Use a composite of various real-time shelter data instead of garbage that lags 12-15 months. It would have highlighted the inflation issue in 2021 and that it is back under 2% now. Problem solved!How would you fix it? Ask a bunch of randos how much their grocery bills went up and average those?

Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT: Stock and Investment Talk

- Thread starter RU-05

- Start date

Cost of drop-in hockey ice time and cans of beer for locker room at my rink have not gone up at all so there is NO inflation. It’s all science and math!How would you fix it? Ask a bunch of randos how much their grocery bills went up and average those?

Need to check IWM.Russell drops 3%. $1980.

Hmm, still above $195.

Lyft up 65% in extended after big earnings beat. LOL! I guess the street was expecting a train wreck?

www.cnbc.com

www.cnbc.com

Lyft shares pull way back after CFO corrects major earnings release error

Lyft reported better-than-expected earnings on Tuesday and issued uplifting guidance.

Is that company still in business? :)Another train wreck for $UPST.

Yeah, until they realized they provided inaccurate margin information; 500 bp increase, vs. 50 bp….. minor details, lolLyft up 65% in extended after big earnings beat. LOL! I guess the street was expecting a train wreck?

Lyft shares pull way back after CFO corrects major earnings release error

Lyft reported better-than-expected earnings on Tuesday and issued uplifting guidance.www.cnbc.com

LOL! Now that is the Lyft we all expect.Yeah, until they realized they provided inaccurate margin information; 500 bp increase, vs. 50 bp….. minor details, lol

Morningstar reports:

“Cathie Wood's Ark Invest has destroyed $14 billion in wealth over the past decade.”

“A Morningstar analysis found that Ark Invest topped the list of wealth destroyers among other investment companies.”

All this during a time where the S&P was up around 150%.

The problem is: Her worst performance was when her funds had the biggest balances.

“Cathie Wood's Ark Invest has destroyed $14 billion in wealth over the past decade.”

“A Morningstar analysis found that Ark Invest topped the list of wealth destroyers among other investment companies.”

All this during a time where the S&P was up around 150%.

The problem is: Her worst performance was when her funds had the biggest balances.

Well, it's not all about her or the fund, but also investors that FOMO'ed in at the wrong time. Here is the full article:Morningstar reports:

“Cathie Wood's Ark Invest has destroyed $14 billion in wealth over the past decade.”

“A Morningstar analysis found that Ark Invest topped the list of wealth destroyers among other investment companies.”

All this during a time where the S&P was up around 150%.

The problem is: Her worst performance was when her funds had the biggest balances.

15 Funds That Have Destroyed the Most Wealth Over the Past Decade

These funds managed to lose value for shareholders even during a generally bullish market.

