I don't own any bitcoin ETFs. I was in GBTC at one point. I just own bitcoin and Ethereum. I have been in and out of MARA call options. I might buy some RIOT calls given the underperformance.Outstanding earnings report for BEAM! All 7 of my small cap biotechs are doing well, but I missed out on BEAM. At least for the time being.

Are you involved with BTC or the etfs at all? I was hoping the etfs would get options by now, but nothing so far. I might have to jump into MARA calls during the next dip.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High School

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT: Stock and Investment Talk

- Thread starter RU-05

- Start date

What general timeline do you use for miner calls? A few months? Do you ever do leap calls? May be interesting to have calls that extend through the entire bull cycle.I don't own any bitcoin ETFs. I was in GBTC at one point. I just own bitcoin and Ethereum. I have been in and out of MARA call options. I might buy some RIOT calls given the underperformance.

No iCar for AAPL! Probably a good idea.

www.cnbc.com

www.cnbc.com

Apple cancels plans to build an electric car

Apple will wind down its team working on electric cars, called Special Projects Group, according to a report from Bloomberg News.

I would have liked to see an iCar…I only skimmed the article = is there any chance Apple shuts down the unit because they would rather buy a company like Rivian and simply slap on the Apple brand?No iCar for AAPL! Probably a good idea.

Apple cancels plans to build an electric car

Apple will wind down its team working on electric cars, called Special Projects Group, according to a report from Bloomberg News.www.cnbc.com

I don't buy many (if ever) Leap calls. Most of my calls in miners for 2-4 weeks out.What general timeline do you use for miner calls? A few months? Do you ever do leap calls? May be interesting to have calls that extend through the entire bull cycle.

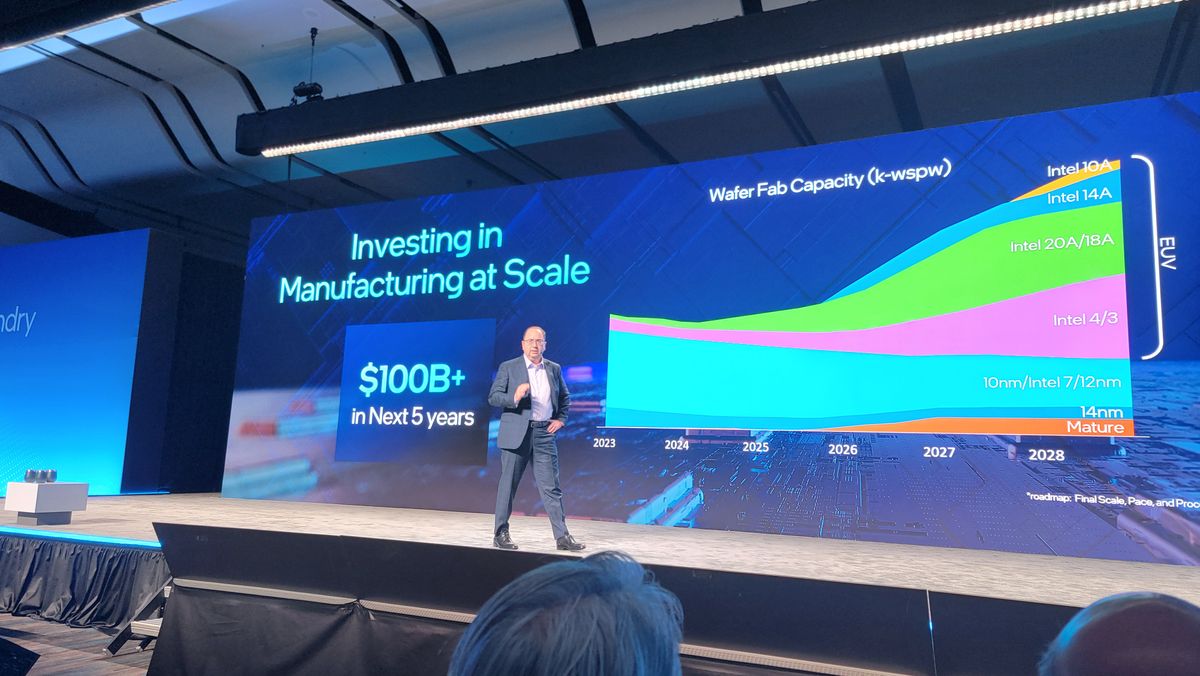

Intel for quite some time has been a 1 step forward 1-2 steps backward company. That somewhat even pre-dates when Lisa Su took the helm at AMD and they kind of had a monopoly on things

I do think there's possibly some potential in bringing manufacturing on shore but that might be some time til we see if there's substantial fruit there. As far as tech advances etc..I'm skeptical when it comes to INTC delivering and capitalizing on it.

