and frunk that closed with such harsh clunks, the car was closer to the quality of yugo than a 3 series. He was not happy and spent the next 8 months trying to get repairs.

You suspected wrong, my nephew currently has a 2017 GM and its a piece of garbage, constantly having problems. Most of the issues are basic electronics, so i have no confidence they will able get more complicated electronics right. They are poorly designed, constructed and use cheap parts.

I personally haven't bought one in 20 yrs and probably never will. Every few years they push out stories about how the quality has improved, but it's never true. The proof is in the resale value of those cars. I'm not buying a Telsa anytime soon either, so that doesn't matter to me.

You seem to believe in the Big3, so that's what you should buy. I'm not sure why you care so much about what car I prefer. LOL.

Tesla and BTC. Thought you might find this interesting.The post you replied to was more about bitcoin than Tesla (even though I pasted in an excerpt fro Tesla’s 10-k filing). I found it fascinating that the accounting treatment classifies crypto as a) long term, and not current; b) intangible; and c) subject to the same rules as intangible impairment rather than traded items which can be easily marked to market. Granted, that’s how accountants have decided to characterize crypto under US GAAP, and they aren’t the last word, but it is fascinating.

To your point, I don’t love the purchase by Tesla. Here is a company with massive growth potential and correspondingly massive investment needs. As a shareholder, it’s reasonable to expect future share issuance, and dilution, to help finance these needs. In my opinion, it’s not reasonable to dilute shareholders who invest in the presumed EV global powerhouse only to see them turn around and make a speculative purchase of crypto currency. Just not the proper allocation of resources, and not what shareholders expected, I suspect.

I also don’t love the argument that this will facilitate global purchases. Chinese pay in CNY, and expenses incurred to manufacture cars in China are also remitted in CNY. Same with USD and Euros. These provide natural hedges against currency movements in each jurisdiction, and bitcoin provides none of those natural hedge benefits. A business should care about such hedging, and I don’t see how bitcoin meets that need at all.

Reports are that Tesla made more on their BTC purchase in a matter of weeks than they did on cars in 14 years.

If you exclude the sale of alternative energy credits I'd say that's got a 99.44% chance of being right.

Supercruise uses lidar and HD mapping = training wheels. Ultimately a dead end on the path to full autonomy.Ok - good for you.... Still haven't stated why?

Is it because of fit and finish? Tesla's sucks btwis it because autopilot is superior? Have you compared with super cruise? Because some industry folks think it's superior.

Love your blanket statements that aren't grounded in anything real. Lol

Waymo is currently using this system in a portion of Phoenix. It's nice if you're in a geofenced area. Not happening large scale.

🥳Bullish market narrative as per CNBC Bob Pissani.

Stimulus, vaccine rollout and earning keep growing. "q1, q2 earning estimates are rising fast"

This should be a nice year for the market. Got to take advantage of these times.....before the winds change.

Cliffnotes?

It could also backfire into a great commercial for current EV producers. They're getting everyone hyped for EVs, yet they have no product for sale other than limited quantities of The Bolt. And when are they going to get serious about production? Only 10K reservations taken for the 1st ed. Hummer? Other trims will be available in 2023 and 2024. They're in a tough spot especially being chained to their ICE business.I’ve been down on GM but I agree, they nailed the marketing here.

The dude lost me at the fake phone call.I'm lazy. Throw it on in the background

Nah, I'm sure there's PLENTY of private companies out there that will take a blank check and turn $10 into $200.Good piece. They sound shady.

That being said, over the summer I picked up some warrants on a busted weed SPAC KERN for pennies on a dollar. The warrant quadrupled since the Senate flipped and now I'm playing with the house money the company will get above the $10 that investors pissed away.

Nah, I'm sure there's PLENTY of private companies out there that will take a blank check and turn $10 into $200.

That being said, over the summer I picked up some warrants on a busted weed SPAC KERN for pennies on a dollar. The warrant quadrupled since the Senate flipped and now I'm playing with the house money the company will get above the $10 that investors pissed away.

Curious what you liked about the company besides the legalization angle? Or did you just like the trade?

Yes, his financial engineering skills rival 80s masters like Jack Welch of GE and Roberto Goizueta of Coca-Cola. Your grandkids will think he's the next Warren Buffet, not the next Bill Gates.Reports are that Tesla made more on their BTC purchase in a matter of weeks than they did on cars in 14 years.

Back in 2017ish I decided to put a thousand bucks into every semi-legit OTC weed stock I came across. (there were 22 total) thinking Murphy's election would trigger end to Prohibition nationally. Around mid-2018 MTech Acquisition (MTEC) came out, one of the first weed SPACs, so I picked up my base thousand bucks, just to figure out WTF a SPAC was. Long story short, I took a tax loss on it, but picked up the warrants to retain exposure, and was going to do a 30 day swap of them but never sold the position. Looking at my notes, I picked them up at 65 cents, but it wasn't last summer, it was 10/19 and I just forgot about them. lolCurious what you liked about the company besides the legalization angle? Or did you just like the trade?

CNBC saying WSB is driving the current moves in the cannabis sector.

Not surprised. Put stop-limits on the MJ in my rollover IRA. I see why it was going up, but not to this extent. So if reality sets in I'll take my 75% and wait for a reentry point on a return to slow and steady.

Sold my SNDL this morning, might regret it but happy with the return.Not surprised. Put stop-limits on the MJ in my rollover IRA. I see why it was going up, but not to this extent. So if reality sets in I'll take my 75% and wait for a reentry point on a return to slow and steady.

I'm still in, very close to a trim level, but I'm willing to let a solid chunk ride the wave.Sold my SNDL this morning, might regret it but happy with the return.

I'm still in too.I'm still in, very close to a trim level, but I'm willing to let a solid chunk ride the wave.

I've done very well on both TELL and REI recently.I know you guys have been going on about TSLA, Ev etc for some time. But any thoughts on Oil E&P to park some money ?

Not sure about long term, but I think the short term continues to look pretty good. Reopening, Inflation hedge, limited drilling driving up prices.

I’m long the market, but for anyone that doesn’t believe the market is approaching bubble territory just consider how long the “Stock and Investment Talk” thread has grown on a college football message board. Retail traders are loving life because everything is working right now without regard to fundamentals. Add in WSB, SPAC mania, RH gamification, etc. and the market is blowing past new highs almost every week during a pandemic.

But where are we in the bubble? As I note above, big stimulus is likely, the vaccine is rolling out, and earnings continue to beat expectations with estimates rising for q1 and q2. Is the bubble going to pop when we are in the midst of a grand reopening in this country this spring?I’m long the market, but for anyone that doesn’t believe the market is approaching bubble territory just consider how long the “Stock and Investment Talk” thread has grown on a college football message board. Retail traders are loving life because everything is working right now without regard to fundamentals. Add in WSB, SPAC mania, RH gamification, etc. and the market is blowing past new highs almost every week during a pandemic.

I'm just going to try and milk the run as much as possible so that if and when it does pop, I'm far enough ahead that I'll be a net positive.

Similar threads

- Replies

- 175

- Views

- 6K

- Replies

- 302

- Views

- 7K

- Replies

- 33

- Views

- 762

- Replies

- 10

- Views

- 5K

ADVERTISEMENT

ADVERTISEMENT