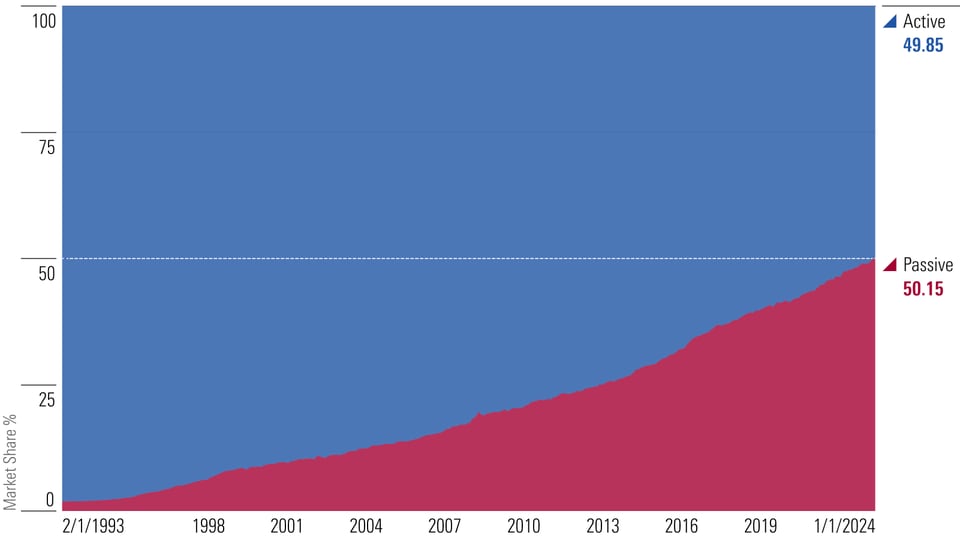

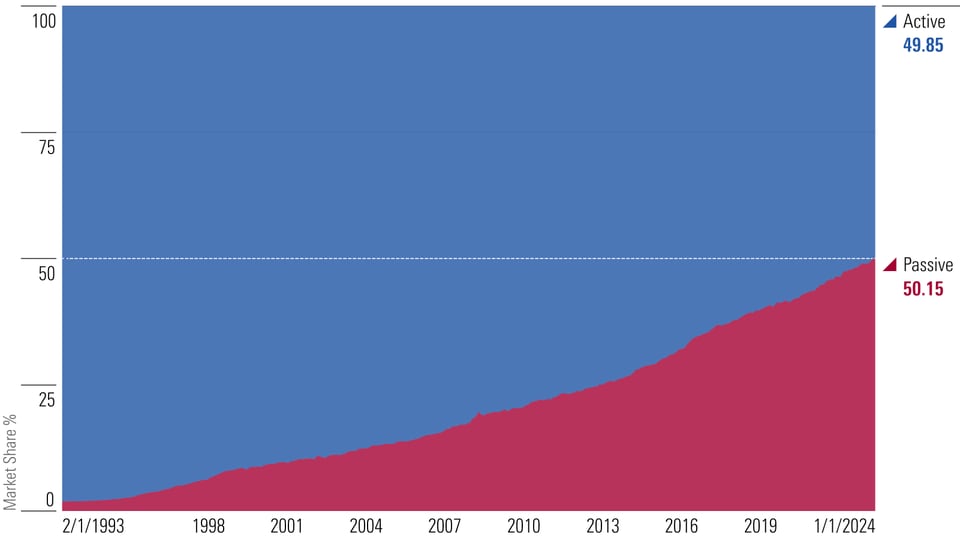

Also, in other news, index funds are the new king!

Pretty amazing chart:

Market Share: All Funds

(Active vs. passive market shares, all long-term mutual funds and ETFs, Feb. 1, 1993 - Jan. 1, 2024)

Well, it's not all about her or the fund, but also investors that FOMO'ed in at the wrong time. Here is the full article:

15 Funds That Have Destroyed the Most Wealth Over the Past Decade

These funds managed to lose value for shareholders even during a generally bullish market.www.morningstar.com

Also, in other news, index funds are the new king!

Pretty amazing chart:

Market Share: All Funds

(Active vs. passive market shares, all long-term mutual funds and ETFs, Feb. 1, 1993 - Jan. 1, 2024)

Great articles, should be required reading. I’m a big believer in index funds, as you know. Without looking, my portfolio is about 50% index funds. I have some actively managed vanguard funds and some individual stocks but to me, I think low cost index funds and diversification should be strongly considered as core foundations of a portfolio. The “wealth destroyers” were, not surprisingly, narrowly focused “hot” picks of the day. Thanks for posting these!

I've been moving more and more to index funds/etfs (not including my personal/fun account), even during the last 15 months of a rallying market. As for active funds, I'm pretty much down to 3 with large positions: FDGRX, FBGRX, and DODGX. A few of my old main stays had fund managers retire, so I moved on to the indexes.Great articles, should be required reading. I’m a big believer in index funds, as you know. Without looking, my portfolio is about 50% index funds. I have some actively managed vanguard funds and some individual stocks but to me, I think low cost index funds and diversification should be strongly considered as core foundations of a portfolio. The “wealth destroyers” were, not surprisingly, narrowly focused “hot” picks of the day. Thanks for posting these!

Uh oh.... Next thing you know, you'll be chasing the neighborhood kids off your lawn and collecting stamps.I've been moving more and more to index funds/etfs (not including my personal/fun account), even during the last 15 months of a rallying market. As for active funds, I'm pretty much down to 3 with large positions: FDGRX, FBGRX, and DODGX. A few of my old main stays had fund managers retire, so I moved on to the indexes.

But I'm expanding my crypto portfolio. :)Uh oh.... Next thing you know, you'll be chasing the neighborhood kids off your lawn and collecting stamps.

Don’t worry, there will be crypto index funds soon enough too.But I'm expanding my crypto portfolio. :)

STX is pumping! :)Don’t worry, there will be crypto index funds soon enough too.

Its a 4 bagger for me so far.STX is pumping! :)

AI hype in the news more and more.