AMD was kicking Intel's "Pentium" butt back in early aughties.

Then Intel shocked everybody with Intel Core 2 (Core2Duo) in 2006

AMD became Canadian Football to Intel's NFL

Intel kind of squandered the public market with more expensive processors that didn't add much.

Intel gets tangled-up in its enterprise dominance and the performance innovations start to flatten.

Intel had more business/networking functions in all its chips, and many flaws/exploits were discovered.

How to keep a window open and closed at the same time was intel's problem .

They were still have problems through last year ( https://www.pcworld.com/article/202...ns-of-intel-cpus-how-to-protect-yourself.html ).

Other makers had some issues but only in research.

Intel always get the worst end and that's why I dropped them.

Alas thing are different now as processors move to use of "chiplets"(AMD) and "tiles" (Intel).

Processors are smaller and functions broken down among groupings of processors.

On production side there is less silicon waste since wafers go further.

With Intel's native production ability and the nervousness over Taiwan/TSMC, Intel could get some juice.

LG invented IPS panels and sold them to many makers while still having their own brand.

Intel making chips for others while still making their own isn't that screwy.

To have the new designs come around while the AI hype escalates makes an opening for Intel.

Intel does run dopey for decades at a time, but when they get all cylinders firing they can be pack leader.

Of course leadership counts for a lot and I like the old hand coming back with new focus and not the woke.

Japan is also getting back into processor production and they are considered more secure.

If security is a goal Japan is the way to go.

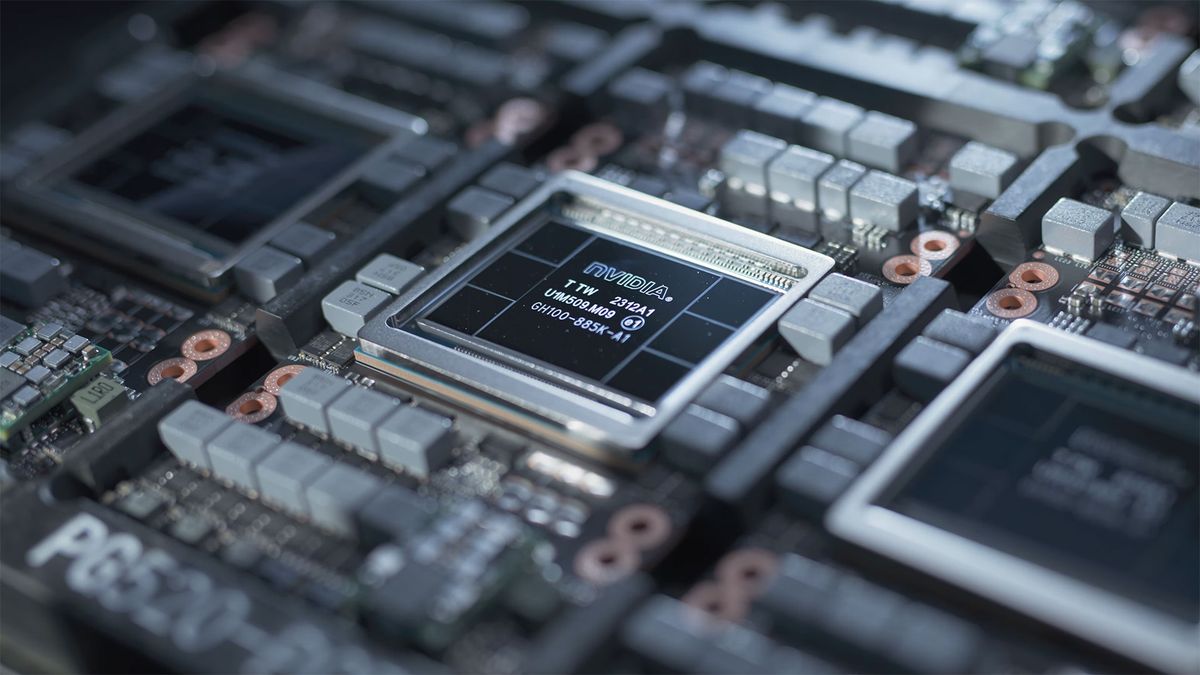

Nvidia AI processors already being resold to reduce overbuys

Buyers of Nvidia's highest-end H100 AI GPU are reportedly reselling them as supply issues ease

Buyers of Nvidia's highest-end H100 AI GPU are reportedly reselling them as supply issues ease

Nvidia's H100 processors are easier to get and rent.

