quick dip, moonshot cometh this summer unless Iran goes full regard

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High School

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT: Stock and Investment Talk

- Thread starter RU-05

- Start date

Earnings are going to be epic for the big boys. Some folks predicting 6,000 by year end.quick dip, moonshot cometh this summer unless Iran goes full regard

Majority of heads on CNBC yesterday(not the regular heads, but investment people from the big banks like GS) were saying July.September and/or December are viable for the Fed's next move: a minimal rate cut. But a Fed move in September (just before the election) may be politically disruptive. Fed "neutrality" is the concern re: impact on the election. So December would be more likely. That said, one more data showing inflation may call for a rate increase rather than a cut.

I think part of that is thinking we need to get one in, but not waiting for it to be in the "political window".

Still some thinking that PCE will not be as hot, just as PPI this morning was not.

Still should be June, but July would be fine. Seriously, are we really going to delay a cut due to auto insurance which is a lagging symptom of the past spike in auto prices (and will resolve itself since auto prices have already crashed)?Majority of heads on CNBC yesterday(not the regular heads, but investment people from the big banks like GS) were saying July.

I think part of that is thinking we need to get one in, but not waiting for it to be in the "political window".

Still some thinking that PCE will not be as hot, just as PPI this morning was not.

Time for the Fed to start slowly moving to neutral.

UNH firmly in the 440s this morning. Think this range is a key area to hold and not break definitively.

JNJ was also brought up this morning on squawk. Took a look at a chart and that's also broke down from a longer term key support. Tried to retest and was rejected. I gotta say JNJ and KVUE haven't really done well after the split I was kind of interested in KVUE because I like staples/dividend payers but it doesn't seem to get treated the same way as other staples.

JNJ was also brought up this morning on squawk. Took a look at a chart and that's also broke down from a longer term key support. Tried to retest and was rejected. I gotta say JNJ and KVUE haven't really done well after the split I was kind of interested in KVUE because I like staples/dividend payers but it doesn't seem to get treated the same way as other staples.

Just bought UNH at $446 and change. Unfortunately, COST is up today on positive sales news. BA is continuing to drop. BMY also back under $50.UNH firmly in the 440s this morning. Think this range is a key area to hold and not break definitively.

JNJ was also brought up this morning on squawk. Took a look at a chart and that's also broke down from a longer term key support. Tried to retest and was rejected. I gotta say JNJ and KVUE haven't really done well after the split I was kind of interested in KVUE because I like staples/dividend payers but it doesn't seem to get treated the same way as other staples.

Forgot to mention, RIVN finally broke under $10.

Was going to mention RIVN below $10. I continue to hold what is now a modest position, deep in the red, want to add eventually, but it needs to find a floor.Just bought UNH at $446 and change. Unfortunately, COST is up today on positive sales news. BA is continuing to drop. BMY also back under $50.

Forgot to mention, RIVN finally broke under $10.

Just a quick look but that chart looks like it wants to have a bottoming out, not a quick reversal.UNH firmly in the 440s this morning. Think this range is a key area to hold and not break definitively.

JNJ was also brought up this morning on squawk. Took a look at a chart and that's also broke down from a longer term key support. Tried to retest and was rejected. I gotta say JNJ and KVUE haven't really done well after the split I was kind of interested in KVUE because I like staples/dividend payers but it doesn't seem to get treated the same way as other staples.

P/E of 18, which is near the lower range on a 10 year. EPS, at least in terms of analyst consensus, does look to have strong growth moving fwd, though the market appears to be questioning that.

Still eyeing RIVN for the right time to buy (options or shares).Was going to mention RIVN below $10. I continue to hold what is now a modest position, deep in the red, want to add eventually, but it needs to find a floor.

I mentioned I’m wondering if a double top isn’t forming in UNH if it doesn’t hold this area. That would take it down quite a bit taking a measured move.Just a quick look but that chart looks like it wants to have a bottoming out, not a quick reversal.

P/E of 18, which is near the lower range on a 10 year. EPS, at least in terms of analyst consensus, does look to have strong growth moving fwd, though the market appears to be questioning that.

Looks to me like it is forming a double golden eagle pattern, so it should go back to ATHs soon. :)I mentioned I’m wondering if a double top isn’t forming in UNH if it doesn’t hold this area. That would take it down quite a bit taking a measured move.

I'd say the double top is already in place. Question now is how long does it take to recover from it.I mentioned I’m wondering if a double top isn’t forming in UNH if it doesn’t hold this area. That would take it down quite a bit taking a measured move.

Again my quick look take makes me think this dip will be bigger then the one between the 2 tops.

Maybe that is typically the reaction after a double top?

The double top isn’t confirmed yet. Double top is confirmed after the fact that’s why I say a break of this level is important. If it holds then great but if it breaks then you could get a similar measured move down that is about the same as the move from the peaks to the valley in the middle of the peaks so that could take you down quite a bit farther.I'd say the double top is already in place. Question now is how long does it take to recover from it.

Again my quick look take makes me think this dip will be bigger then the one between the 2 tops.