AI processors actually use bit 8 computing vs 32/64.

Its a 4 cylinder Subaru having people think its a turbo sportscar

"Michio Kaku, a professor of theoretical physics at City College of New York and CUNY Graduate Center believes current AI models are little more than glorified tape recorders.

Kaku was interviewed by CNN's Fareed Zakaria (via Business Insider). When asked for his thoughts on AI, Kaku said: "It takes snippets of what's on the web created by a human, splices them together, and passes it off as if it created these things, and people are saying: 'Oh my God, it's a human, it's humanlike.'" He goes on to say "AI cannot distinguish true from false".

www.pcgamer.com

www.pcgamer.com

SEC warning

AI processors actually use bit 8 computing vs 32/64.

Its a 4 cylinder Subaru having people think its a turbo sportscar

"Michio Kaku, a professor of theoretical physics at City College of New York and CUNY Graduate Center believes current AI models are little more than glorified tape recorders.

Kaku was interviewed by CNN's Fareed Zakaria (via Business Insider). When asked for his thoughts on AI, Kaku said: "It takes snippets of what's on the web created by a human, splices them together, and passes it off as if it created these things, and people are saying: 'Oh my God, it's a human, it's humanlike.'" He goes on to say "AI cannot distinguish true from false".

AI chatbots and large language models are little more than 'glorified tape recorders'

According to Michio Kaku, a theoretical physicist.

SEC warning

SEC Head Warns Against ‘AI Washing,’ the High-Tech Version of ‘Greenwashing’

Agency head Gary Gensler cautioned businesses against peddling phony AI-related hype

It's a 0.3 bagger (+30%) for me so far, but it's a start! :)Its a 4 bagger for me so far.

Nice 8% pop for Z today off earnings.My buddy and I were just talking stocks. He likes Z and COMP and I actually talked him into starting small(very small) positions on each.

Z expecting 15% rev growth, and significant EPS growth(Non gaap it's profitiable, gaap it is not, but I hate that there is this distinction and E-trade doesn't clearly make the distinction) and it is free cash flow positive. Always beats too.

COMP has less growth and not expecting to be profitable in the next bunch of years, but it looks to be getting past trough rev's in 2023, it is expected to be free cash flow positive in 2024, and is dirt cheap on rev's at .3x (that is point three). Z by comparison is 7x rev's.

Both stocks dropped hard into Nov lows, rebounded and have consolidated without dropping, this past month. Z still below pre covid (edit) highs.