Intel puts 1nm process (10A) on the roadmap for 2027 — also plans for fully AI-automated factories with 'Cobots'

1nm chips to arrive in late 2027.

Last edited:

First institutional shoe to drop. Fidelity formally recommends BTC for 1-3% of portfolios:

www.tradingview.com

www.tradingview.com

Expert Predicts Bitcoin At $750,000 As Fidelity Advises 1-3% Allocation

In a major shift within the financial industry, Fidelity Investments, with its colossal $12.6 trillion in assets under administration, is now recommending that the traditional 60/40 portfolio model should evolve to include a 1-3% allocation to crypto, specifically through its spot Bitcoin ETF (FBTC…

Financial firm recommends its own product. Shocker!!!!!First institutional shoe to drop. Fidelity formally recommends BTC for 1-3% of portfolios:

Expert Predicts Bitcoin At $750,000 As Fidelity Advises 1-3% Allocation

In a major shift within the financial industry, Fidelity Investments, with its colossal $12.6 trillion in assets under administration, is now recommending that the traditional 60/40 portfolio model should evolve to include a 1-3% allocation to crypto, specifically through its spot Bitcoin ETF (FBTC…www.tradingview.com

Gonna need to add another zero to that number soon! :)Bitcoin hits 60k.

define soonGonna need to add another zero to that number soon! :)

This bull cycle, so over the next 12-15 months. It's going to be interesting to watch. It seems like the ETFs have really disrupted the normal 4-year cycle for BTC.....in an even more bullish way. It's quite simply a supply and demand story right now.define soon

The easiest way for BTC exposure is via the new spot BTC ETFs. The 2 largest are:What is the easiest way to enter the crypto market having never invested before? Are there mutual funds from any reputable companies you would recommend?

IBIT (iShares from Blackrock)

FBTC (Fidelity)

Both have very modest expense ratios. If you are brand new to crypto, I would check these out and see how it goes.

If you would really like some exposure to the #2 crypto, Ethereum, there are only trusts and future contract ETFs at this time. The largest is Grayscale's Ethereum Trust: ETHE. It tracks Ethereum very closely, but it is not a traditional spot ETF yet and has a high fee.

The easiest way for BTC exposure is via the new spot BTC ETFs. The 2 largest are:

IBIT (iShares from Blackrock)

FBTC (Fidelity)

Both have very modest expense ratios. If you are brand new to crypto, I would check these out and see how it goes.

If you would really like some exposure to the #2 crypto, Ethereum, there are only trusts and future contract ETFs at this time. The largest is Grayscale's Ethereum Trust: ETHE. It tracks Ethereum very closely, but it is not a traditional spot ETF yet and has a high fee.

Thanks. Can I buy any of these things through my Schwab account or do I have to set up an entirely new account with one of these companies? Again brand new to this so have no clue how it works!

Yes, you should have access to IBIT, FBTC and even ETHE via your Schwab account. There are a few very conservative platforms that still haven't made them available yet (e.g., Vanguard), but most others have once they were approved by the SEC.Thanks. Can I buy any of these things through my Schwab account or do I have to set up an entirely new account with one of these companies? Again brand new to this so have no clue how it works!

These are basic ETFs and can be bought and sold like a normal ETF or stock. Very simple! :)

So the first two are like mutual funds of crypto(have exposure to many types) and the other(ETHE) is like buying an individual stock in one type, Etherium? If so the first two are probably safer but the other has more potential upside I would guess…Yes, you should have access to IBIT, FBTC and even ETHE via your Schwab account. There are a few very conservative platforms that still haven't made them available yet (e.g., Vanguard), but most others have once they were approved by the SEC.

These are basic ETFs and can be bought and sold like a normal ETF or stock. Very simple! :)

No, sorry for the confusion. IBIT and FBTC are spot Bitcoin ETFs and only track the performance of Bitcoin. Very similar to a Gold ETF. So these are not "mutual funds" of the crypto market. That doesn't exist right now.So the first two are like mutual funds of crypto(have exposure to many types) and the other(ETHE) is like buying an individual stock in one type, Etherium? If so the first two are probably safer but the other has more potential upside I would guess…

Honestly, Bitcoin/BTC is a whale in the crypto pond. As Bitcoin moves, so does the entire market. Having exposure to Bitcoin via one of the ETFs is like having exposure to the broad crypto market.