Maybe that is typically the reaction after a double top?

Masters starts today so maybe lol.Looks to me like it is forming a double golden eagle pattern, so it should go back to ATHs soon. :)

Was going to mention RIVN below $10. I continue to hold what is now a modest position, deep in the red, want to add eventually, but it needs to find a floor.

I added some RVN this morning.... trying to grab that falling knife.

huh?Outstanding morning of bank earnings - JPM, Citi, Blackrock, Wells. The economy is rolling.

no one would call the composition of the earnings good. think canary in the coal mine and now we'll see cuts priced further out if at all given summer spending season is coming and oil is going higher

All beat earnings and revenue estimates, right?huh?

no one would call the composition of the earnings good. think canary in the coal mine and now we'll see cuts priced further out if at all given summer spending season is coming and oil is going higher

c'mon, you know how this is played which is to say you are not looking back. there is nothing positive in their reportsAll beat earnings and revenue estimates, right?

Intel, AMD stock drop on report China is phasing out foreign chips By Investing.com

Intel, AMD stock drop on report China is phasing out foreign chips

www.investing.com

Classic buy the dip day. Stocks and bonds down.Traders probably don’t want to go long into the weekend.

hope we do but I doubt the mkts would know when a 'secret strike' was coming.No bounce at all after the Iran news.

all talk going forward is going to be about growth vs inflation and debt levels

of course externalities like lighting up Iran will be present

Inspired by Elon I grabbed some moreMSFT at 420. There seems be a new floor at that level. My avg cost is now 339 and I totally missed the ultimate floor of I believe 220ish a couple of years ago.Classic buy the dip day. Stocks and bonds down.

Add to your MSFT position when appropriate. Put those shares on a shelf and look at them in 2030. You will be thrilled! :)Inspired by Elon I grabbed some moreMSFT at 420. There seems be a new floor at that level. My avg cost is now 339 and I totally missed the ultimate floor of I believe 220ish a couple of years ago.

I saw some upwardly revised price targets yesterday on MSFT…so a five handle per share actually seems attainable in the near future and I’ve gotten used to the solid rips higher followed by mini-correction breathers as it’s been fairly low volatility-wise. Worst-case assuming some unforeseen craziness I could see a 20% pullback happening and I’d still be at breakeven. And thank goodness they don’t make cars.Add to your MSFT position when appropriate. Put those shares on a shelf and look at them in 2030. You will be thrilled! :)

I see bonds are up.Classic buy the dip day. Stocks and bonds down.

Oops, I meant yields down (along with stocks still down).I see bonds are up.

LOL! Watching this video right now. :)He has been saying since last December expect a pullback in Q2. From what I've seen of Tom he gets more right then wrong.

I don't know who this guy is but the tech savy people know Nvidia is part tech, part smoke, part mirrors.

finance.yahoo.com

finance.yahoo.com

The best AI guy to listen to is Jim Rickards (NJ guy).

He's financial expert, lawyer and designed neural networks for CIA.

He's one of the few people who knows the AI scene from all angles and people should really time to listen

He knows some good will come so he's not a bear but he sees the hype, dangers and the path to go down.

People will be way ahead after hearing this man

Musk is gassing AI because Tesla is floundering and he's positioning Tesla more strongly as an AI company.

AI is not going to be epic in a few months

en.wikipedia.org

en.wikipedia.org

Nvidia is in a bubble, stocks will disappoint for a decade, and a recession will strike this year, markets guru warns

Stocks have lost touch with reality, the microchip buying frenzy won't last, and stagflation is in the cards, Jesse Felder said.

The best AI guy to listen to is Jim Rickards (NJ guy).

He's financial expert, lawyer and designed neural networks for CIA.

He's one of the few people who knows the AI scene from all angles and people should really time to listen

He knows some good will come so he's not a bear but he sees the hype, dangers and the path to go down.

People will be way ahead after hearing this man

Musk is gassing AI because Tesla is floundering and he's positioning Tesla more strongly as an AI company.

AI is not going to be epic in a few months

James Rickards - Wikipedia

he's very good but cpi isn't going down through the summer, those are prime spending monthsHe has been saying since last December expect a pullback in Q2. From what I've seen of Tom he gets more right then wrong.

Inflation: How much prices for important goods and services have risen under Biden - Washington Examiner

While annual inflation is down to more manageable levels, the compounded price increases of goods and services since Biden entered office has hurt consumers.