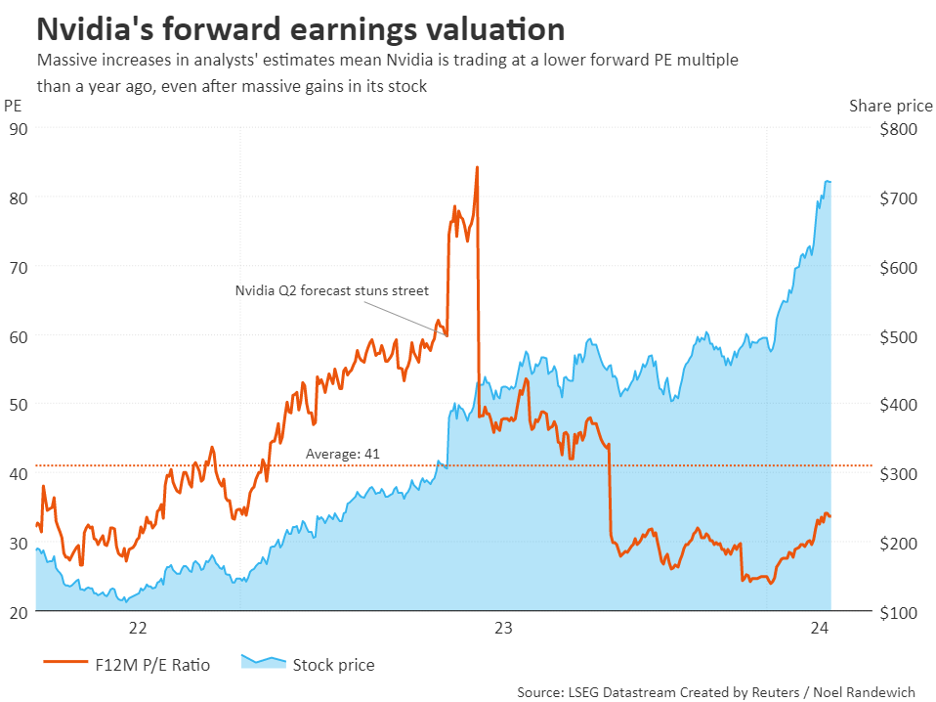

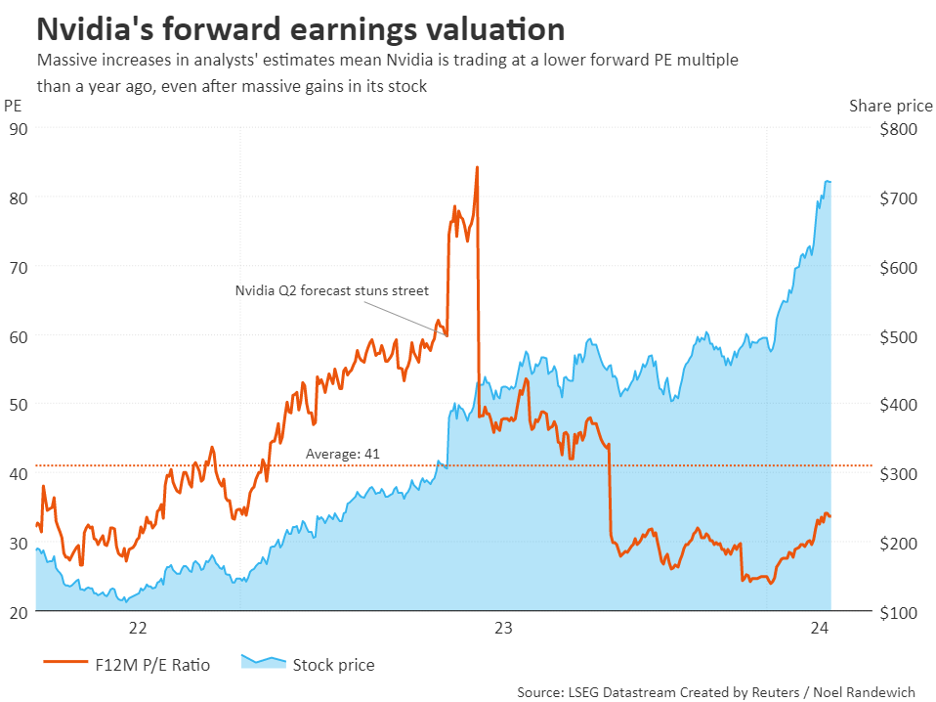

Somewhat related SMCI keeps ripping. Over $900NVDA up to #3:

Nvidia replaces Alphabet as Wall St's third most valuable company

Loading…

www.fidelity.com

I sold at $790. Looked like a good sell for about 3 hours.

I did have BLNK up 30%. Which merely gets me back in the green overall in the position.

And UBER which is my biggest holding up 14%. So that was really nice.

And UBER which is my biggest holding up 14%. So that was really nice.

I have no idea what to do with SMCI. I trimmed 25% last week and I think it's already back up to the old value (before I took some profit). LOL!Somewhat related SMCI keeps ripping. Over $900

I sold at $790. Looked like a good sell for about 3 hours.

Did you see this today on CNBC? Gene M isn't a wild bull, but.....

For those whining about our current 3% inflation:

Argentina’s annual inflation rose to 254%

www.ft.com

www.ft.com

:)

Argentina’s annual inflation rose to 254%

How Javier Milei is trying to curb Argentina’s 250% inflation

Libertarian economist must walk a tightrope to defuse price pressures

:)