Bitcoin/BTC's market cap is $1.2T

Ethereum's market cap is $400B

And then it is Solana at $40B and so on

Having exposure to Bitcoin and Ethereum is plenty for a crypto beginner. I mess around with smaller crypto projects, but the vast majority of my crypto holdings are Bitcoin and Ethereum.....which is the norm for most people.

Thanks for clarifying. So if you were going to pick one of these to invest in, what would you chose! Looking for the highest potential upside…

Personally I’d stick with Bitcoin. Ethereum likely won’t run too much more than what Bitcoin does. Maybe go 75/25. The highest upside stuff is the highest risk stuff, you’re gonna need a coinbase account for that.Thanks for clarifying. So if you were going to pick one of these to invest in, what would you chose! Looking for the highest potential upside…

I don’t do crypto but is this the best time to be jumping on if you’re not already in? I don’t see it any different than stocks. Seems like the hype train is full speed ahead and is that the best entry for any investment? When it was tanking some time ago that seemed like a better time to enter of you’re really interested. See if any pullbacks might provide better entry points. I say this as a Joe Retail but when the lay person/Joe Retail start taking notice and jump on it could be a time to be more careful.

Totally agree with this. I love Ethereum, but Bitcoin is the big dog and dictates what happens in the market. They are 2 very different types of cryptos and compliment each other well.Personally I’d stick with Bitcoin. Ethereum likely won’t run too much more than what Bitcoin does. Maybe go 75/25. The highest upside stuff is the highest risk stuff, you’re gonna need a coinbase account for that.

Nothing wrong with starting to DCA into the BTC ETFs and ETHE. Of course nothing goes up in a straight line, but set a reoccurring weekly amount and go from there. I have no idea if BTC will be $60K, $40K, or $80K in a few weeks. However, based on simple supply and demand, the trend is upwards.I don’t do crypto but is this the best time to be jumping on if you’re not already in? I don’t see it any different than stocks. Seems like the hype train is full speed ahead and is that the best entry for any investment? When it was tanking some time ago that seemed like a better time to enter of you’re really interested. See if any pullbacks might provide better entry points. I say this as a Joe Retail but when the lay person/Joe Retail start taking notice and jump on it could be a time to be more careful.

"I'm often wrong about many things" -- Charlie Munger"Crypto is rat poison...." -- Charlie Munger.

Someone bought a few hundred million of Bitcoin last week. Classy of Buffett to wait until Charlie passed to start buying."Crypto is rat poison...." -- Charlie Munger.

Coinbase users see $0 balance after crypto-trading app suffers glitch

Coinbase users took to social media platform X on Wednesday screenshots showing that their accounts appeared to have no money in them.

BTC just pumped to $64K and then COIN glitched and crashed the market. LOL! Welcome to crypto. The dust seems to be settling. Buy the dip! :)

Coinbase users see $0 balance after crypto-trading app suffers glitch

Coinbase users took to social media platform X on Wednesday screenshots showing that their accounts appeared to have no money in them.www.cnbc.com

BTC just pumped to $64K and then COIN glitched and crashed the market. LOL! Welcome to crypto. The dust seems to be settling. Buy the dip! :)

I was able to pick up more STX and IMX on the dip. :)

Excellent quarter for CRM, double beat and solid guidance! Down a bit in extended, but that likely won't last long.

www.cnbc.com

www.cnbc.com

Salesforce shares slip after the company calls for single-digit full-year revenue growth

Salesforce said revenue growth will slow to 8.6% in the new fiscal year, but revenue guidance exceeds Wall Street's estimates.

Textbook buy the dip. Market being emotional since FS is retiring. I own SNOW and will add.Speaking of dips, this hurts…

Last edited:

Nice…I wanted to buy this when it was at $190 then get to ticking up and I missed the boat… $175 is very attractiveTextbook by the dip. Market being emotional since FS is retiring. I own SNOW and will add.

I originally got in at $146, but would be happy to add even if it increases my cost basis a bit. Amazing company.Nice…I wanted to buy this when it was at $190 then get to ticking up and I missed the boat… $175 is very attractive

BTC just pumped to $64K and then COIN glitched and crashed the market. LOL! Welcome to crypto. The dust seems to be settling. Buy the dip! :)

"Sometimes I call it crypto 'crappo,' sometimes I call it 'crypto s---.' It's just ridiculous that anybody would buy this stuff," Charlie Munger, 99, told CNBC's Becky Quick, adding: "It's totally absolutely crazy, stupid gambling."