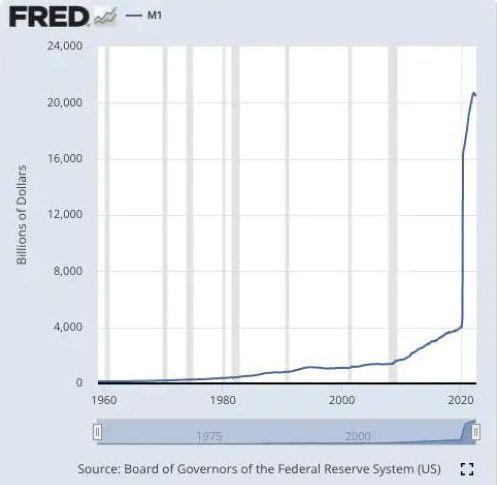

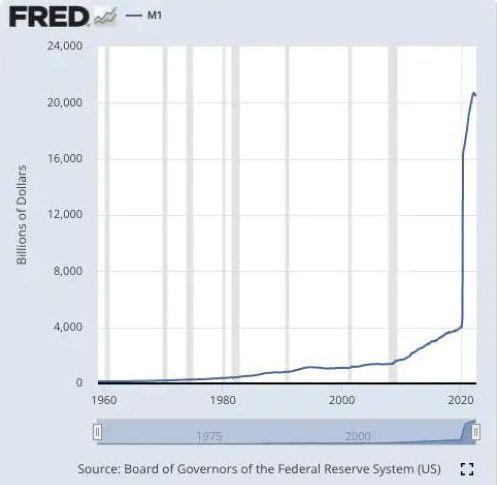

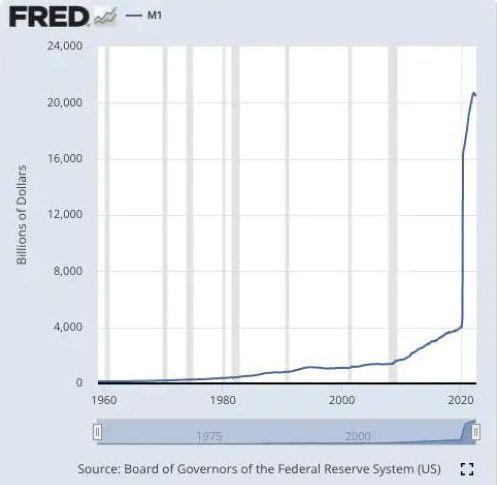

As a I recall, inflation is technically a money supply issue - supply grows faster than an economy can produce goods and services. What I learned last week was that a lot of the billions passed in spending bills don't hit right away (can take a few years). The "infrastructure" bill spending is just starting to come in now. Money has been getting finessed into economy for all sorts of directions - including "emergency funds" Yellin opens floodgates too.

Inflation liftoff

www.cnn.com

www.cnn.com

Inflation liftoff

Larry Summers sends stark inflation warning to Joe Biden

Larry Summers sends stark inflation warning to Joe Biden | CNN Business

Larry Summers is urging Washington to tap the brakes on stimulus — or risk unleashing a serious burst of inflation.

correct but the the nuanced change is the habit of consumers and the use for cc for liquidity. Fed needs kill the credit cards if it wants spending stopped. Employment is becoming less of a major factor due to gov't programs. I"m not sure what the inflection point is now given support unemployed and non workers get. When I was offered by the BLS right before I decided not to go to the LSE after Grad School, one of the areas I told them, if I accepted, was the periphery to spending and it's growing impact on traditional models. They looked at me like I had 5 headsAs a I recall, inflation is technically a money supply issue - supply grows faster than an economy can produce goods and services. What I learned last week was that a lot of the billions passed in spending bills don't hit right away (can take a few years). The "infrastructure" bill spending is just starting to come in now. Money has been getting finessed into economy for all sorts of directions - including "emergency funds" Yellin opens floodgates too.

Inflation liftoff

Larry Summers sends stark inflation warning to Joe Biden

Larry Summers sends stark inflation warning to Joe Biden | CNN Business

Larry Summers is urging Washington to tap the brakes on stimulus — or risk unleashing a serious burst of inflation.www.cnn.com

Bernanke touched on changes to how things are looked at but govie moves slow. Credit is the key, population now looks at credit like bank/corporate Treasury groups do and that is not good

First cut in July, Fed wants to throw in a token cut as predicted and then get out of the way for the fall election.I don't think we see any cuts this year unless employment implodes as a result of massive reduction in spending by the consumer. Retail Sales just told you the Fed is most likely going to pivot from neutral to concern

I don't see it, all the data is running opposite of this and more than half the committee stated they fear not slowing fast enough. I don't see the Fed throwing a bone in July for the sake of it and then stopping till next year. Not the mention, the mkt has 3 cuts priced in till end of year and that is most certainly going to have to reprice out.First cut in July, Fed wants to throw in a token cut as predicted and then get out of the way for the fall election.

What data? PCE core is 2.8% YoY and heading lower next week (likely 2.7%). This is the metric for the Fed's 2% target. Pretty damn close. CPI is garbage and irrelevant.I don't see it, all the data is running opposite of this and more than half the committee stated they fear not slowing fast enough. I don't see the Fed throwing a bone in July for the sake of it and then stopping till next year. Not the mention, the mkt has 3 cuts priced in till end of year and that is most certainly going to have to reprice out.

Probably a cut in July and another one in Dec (after the election).

Similar threads

- Replies

- 178

- Views

- 7K

- Replies

- 418

- Views

- 11K

- Replies

- 33

- Views

- 780

- Replies

- 14

- Views

- 7K

ADVERTISEMENT

ADVERTISEMENT