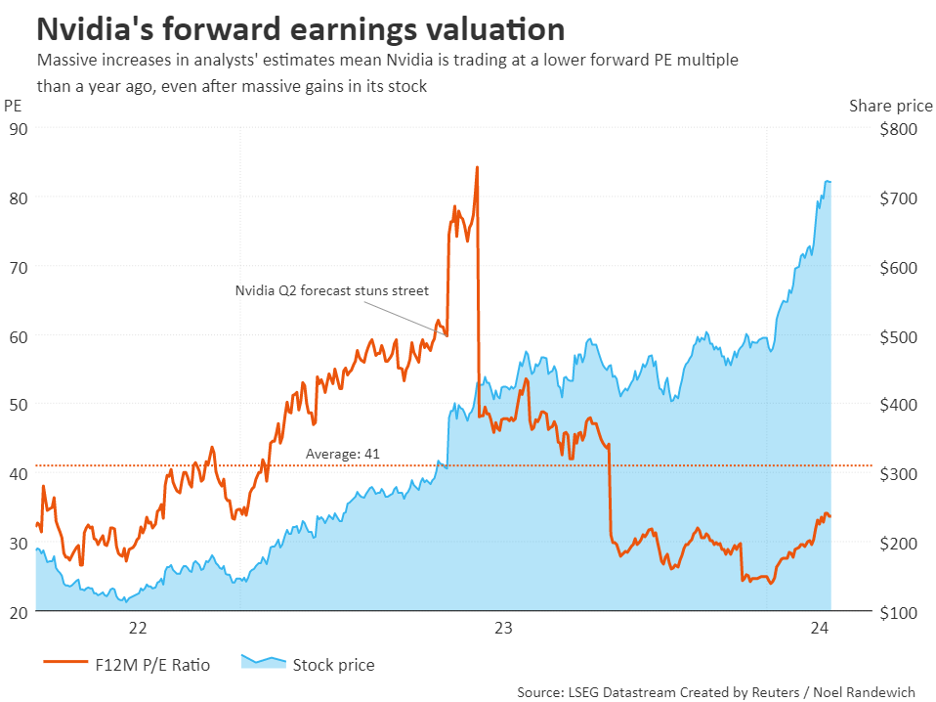

Awesome chart! NVDA's share price goes up, but PE goes down. Thanks AI!

Maybe that's a Lyft like situation and they misplaced the decimal point?For those whining about our current 3% inflation:

Argentina’s annual inflation rose to 254%

How Javier Milei is trying to curb Argentina’s 250% inflation

Libertarian economist must walk a tightrope to defuse price pressureswww.ft.com

:)

I def got out of SMCI too early. Up another 20% in about 4 days. My 200% gain could have been 300%.Awesome chart! NVDA's share price goes up, but PE goes down. Thanks AI!

Still cheap.

But as noted on the Compount, an RSI in the 90's which is a super hot.

LYFT is now off and running since earnings.

Up 50% in 3 days.

Price to rev's of 1.2x. Uber is 3.8x.

10x price to book, vs 12x for uber.

Uber is profitable, and much cheaper on price to cash flow, 19x vs 70x.

But if Lyft can continue to tighten up the ship, potential for significant upside.

Up 50% in 3 days.

Price to rev's of 1.2x. Uber is 3.8x.

10x price to book, vs 12x for uber.

Uber is profitable, and much cheaper on price to cash flow, 19x vs 70x.

But if Lyft can continue to tighten up the ship, potential for significant upside.

That's a crazy high RSI. But will this be a mini-NVDA? As in the revenue growth will justify the price rally. We shall see.I def got out of SMCI too early. Up another 20% in about 4 days. My 200% gain could have been 300%.

Still cheap.

But as noted on the Compount, an RSI in the 90's which is a super hot.

In other news, my ARM put are hanging in there. Up a smidge overall.

Anyone going for an options play of COIN's earnings report today? :)

I keep stalling and stumbling on those IWM calls. I have plenty of skin in the game with small caps (UWM, VB, VBK) but those calls are for a HR swing with my personal account. No matter when and regardless of bumps in the road, rates are going lower and small caps are painfully undervalued.Russell 2k back to $2034.

Quickly came back from that 4% drop due to the hot cpi sell off.

I dunno, suggests to me it wants to complete that break out.

We shall see.

COIN is pumping! Sadly, got stuck in a work meeting and missed out on those calls.Russell with a big day. 2.5% Finishes at $261.

Different topic. Some good beats after hours.

TOST, COIN, Trade desk, all up nicely.

Doordash with a miss. Looks like FSLY(remember this one?) with a big miss.

ATH for the S&P 500. The market is giving the CPI (and bears) the middle finger.

S&P 500 closes at record high, Dow gains 300 points in late-day rally

The S&P 500 notched a new record high, as stocks rose to rebound from their losses earlier this week.

Similar threads

- Replies

- 175

- Views

- 6K

- Replies

- 361

- Views

- 9K

- Replies

- 33

- Views

- 773

- Replies

- 11

- Views

- 6K

ADVERTISEMENT

ADVERTISEMENT