"I think the people who oppose my position are idiots, so I don't think there is a rational argument against my position," he said.

"I think the people who are professional traders that go into trading cryptocurrencies, it's just disgusting," he said. "It's like somebody else is trading turds and you decide, ‘I can't be left out.'"

Munger criticized cryptocurrency traders as participants in a get-rich-quick scheme, contributing little to civilization. He expressed his distaste for the burgeoning market, highlighting his belief that it was regrettable that the U.S. hadn’t banned cryptocurrency trading. Munger admired China’s approach to cryptocurrencies, noting the country's ban and considering it a wiser approach than the U.S. stance.

His scrutiny didn’t spare the nature of cryptocurrencies. He has been quoted as saying that cryptocurrencies, including Bitcoin, are likely to go to zero and have no intrinsic value. He emphasized the high volatility and lack of regulatory frameworks as major concerns.

The 99-year-old billionaire was troubled by the use of cryptocurrency in illegal activities like drug dealing, terror funding, kidnapping and extortion.

He went on to use the extreme analogy of trading in freshly harvested baby brains to underline his disapproval.

“Suppose you could make a lot of money trading freshly harvested baby brains," he said. "You wouldn't trade them, would you? It's too awful a concept. To me, Bitcoin is almost as bad. ... I regard the thing as a combination of dementia and immorality. And I think the people pushing it are a disgrace.”

Charlie was not a fan. It seems....

He loses me at “troubled by the use of cryptocurrency in illegal activities like drug dealing, terror funding, kidnapping and extortion.” Any form of currency does this, crypto is infinitely more traceable than cash in said activities. I always assumed guys like him were more educated on things they have such strong opinions about, clearly not."Sometimes I call it crypto 'crappo,' sometimes I call it 'crypto s---.' It's just ridiculous that anybody would buy this stuff," Charlie Munger, 99, told CNBC's Becky Quick, adding: "It's totally absolutely crazy, stupid gambling."

"I think the people who oppose my position are idiots, so I don't think there is a rational argument against my position," he said.

"I think the people who are professional traders that go into trading cryptocurrencies, it's just disgusting," he said. "It's like somebody else is trading turds and you decide, ‘I can't be left out.'"

Munger criticized cryptocurrency traders as participants in a get-rich-quick scheme, contributing little to civilization. He expressed his distaste for the burgeoning market, highlighting his belief that it was regrettable that the U.S. hadn’t banned cryptocurrency trading. Munger admired China’s approach to cryptocurrencies, noting the country's ban and considering it a wiser approach than the U.S. stance.

His scrutiny didn’t spare the nature of cryptocurrencies. He has been quoted as saying that cryptocurrencies, including Bitcoin, are likely to go to zero and have no intrinsic value. He emphasized the high volatility and lack of regulatory frameworks as major concerns.

The 99-year-old billionaire was troubled by the use of cryptocurrency in illegal activities like drug dealing, terror funding, kidnapping and extortion.

He went on to use the extreme analogy of trading in freshly harvested baby brains to underline his disapproval.

“Suppose you could make a lot of money trading freshly harvested baby brains," he said. "You wouldn't trade them, would you? It's too awful a concept. To me, Bitcoin is almost as bad. ... I regard the thing as a combination of dementia and immorality. And I think the people pushing it are a disgrace.”

Charlie was not a fan. It seems....

The most popular form of currency for illegal activity = US Dollar (and by a wide margin)He loses me at “troubled by the use of cryptocurrency in illegal activities like drug dealing, terror funding, kidnapping and extortion.” Any form of currency does this, crypto is infinitely more traceable than cash in said activities. I always assumed guys like him were more educated on things they have such strong opinions about, clearly not.

Why do cyber ransoms always ask for crypto? He is just stating the facts.He loses me at “troubled by the use of cryptocurrency in illegal activities like drug dealing, terror funding, kidnapping and extortion.” Any form of currency does this, crypto is infinitely more traceable than cash in said activities. I always assumed guys like him were more educated on things they have such strong opinions about, clearly not.

Lol, why does every drug dealer and bookie ask for cash? Why does every phone scam ask for gift cards?Why do cyber ransoms always ask for crypto? He is just stating the facts.

Zero facts stated on his part, same Eizabeth Warren nonsense opinion.

Similar threads

- Replies

- 178

- Views

- 7K

- Replies

- 408

- Views

- 10K

- Replies

- 33

- Views

- 779

- Replies

- 12

- Views

- 6K

ADVERTISEMENT

ADVERTISEMENT