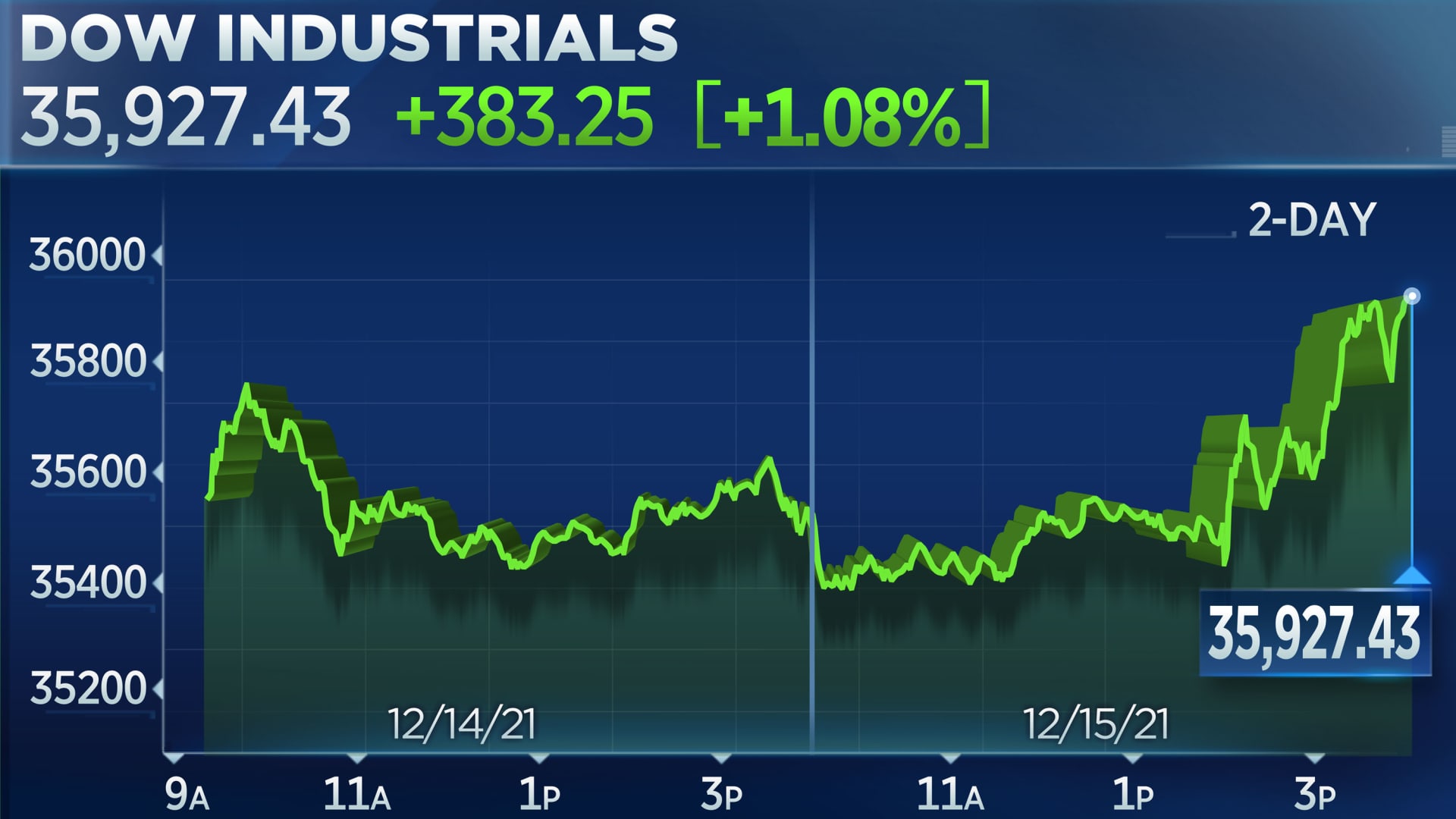

T is a bad stock, but even worse, is a bad company. Still, MS has it's FMV at $36:

Fair Value and Profit Drivers | by Michael Hodel Updated Oct 21, 2021

Our $36 fair value estimate excludes DirecTV results beyond 2021, instead including the cash we expect AT&T will realize from its venture with TPG. We continue to include WarnerMedia in its current form. We expect several of the same trends that have hit AT&T’s businesses recently will remain in place, yielding modest wireless revenue growth, despite increased network capacity, while heavy content investment pressures WarnerMedia’s profitability.

In wireless, we expect AT&T will modestly gain market share through 2022 as it reestablishes its market position. We believe postpaid revenue per phone customer, which bottomed in 2018 with the transition to unsubsidized rate plans but has stagnated recently, will remain around $54 per month over the next couple year and then grow modestly thereafter amid a relatively stable competitive environment. We estimate AT&T generates a bit less than $1 billion in revenue annually from connected devices, such as cars. We model this revenue roughly tripling over the next five years as things like edge computing gain adoption, but this estimate is highly uncertain. We expect wireless service revenue will increase 4% annually on average through 2025, with wireless margins declining modestly over this period, as pricing rationalization partially offsets rising network operating costs.

At WarnerMedia, we expect a 14% rebound in revenue during 2021 with 5% average annual growth through 2025 after that. We model growth, absent the rebound from the pandemic, holding fairly steady as HBO Max gains acceptance and offsets weakness in the traditional television business. We don’t have high expectations for the advertising business over the long term, as consumer behavior shifts away from ad-supported formats reduces inventory, offset only in part by stronger pricing. We also expect that increased investments in content required to fend off newer entrants will pressure margins.

We expect the consumer broadband business will deliver steadily improving growth as the fiber build gains momentum. We also expect the enterprise services business can gradually return to growth in the coming years. In total, we believe consolidated revenue can grow about 3% annually over the next five years, excluding the impact of the divested television business. We expect AT&T will produce modest consolidated EBITDA margin expansion, with capital spending increasing to support the fiber network upgrade and 5G deployment.